Shareholders of Hillenbrand would probably like to forget the past six months even happened. The stock dropped 22.8% and now trades at $20.96. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Hillenbrand, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we're cautious about Hillenbrand. Here are three reasons why we avoid HI and a stock we'd rather own.

Why Do We Think Hillenbrand Will Underperform?

Hillenbrand, Inc. (NYSE: HI) is an industrial company that designs, manufactures, and sells highly engineered processing equipment and solutions for various industries.

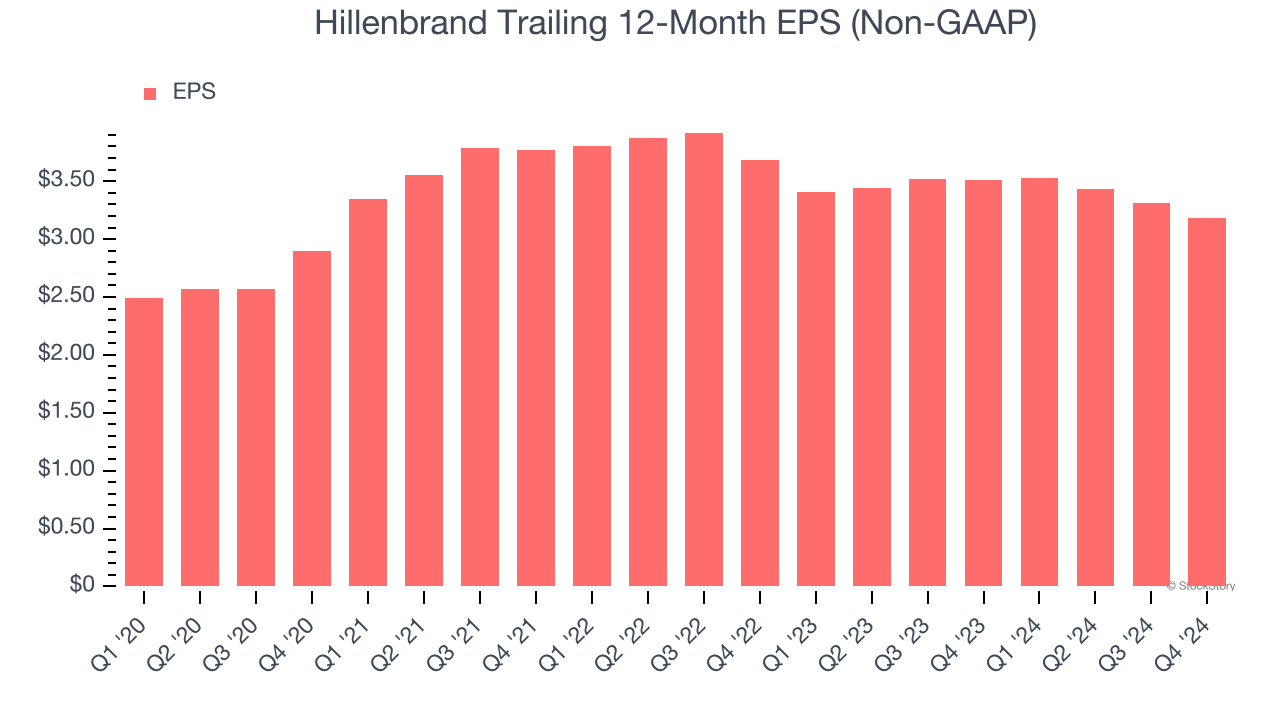

1. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Hillenbrand’s EPS grew at an unimpressive 4.3% compounded annual growth rate over the last five years, lower than its 9.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

