Amazon (AMZN) stock has struggled to keep pace with the broader market in 2025, trailing most of its large technology peers. Shares are only modestly higher for the year, up about 2% in a sharp contrast to the strong gains posted by the S&P 500 Index ($SPX).

Despite Amazon’s muted share price performance, the company’s underlying fundamentals remain strong and are gaining momentum. Its core business segments are expanding at a healthy pace, setting the stage for a notable increase in its stock price in 2026.

3 Reasons Why AMZN Could Deliver Solid Gains in 2026

Amazon is entering 2026 with multiple catalysts working in its favor. AMZN’s cloud division, Amazon Web Services (AWS), continues to show strong growth as businesses increase their reliance on cloud infrastructure to run operations and deploy new technologies. AWS has long been a key growth catalyst for Amazon’s revenue and profitability, and the segment could deliver notable gains in 2026.

Beyond cloud computing, Amazon is building additional revenue streams that could materially impact its financial performance. The company’s investments in artificial intelligence (AI) are beginning to pay off, particularly through its in-house AI chips, which are emerging as a compelling alternative to Nvidia's (NVDA) and Google's (GOOG) (GOOGL) offerings. These chips could contribute billions of dollars in incremental revenue while strengthening AWS’s competitive edge.

Advertising is another area where Amazon is growing rapidly. With access to a massive shopper base and rich data on consumer behavior, Amazon is uniquely positioned to deliver highly targeted ads at the point of purchase. This business offers attractive margins and continues to scale as more brands allocate a larger share of their marketing budgets to Amazon’s platform.

1. AWS Positions Amazon for Sustained Growth. Amazon is entering 2026 with continued strength in its cloud computing arm. The company’s recent quarterly results show that demand for AWS’s services is accelerating.

AWS generated $33 billion in revenue in Q3, marking a 20.2% year-over-year increase and an acceleration from the previous quarter. Growth was driven by rising adoption of AI workloads alongside steady demand for core cloud services.

One of the strongest indicators of future growth is AWS’s expanding backlog, which hit $200 billion by the end of the third quarter. Management said that this solid backlog number does not include several large deals that were finalized in October. This growing pipeline provides strong visibility into future revenue and suggests that AWS’s growth trajectory is gaining speed.

Further, to meet surging demand, Amazon is making aggressive investments in infrastructure, particularly in power capacity for its data centers. Looking ahead, Amazon plans to double that capacity by 2027, positioning AWS to support cloud and AI-driven growth.

2. AI Chip A Multibillion-Dollar Business for AMZN. Amazon’s push into AI hardware is becoming a multibillion-dollar business with significant long-term implications for its broader ecosystem. Supporting the growth is Trainium2, Amazon’s custom-built AI chip. Demand for the chip has accelerated sharply, reflected by 150% growth in the third quarter. Management has indicated that Trainium2 capacity is now fully subscribed, signaling strong demand.

While Trainium is currently deployed by a relatively small group of large customers, that is expected to change. Amazon plans to expand access with the launch of its next-generation Trainium3 chips, which should make the technology available to a wider customer base.

Adding to the excitement, a recent report from The Information suggests that OpenAI intends to use Amazon’s Trainium chips. The same report indicates Amazon may invest around $10 billion in OpenAI, highlighting a potentially strategic partnership that could further validate Trainium’s capabilities.

3. Advertising: AMZN’s High Margin Business. Amazon’s advertising segment is pushing its revenue and margins higher. Its advertising revenue was $17.7 billion in Q3. Moreover, the ad segment’s growth rate accelerated for three consecutive quarters.

Amazon’s expanding ecosystem and its ability to offer advertisers highly targeted ads bode well for growth. Its new and deepening partnerships are broadening advertiser reach across its platforms, creating more ways for brands to connect with consumers.

Another opportunity stems from Prime Video's live sports streaming. As Amazon continues to secure high-profile sports rights, it is unlocking premium ad inventory that commands higher pricing and attracts large advertisers.

The Bottom Line

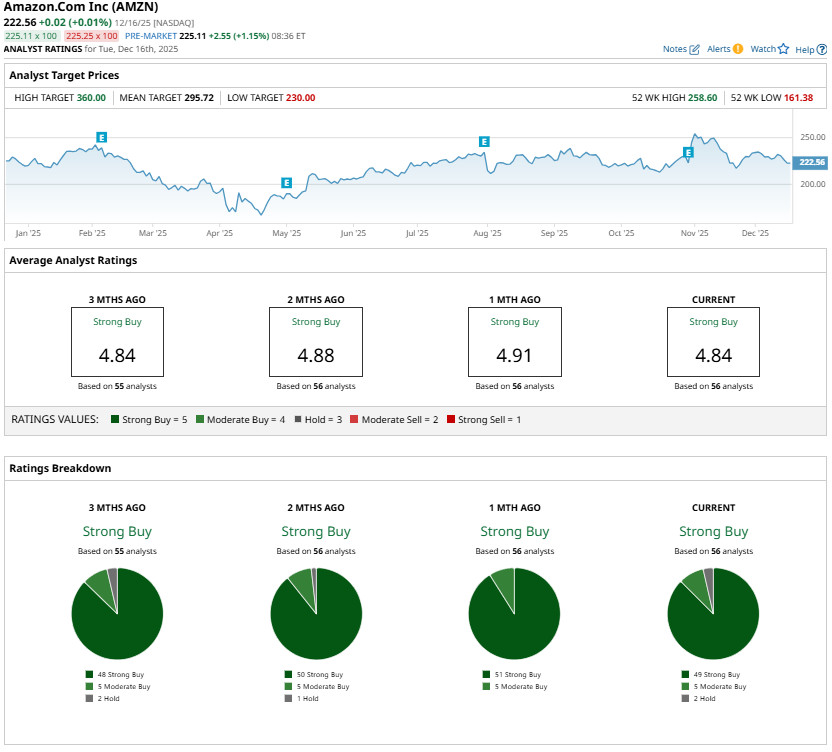

With ongoing strength in its AWS business, a growing AI chip unit, and acceleration in advertising revenue, Amazon stock has three solid catalysts that could push it higher in 2026. Analysts are upbeat on AMZN stock, and maintain a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.

- Netflix Says the Warner Bros’ Deal Is All About ‘Growth.’ Will NFLX Stock Keep Growing in 2026?