Micron Technology (MU) designs and manufactures memory and storage chips, which are essential components inside nearly every modern electronic device. Micron is drawing renewed optimism from Wall Street as improving fundamentals and accelerating pricing momentum reshape the company’s earnings outlook. The company reported an exceptional start to fiscal 2026 last week, delivering revenue, gross margin, and earnings per share well above the high end of its guidance.

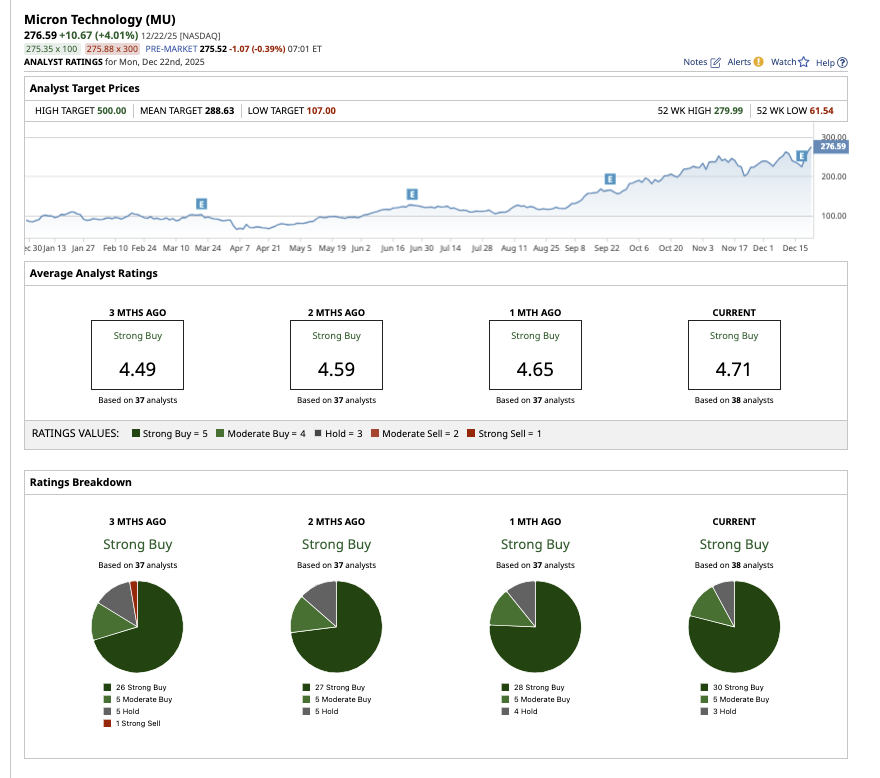

Consequently, many Wall Street analysts raised the target prices for MU stock. Rosenblatt Securities, in particular, has assigned the highest price estimate of $500, implying an upside potential of 80.7% from current levels.

Let’s find out what analysts are saying about the stock and if it is a good buy now.

Data Center Demand Accelerates Sharply

Micron stock has surged 216.7% YTD, wildly outperforming the broader market and many top tech titans. The stock has not risen solely because of hype. It is rising because AI has fundamentally altered the memory sector, and Micron is at the forefront of that transformation.

Its core products include DRAM, NAND flash, and High-Bandwidth Memory (HBM) used by cloud providers, PC and smartphone makers, automotive companies, and industrial customers.

Micron reported Q1 revenue of $13.6 billion, a 57% year-over-year (YoY) increase, marking its third consecutive quarterly revenue record. Gross margin expanded sharply to 56.8%, while adjusted EPS surged to $4.78, a 167% increase from the prior year period.

AI-driven data center expansion is reshaping memory demand. Micron's portfolio of HBM, high-capacity server DRAM, and data center SSDs benefits from the increasing amount of memory and storage content per server. HBM has been crucial to Micron's growth story. The company has already signed pricing and volume agreements for its entire calendar 2026 HBM supply, including next-generation HBM4 goods. Micron now forecasts the HBM total addressable market to increase at a 40% annual rate through 2028, rising from $35 billion in 2025 to approximately $100 billion by 2028, two years earlier than previously anticipated. Notably, the projected HBM market would be larger than the entire DRAM business by 2024.

HBM demand is also intensifying supply constraints, as each unit of HBM requires much more DRAM capacity than standard DDR5. Memory, according to Micron, is not a commodity component but rather a strategic asset required for AI cognition, performance, and real-time decision-making in data centers and edge applications.

Micron continues to extend its manufacturing leadership, having led the industry for four consecutive DRAM nodes and three NAND nodes. Its 1-gamma DRAM node is ramping up and will drive most DRAM bit growth in calendar year 2026, accounting for the majority of output in the second half of the year. Micron is ramping up its G9 node with high yields for data center and client SSDs. G9 technology will be the key driver of NAND bit growth in 2026, with the potential to become Micron's largest NAND node later in fiscal 2026. During the quarter, the company also achieved a record mix of QLC NAND, maintaining its position as a leader in high-capacity storage.

Not Just Data Center Demand

Aside from data centers, Micron is experiencing high demand in PCs, mobile devices, automotive, and industrial markets. The company is also increasing investments across its worldwide manufacturing portfolio, including earlier-than-expected wafer output from its Idaho fab. Additional fabs in New York, increased capacity in Japan and Singapore, and an assembly and test facility in India that will open in 2026 are all in the works.

Free cash flow reached a quarterly record of $3.9 billion, surpassing Micron’s prior peak by more than 20%. The company used this strength to reduce debt by $2.7 billion, return to a net cash position, and maintain $15.5 billion in liquidity. Looking ahead, Micron anticipates fiscal Q2 revenue of $18.7 billion, gross margins of around 68%, and a record EPS of $8.42. As AI-driven demand accelerates, management expects sales, margins, profitability, and free cash flow to grow further in fiscal 2026.

Analysts believe Micron is entering one of the most profitable periods in its history. Fiscal 2026 sales are expected to increase by 97.9% to $73.9 billion, followed by a 16.9% YoY increase in fiscal 2027. Similarly, earnings could rise by an outstanding 284.5% in fiscal 2026, followed by another 17% in fiscal 2027.

Micron stock is currently trading at seven times forward earnings, which looks unusually low for a company with this growth profile in the semiconductor industry. This could probably be because Micron operates in the memory market, which has been historically viewed as highly cyclical. If AI-driven demand continues to reshape the memory industry, Micron’s valuation could eventually catch up to its rapidly rising earnings.

What Are Other Analysts Saying About MU Stock?

Following the Q1 results, Citi analyst Christopher Danely reiterated a “Buy” rating on MU stock and raised his price target to $330, pointing to a powerful combination of operating strength and favorable industry dynamics. Danely’s bullish stance is rooted in Micron’s most recent quarterly performance, which came in well above market expectations across key financial metrics. Danely emphasized that Micron’s forward guidance marked an even more important inflection point. The upbeat guidance shows that profitability is not only improving but also increasing at a rapid pace.

Similarly, Deutsche Bank reaffirmed its bullish stance on Micron, raising its price target to $300 from $280 while maintaining a “Buy” rating. The firm highlighted Micron’s “another stunning” quarterly performance and outlook, noting that the company exceeded already lofty expectations on both pricing and gross margin strength.

Additionally, Barclays, Morgan Stanley, BofA, and Wolfe Research also increased their price targets for the stock.

Overall, on Wall Street, Micron stock has earned a “Strong Buy” rating. Out of the 30 analysts covering MU, 22 rate it a “Strong Buy,” four rate it a “Moderate Buy,” three recommend a “Hold,” and one says it is a “Strong Sell.” The average target price for the stock is $288.63, which is 4.3% above current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart