Artificial intelligence has been the theme on Wall Street for more than three years now. Headlined by the likes of Nvidia (NVDA), AMD (AMD), and Broadcom (AVGO), chipmakers have been the undisputed winners, and their share price actions reflect the same. On the other hand, as inflation continues to hover around the 3% level, above the Fed's comfort rate of 2%, one would not expect stocks from the retail sector to outperform these AI juggernauts. However, that is precisely what Dillard's (DDS) has done over the past five years.

About Dillard's

Founded in 1938 and based out of Arkansas, Dillard's operates full-line department stores and clearance centers across the U.S., primarily in the Southeast, Southwest, West, and Midwest. Other than retail operations, the company is also engaged in providing construction services. It operates approximately 272 full-line department stores plus around 28 clearance centers across 30 U.S. states and over 140 cities as of late 2025.

Valued at a market cap of $10.2 billion, the DDS stock is up 54% on a year-to-date (YTD) basis, outperforming the likes of Broadcom, AMD, and Microsoft (MSFT). Notably, the stock offers a dividend yield of 4.76%, which is higher than the sector median of 1.023%. Further, the company has been raising dividends consecutively over the past 14 years, and with a payout ratio of just 2.87%, the headroom for growth remains.

But is that enough to warrant an investment? Let's analyze.

All Good (Except Sales Growth)

Dillard's, despite its share price pop, is not for the growth enthusiasts. While its earnings have grown at a CAGR of 6.28% over the past 10 years, revenues have actually declined at a CAGR of 0.28% in the same period. Modest revenue growth was reported in the most recent quarter as well.

In Q3 2025, Dillard's net sales were $1.47 billion, up a mere 2.8% from the previous year. Comparable store sales, a key indicator of organic store sales, inched up by just 3% in the same period. Further, gross margins improved to 45.3% in the quarter, an increase from the previous year's figure of 44.5%, implying effective control over direct costs.

Overall, earnings for the quarter were reported to be $8.31 per share, a YoY rise of 7.5%. Notably, the EPS also came in higher than the consensus estimate of $6.18, as the past two years have seen the company's earnings miss estimates on just one occasion.

Coming to cash flows, for the nine months ended Nov. 1, Dillard's reported net cash from operating activities of $505.8 million, up from $349.4 million in the year-ago period. Overall, the company closed the quarter with a cash balance of $1.15 billion, much higher than its short-term debt levels of $96 million.

Finally, aside from its record of shelling out regular dividends, Dillard's has rewarded shareholders through share repurchases. While during the quarter, the company repurchased shares worth $107.8 million, the past decade has seen the company carrying out share buybacks worth more than $3 billion.

Thus, a slowdown in sales growth cannot be squarely blamed on the company's operations, as the wider retail sector has been subdued for a while now. Structural headwinds such as mall traffic decline and the emergence of e-commerce over the years have played a significant role. Considering this, Dillard's showing has been commendable, as it has done what it can in this scenario: controlling costs, raising margins, keeping debt under control, and increasing earnings with an effective cash management strategy.

Can the Good Times Continue to Roll?

Now, Dillard's needs just one thing: sales growth. That will ensure that the company's upmove was not just based on effective balance sheet management but is built upon solid, sustainable growth. To that end, the company is taking some initiatives.

First up, Dillard's has been putting more effort into freshening up its stock lately, bringing in clothes and accessories that feel current and on-trend, particularly on the men's side. This is to bring in younger shoppers and get the regulars to stop by more often. That's shown up in better sales numbers of late. The categories doing the heavy lifting are the ones with stronger margins and real pull, like women's clothing, handbags, shoes, and makeup.

Conversely, while the stores are still the main game for Dillard's, the company is spending serious cash on the website too. They're building out the online shopping experience and making it work hand-in-hand with what's in the stores, so customers don't feel any drop-off. It's beginning to click, with online sales expected to surpass $400 million for 2025. Stuff like ordering online and grabbing in-store, nicer product pages, and a wider catalog of items online are helping drive that.

Finally, Dillard's uses targeted promotions and marketing to attract both value-conscious and brand-focused shoppers. Promotions are tailored to drive both traffic and conversion, emphasizing value without eroding margin.

However, it's not all smooth sailing. Inflation is still biting, and the job picture is getting shakier, so shoppers are tightening their purse strings in ways Dillard's can't fully fix. And being smaller in scale than the giants means it's tougher to match them on price; Amazon (AMZN) and Walmart (WMT), the behemoths in the space, have much more financial muscle to pull customers to their aisles.

The shares are priced for a lot of good news already too, trading at a forward P/E of 20.06 and P/B of 5.81. Both stats are quite a bit above the sector averages of 17.66 and 2.70, which doesn't leave much buffer if the spending environment cools further.

Analyst Opinion on DDS Stock

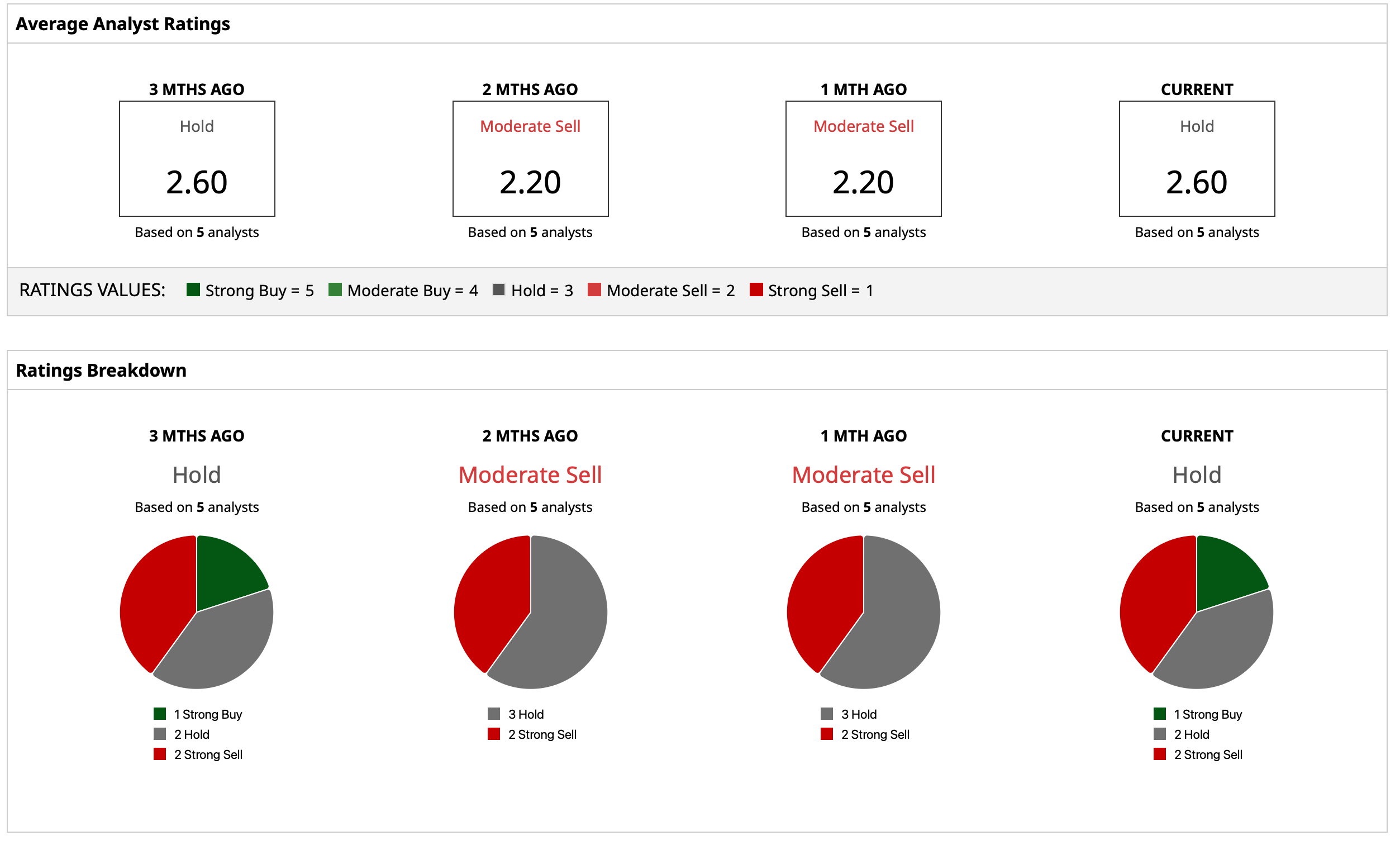

Taking all of this into account, analysts have deemed DDS stock a “Hold,” with a mean target price that has already been surpassed. The high target price of $700 denotes an upside potential of about 6% from current levels. Out of five analysts covering the stock, one has a “Strong Buy” rating, two have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Bank Stock May Be Small, But It Has Big Potential

- Could This Unexpected Tech Stock Be One of the Best Buys for 2026?

- Analysts Say This 1 Lesser-Known Chip Stock Is a Top Buy for 2026. Should You Add It to Your Portfolios Here?

- Disney Made a Bold Move By Partnering with OpenAI: Will It Help DIS Stock Recover?