Franklin Resources, Inc. (BEN), headquartered in San Mateo, California, is a global investment management firm serving clients in over 150 countries. Valued at $12.4 billion by market cap, the company offers a wide range of services across equity, fixed income, alternative investments, and multi-asset strategies, and manages over $1.6 trillion in assets. The leading investment manager is expected to announce its fiscal first-quarter earnings for 2026 in the near term.

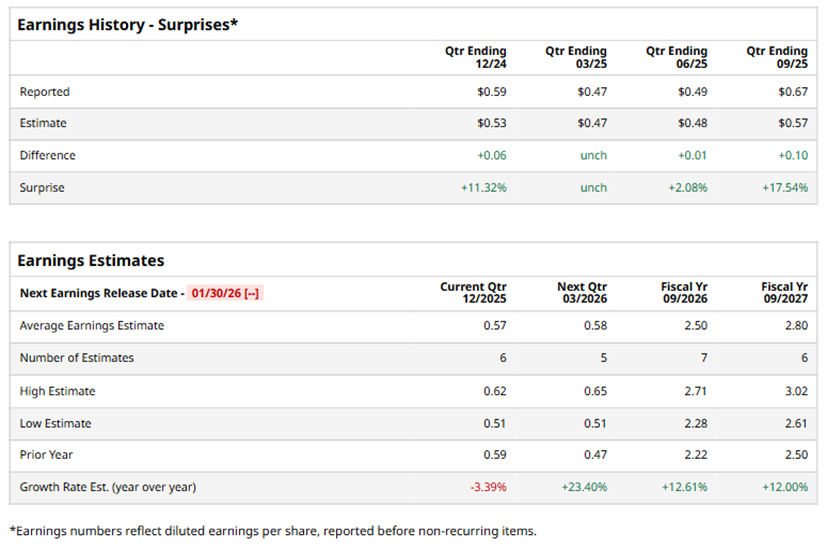

Ahead of the event, analysts expect BEN to report a profit of $0.57 per share on a diluted basis, down 3.4% from $0.59 per share in the year-ago quarter. The company has surpassed or met Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect BEN to report EPS of $2.50, up 12.6% from $2.22 in fiscal 2025. Its EPS is expected to rise 12% year over year to $2.80 in fiscal 2027.

BEN stock has outperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 18.2% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 13.9% gains over the same time frame.

Franklin Resources' outperformance was driven by strong alternative assets, ETF inflows, and digital investment solutions, with $22.9 billion raised in private markets and $1.7 billion in digital-asset AUM growth. Management is focusing on growth areas such as tokenization and AI, while managing costs and integrating new capabilities, amid leadership changes aimed at boosting private wealth and global distribution.

On Nov. 7, BEN shares closed down more than 4% after reporting its Q4 results. Its adjusted EPS of $0.67 topped Wall Street expectations of $0.57. The company’s revenue was $2.3 billion, topping Wall Street forecasts of $2.1 billion.

Analysts’ consensus opinion on BEN stock is cautious, with a “Hold” rating overall. Out of 12 analysts covering the stock, three advise a “Strong Buy” rating, four give a “Hold,” one advocates a “Moderate Sell,” and four recommend a “Strong Sell.” BEN’s average analyst price target is $24.45, indicating a potential upside of 2.7% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts

- GOOGL Stock Rocked in 2025, But Is Google’s 2026 Forecast as Bright?

- The Saturday Spread: How Basketball Analytics May Help Extract Alpha (CPNG, DBX, BBY)