Valued at a market cap of $38.7 billion, The Hartford Insurance Group, Inc. (HIG) is an insurance and financial services company based in Hartford, Connecticut. It primarily focuses on property and casualty insurance, group benefits, and mutual funds. It is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

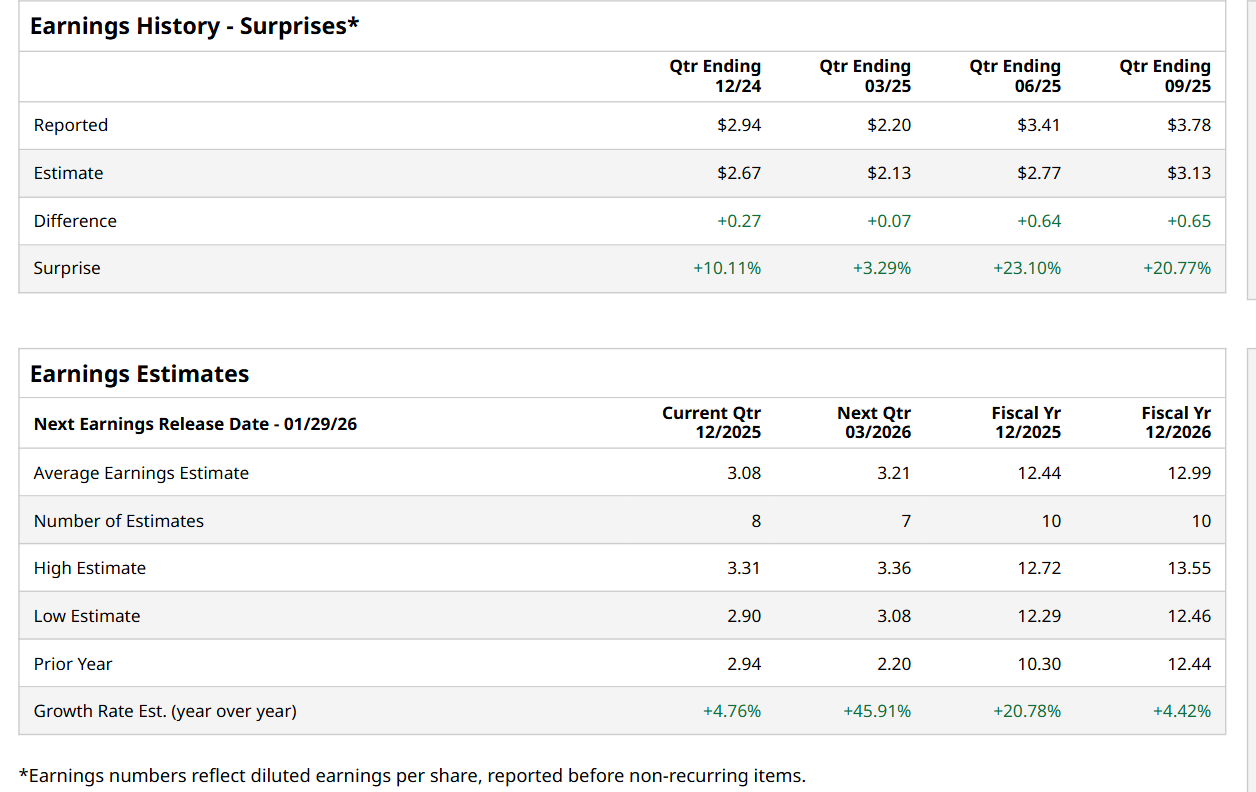

Ahead of this event, analysts expect this insurance company to report a profit of $3.08 per share, up 4.8% from $2.94 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in each of the last four quarters. In Q3, HIG’s EPS of $3.78 exceeded the forecasted figure by a notable margin of 20.8%

For the current fiscal year, ending in December, analysts expect HIG to report a profit of $12.44 per share, up 20.8% from $10.30 per share in fiscal 2024. Furthermore, its EPS is expected to grow 4.4% year-over-year to $12.99 in fiscal 2026.

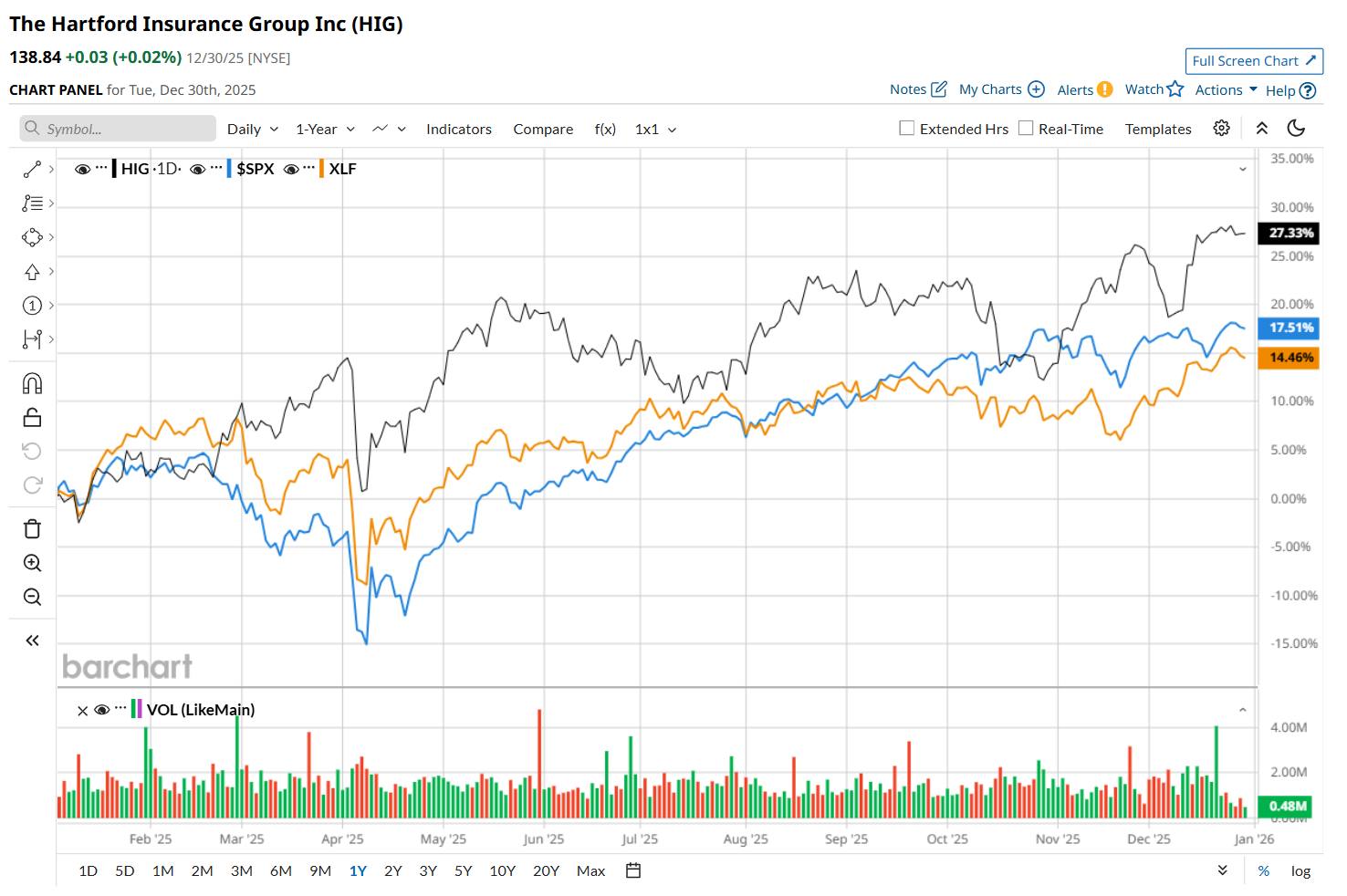

Shares of HIG have soared 27.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.8% return and the State Street Financial Select Sector SPDR ETF’s (XLF) 14.3% uptick over the same time period.

On Oct. 27, HIG reported better-than-expected Q3 earnings results, yet its shares plunged 1.8% in the following trading session. The company’s total revenue improved 7.1% year-over-year to $7.2 billion, surpassing consensus estimates by 1.3%. Moreover, its core EPS climbed by an even more impressive 49.4% from the year-ago quarter to $3.78, handily topping analyst expectations of $3.21.

Wall Street analysts are moderately optimistic about HIG’s stock, with a "Moderate Buy" rating overall. Among 26 analysts covering the stock, 11 recommend "Strong Buy," two indicate "Moderate Buy,” and 13 suggest "Hold.” The mean price target for HIG is $144.32, indicating a 3.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Will Greg Abel Reverse Warren Buffett’s ‘Mistake’ as Berkshire Hathaway’s New CEO?

- Investors Need to Get Ready for a Stock Market Correction in 2026. Here’s Why.

- Buy These 6 Down-and-Out Stocks for a ‘Dogs of the Dow' Rebound in 2026

- 3 Stocks to Short in Early 2026, and 3 ETFs That Make Betting Against Them Even Easier