Conagra Brands (CAG) stock has been getting clobbered over the past few years. This is not unusual, as most consumer packaged goods companies have taken a hit as consumers get priced out and GLP-1 drives a new wave of health awareness trends.

Management is not giving up, though. They're kicking off “Project Catalyst” to reengineer the core business by using AI, data, and automation. The objective is to expand margins by cutting down costs using AI in core operations and making a comeback.

This is a multi-year initiative to overhaul the company's end-to-end workflows. For example, automated product labeling, AI marketing, and predictive maintenance in plants, along with pricing optimization, can all help cut corners as needed and improve the bottom line.

A Rough Period for CAG Shareholders

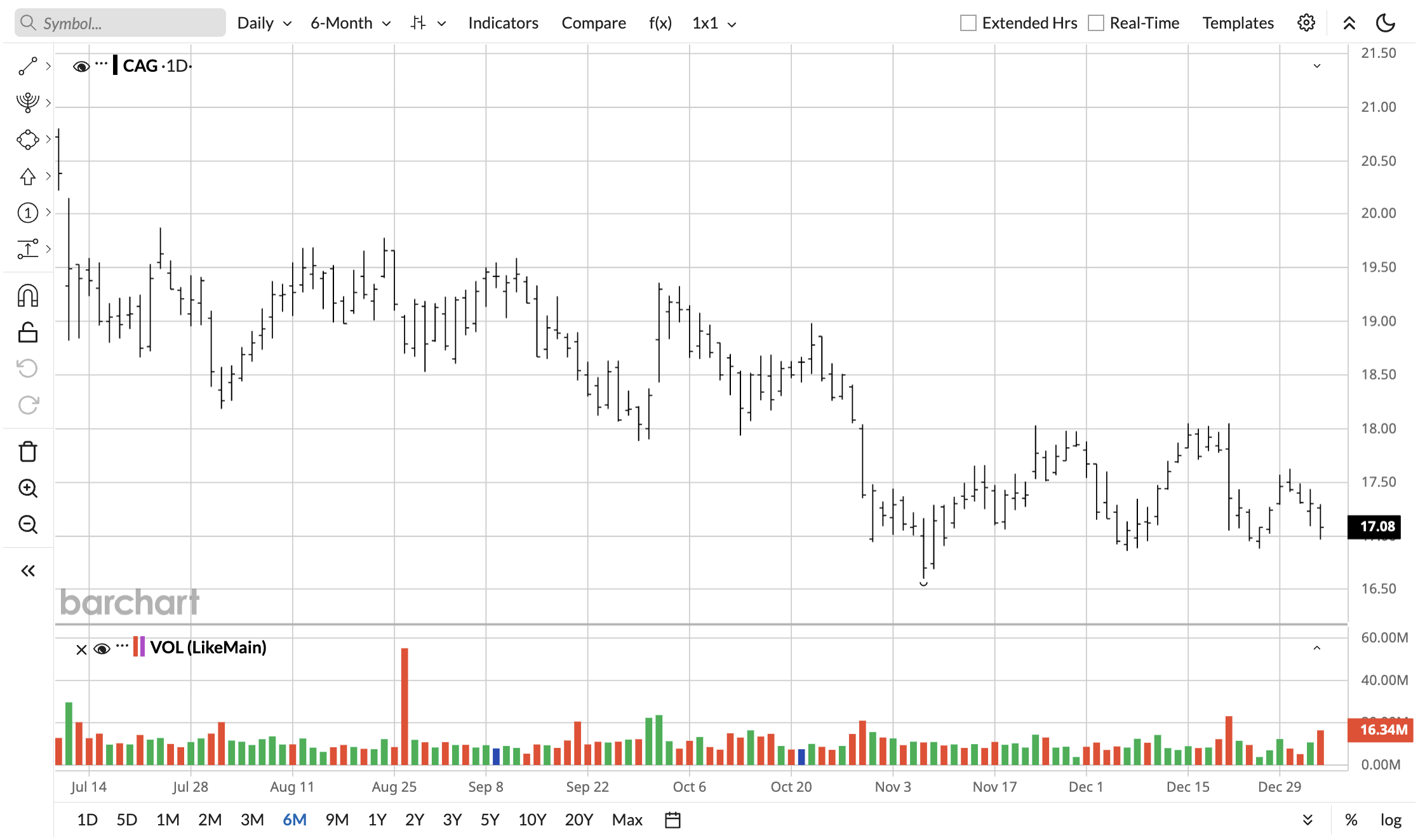

The 2020s have been unforgiving so far. CAG stock traded sideways early on before sliding over 57% from its 2023 peak. The culprit is declining sales and margins. Revenue growth slowed down from a 6.42% year-over-year (YoY) clip in FY 2023 to a decline of 1.84% in FY 2024, worsening to a decline of 3.64% in FY 2025.

Diluted EPS before non-recurring items fell from $2.67 in FY 2024 to $2.3 in 2025. Worse, analysts don't expect an improvement anytime soon. EPS is expected to fall 21.57% YoY in the current quarter and 14.29% in the next quarter. Full-year EPS is expected to decline by 24.78%. A modest 4.05% recovery is expected in FY 2027, but even that is far-fetched if estimates adjust downwards.

Conagra Brands isn't alone in its peril, considering most other packaged food and snacking companies are facing margin pressure. What matters is whether it will be able to claw its way back.

Is a 2026 Recovery on the Agenda?

Conagra Brands delivered surprises in the last two quarters, but earnings remain markedly worse. The condition of the broader industry leaves Conagra scarcely any options to mount a recovery anytime soon. Thus, I would rule out a quick bounce-back to highs above $30.

Wall Street analysts think the same way. The mean price target sits at $19.27, a hair above the current price of about $17.

Most are on the fence with 12 “Hold” ratings, with the “Buy” and “Sell” camps having two ratings each.

Can this new “Project Catalyst” prove everyone wrong? Perhaps, but management is yet to present any hard numbers. I wouldn't rely on a tentative earnings surprise from AI being adopted, as the ongoing margin pressure can end up offsetting that to a point where Conagra falls short of expectations anyway.

Should You Buy CAG Stock Now?

The smartest idea now may be to sit on the sidelines, but a buy isn't as bad as it looks. While earnings are expected to decline more, the price seems to be approaching a floor. The downtrend has slowed down, and CAG stock comes with a hefty 8.2% dividend yield as you wait for it to bounce back.

CAG stock hasn't been this cheap since 2009, so there is an argument to be made that the opportunity cost of weathering the storm for a few more years will be fruitful once this company eventually turns a corner. Once you collect and reinvest all those dividends, the total return can easily reach the triple digits if CAG stock makes a recovery to $30.

When exactly that will happen is anyone's guess, and I believe you can snap up shares at a lower price in the coming months due to the escalating earnings decline. All things considered, I will give CAG stock a “Hold” rating at best.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?

- Precious Metals Remain Strong: Why That’s a Red Flag for Stocks Amid Venezuela Tumult

- Will Roku Dominate Streaming Stocks in 2026?

- What's Driving the Parabolic Rise in Silver Futures, and How Long Can the Rally Last?