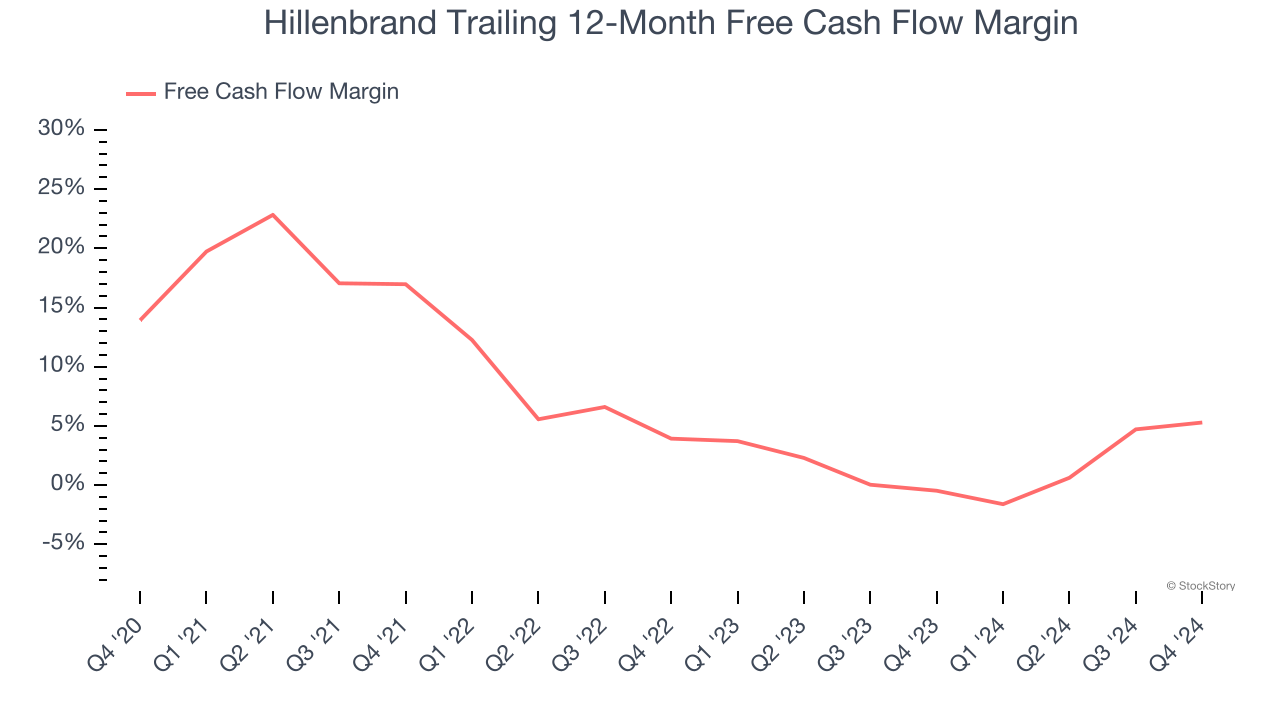

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Hillenbrand’s margin dropped by 8.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Hillenbrand’s free cash flow margin for the trailing 12 months was 5.3%.

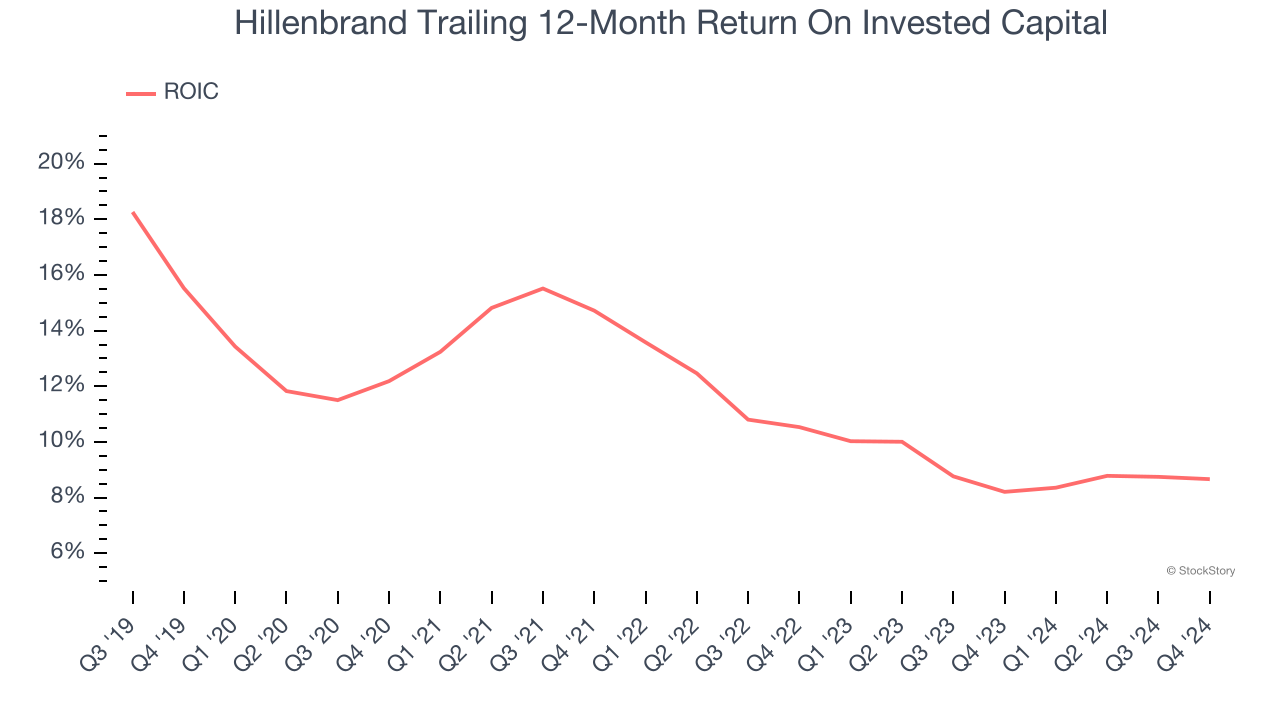

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hillenbrand’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Hillenbrand doesn’t pass our quality test. Following the recent decline, the stock trades at 6.8× forward price-to-earnings (or $20.96 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Hillenbrand

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.