California-based KLA Corporation (KLAC) is a leading semiconductor equipment manufacturer specializing in process control, metrology, and inspection systems used in chip fabrication. Its tools help identify defects, improve yield, and ensure precision across advanced semiconductor nodes. With a market cap of $149 billion, KLA plays a critical role in enabling cutting-edge technologies like AI, 5G, and high-performance computing by supporting chipmakers.

Shares of KLAC have outperformed the broader market over the past 52 weeks. KLAC stock has increased 81.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. However, shares of KLAC are up 78.2% on a YTD basis, outpacing $SPX’s 12.5% rise.

In addition, KLAC has outpaced Invesco Semiconductors ETF’s (PSI) 31.5% rise over the past 52 weeks and 22.8% return in 2025.

On Oct. 29, KLA Corporation released its first-quarter results, reporting revenue of $3.21 billion, up roughly 13% year over year. The company delivered GAAP diluted EPS of $8.47 and non-GAAP EPS of $8.81, reflecting solid profitability and strong execution. KLA also emphasized its healthy cash generation during the quarter and issued Q2 guidance calling for revenue of about $3.23 billion at the midpoint, a non-GAAP gross margin near 62%, and non-GAAP EPS of roughly $8.70. Its share climbed 2.4% post announcement.

Analysts expect KLAC’s EPS to grow 6.4% year over year to $35.40 in the current year ending in June 2026. Moreover, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

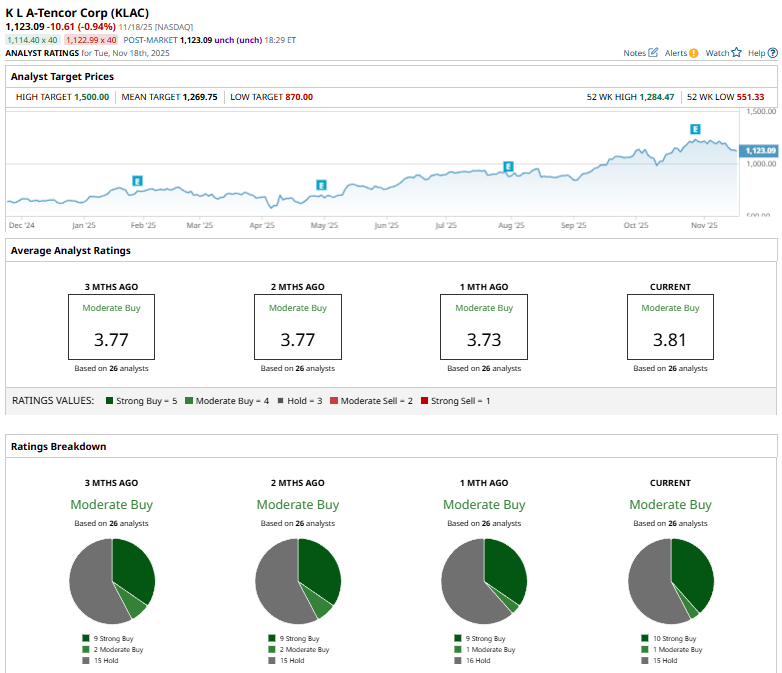

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on ten “Strong Buy” ratings, one “Moderate Buy” and 15 “Holds.”

The current consensus is bullish than a month ago, when it had nine “Strong Buy” suggestions.

Citigroup analyst Atif Malik reaffirmed a “Buy” rating on KLA Corporation on Oct. 31, and sharply raised the price target to $1,450 from $1,060, marking a 36.8% increase and signalling a strong bullish outlook for the stock.

KLAC’s mean price target of $1,269.75 indicates a premium of 13.1% from the current market prices. The Street-high target of $1,500 suggests a robust 33.6% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart