New Chime+ premium tier for members that direct deposit their paycheck offers exclusive benefits like 3.75% Annual Percentage Yield (APY) savings accounts1

Latest additions to product suite meet even more banking needs of everyday Americans

Chime®, a leading consumer financial technology company, today announced that it is rolling out a host of powerful new features, including Chime+, a premium membership tier designed to make its everyday mobile banking* experience even better.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250331742233/en/

Exclusively available to members who set up a qualifying direct deposit through Chime, Chime+ is a free, premium membership tier with an expanded suite of financial tools, perks, and services.

“When Americans are looking for better alternatives to their current banking solutions, they are continuing to turn to Chime,” said Chime Chief Product Officer, Madhu Muthukumar. “That’s because for a decade, Chime has been focused on building and delivering affordable, easy-to-use products that address the most critical financial needs of everyday Americans — helping people get ahead instead of weighing them down with punitive fees. With today’s launches, we’re making it even easier for our members to manage their money and grow their credit.”

Best Chime Yet: Introducing Chime+

Exclusively available to members who set up a qualifying direct deposit through Chime, Chime+ is a free, premium membership tier with an expanded suite of financial tools, perks, and services2. Chime+ includes existing features that Chime members love, like accessing their pay between pay periods with MyPay®3, as well as automatic overdraft coverage without fees with SpotMe®4. The initial set of new exclusive benefits to Chime+ members include:

- Higher Savings Rate: Chime+ members can enjoy 3.75% APY to accelerate their savings.

- Exclusive Chime Deals®: Chime+ members get new, custom cashback offers from top retailers, on top of the savings already available through Chime Deals on everyday purchases like gas and groceries.5

- Priority Support: Chime+ members will have expedited response times to answer questions about their account.

“I was surprised by how many benefits came with Chime+,” said Torry Barton, a Chime member from Kingston, NY. “It feels like a premium service without the extra fees that traditional banks charge. And it was super easy to get started. When I got my paycheck early for the first time, I knew Chime+ was a game changer. Chime+ actually gave me the tools to manage my money better without unnecessary costs. It’s made a huge difference in my financial stability.”

A Smarter, More Powerful Chime App For All Members

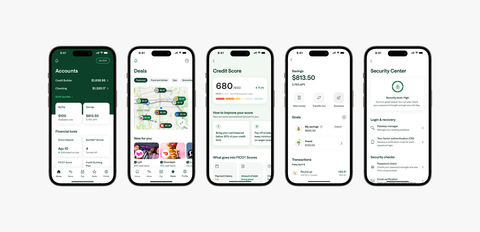

In addition to Chime+, Chime is also rolling out a redesigned app experience that features a variety of new, smarter tools to help all members manage money, build credit, and save with confidence, including:

- Credit building from day one: Members no longer have to direct deposit through Chime to begin safely building credit with the secured Chime Credit Builder Visa® Credit Card6. Now members can build credit on everyday purchases starting the first day they open an account through Chime. Members who use Credit Builder see an average FICO® Score7 increase of 30 points over time after making on-time payments8.

- Personalized credit building tips: The Chime app now lets members see FICO® tracking, custom credit building tips, real-time insights, and key factors influencing their FICO® Score, making it easier to take the next step in their credit journey.

- Savings Goals designed for progress: Members can now set and track personalized savings goals, making it easier than ever to reach financial milestones—whether it’s a vacation fund, emergency savings, or a big purchase.

- Enhanced security center and account protection: A new security hub offers greater control over account security. Members can add passkeys, enable multi-factor authentication, and explore security resources. These settings are in addition to Chime’s always-on security features like real-time transaction alerts.

- Streamlined look and feel in the app: A redesigned app puts Chime’s most popular features right on the home screen with easier navigation and a more intuitive way to see Chime balances, all in one place.

Chime Keeps Innovating to Bring Even More to Chime Members

Chime continues to elevate its member experience with the launch of innovative features and services. Chime recently introduced a new generative AI-powered chatbot for member support, built directly into the app. Early testing showed that the new chatbot doubled member satisfaction scores and it successfully resolved more than two-thirds of member inquiries without the need for escalation. This enhancement exemplifies Chime’s commitment to delivering fast, efficient, and intuitive support for its members. For example, last year, AI-powered support features across the company handled nearly 70% of all member support interactions. Chime’s data streaming platform processes approximately 50 billion real-time data events per month, enabling high-quality, 24/7 member support, all in service of improving the member experience.

Earlier this month, the company also launched Instant Loans9, an all-new service that offers three-month installment loans to pre-approved Chime members who receive direct deposits into their Chime Checking Account. Loans are available up to $500 with a fixed interest that is substantially lower than what’s typically observed in the industry. Additionally, in January, the company announced fee-free10 in-app federal and state tax filing available for all members through its partnership with april and Column Tax.

About Chime

Chime is a financial technology company founded on the premise that basic banking services should be helpful, easy, and free. Chime builds products that allow the company to succeed when its members do. That’s why Chime doesn’t rely on punitive fees such as overdraft, monthly service, or minimum balance fees. Chime is one of the most downloaded banking apps in America. Member deposits are FDIC-insured through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC, up to applicable limits.11 For additional information, please visit www.chime.com.

*Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC.

MyPay® line of credit provided by The Bancorp Bank, N.A. or Stride Bank, N.A.. MyPay services provided by Chime Capital, LLC (NMLS 2316451).

These tax filing offers are not endorsed or offered by our partners, The Bancorp Bank, N.A. or Stride Bank, N.A.

Tax e-file services provided by April Tax Solutions Inc. (“april”). Tax e-file services provided by Column Tax, Inc. (“Column Tax”).

A tax refund may only be direct deposited into an account that is in your name. This means that if you file a joint return, the name of the primary filer must match the name on the account. If a tax refund is directed to an account that is not in your name, it may be rejected and returned to the IRS. No more than three electronic refunds can be deposited into a single financial account. If you exceed this limit you will receive notice from the IRS and a paper check refund.

Third-party trademarks referenced for informational purposes only; no endorsements implied.

1The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of 3/26/2025. No minimum balance required. Must have $0.01 in savings to earn interest. The Chime+ APY is available only while you maintain eligibility requirements for Chime+, otherwise the APY for non-Chime+ members will apply. See Chime+ Terms and Conditions for more details.

2To be eligible for Chime+™ status, you must receive a qualifying direct deposit to your Chime Checking Account in the preceding 34 days. Certain products marketed as Chime+ benefits have additional eligibility requirements. While some Chime+ benefits may have associated fees, none of these fees are mandatory to access Chime+ benefits or to maintain Chime+ status. See Chime+ Terms and Conditions for details. CHIME+ is a Trademark of Chime Financial, Inc.

3To be eligible for MyPay, you must receive qualifying direct deposits to your Chime Checking Account in the preceding 36 days as set forth in the MyPay Agreement. A qualifying direct deposit is a deposit from an employer, payroll provider, gig economy payer, government benefits payer, or other permitted source of income by Automated Clearing House (“ACH”) or Original Credit Transaction (“OCT”). Your MyPay Credit Limit and Maximum Available Advance may change at any time. MyPay is a line of credit and available limits are based on estimated income and risk-based criteria. Eligible members may be offered a $20 - $500 Credit Limit per pay period. Your Credit Limit and Maximum Available Advance will be displayed to you within the Chime app. MyPay is currently only available to eligible Chime members in certain states. Other restrictions may apply. See Bancorp MyPay Agreement or Stride MyPay Agreement for details.

4SpotMe® for Credit Builder is an optional, no interest/no fee overdraft line of credit tied to the Secured Deposit Account; SpotMe on Debit is an optional, no fee service attached to your Chime Checking Account (individually or collectively, “SpotMe”). Eligibility for SpotMe requires $200 or more in qualifying direct deposits to your Chime Checking Account each month.

Qualifying members will be allowed to overdraw their Chime Checking Account and/or their Secured Deposit Account up to $20 in total, but may be later eligible for a higher combined limit of up to $200 or more based on member’s Chime account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your SpotMe Limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your SpotMe Limit. SpotMe for Credit Builder and SpotMe on Debit share a single SpotMe limit. Your SpotMe Limit may change at any time, at Chime or its banking partners’ discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions or OTC cash withdrawal fees at retailers. SpotMe won't cover non card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe Terms and Conditions.

5Eligibility requirements and limits apply. Cash back rates may vary. Check the Chime app for merchant offer details. See Chime Deals® Terms and Conditions.

6To apply for Credit Builder, you must have an active Chime® Checking Account.

7Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn More.

8Based on a representative study conducted by Experian® in January 2024, members who made their first purchase with Credit Builder between June 2022 and October 2022 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

9Instant Loans are made by The Bancorp Bank, N.A., Member FDIC.

10There are no fees required to use this product. Chime does not require you to deposit your refund into your Chime Account to qualify for free tax filing. Certain costs may be incurred if you decide to obtain other optional financial products offered in relation to your tax filing. The Internal Revenue Service (IRS) may impose penalties or other charges depending on your personal tax situation. If the april tax preparation software makes a mathematical error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, april will reimburse you up to a maximum of $10,000. See april terms for details. If interest and/or a penalty is imposed by the IRS as a result of a computational error by Column Tax, you may be entitled to up to $10,000 reimbursement by Column Tax. See Column Tax terms for details.

11Chime is not FDIC-insured. The Bancorp Bank, N.A. and Stride Bank, N.A. are the FDIC-insured members. Deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. The current FDIC coverage limit is $250,000 per depositor, per FDIC-insured financial institution, per ownership category.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250331742233/en/

Contacts

Media: press@chime.com