Today, unusual volume in out-of-the-money (OTM) Marvell Technology, Inc. (MRVL) put options is focusing attention on MRVL stock. Based on its recent acquisition and strong free cash flow, MRVL stock may be 38% undervalued at over $116 per share.

Marvell Technology, a system-on-a-chip designer, announced a bolt-on acquisition yesterday to enhance its AI-related product offerings.

However, MRVL stock is down today to $84.32 per share, providing an opportunity for value investors. Some investors are shorting out-of-the-money (OTM) puts in a one-month expiry period. That is a strong bullish signal for MRVL stock.

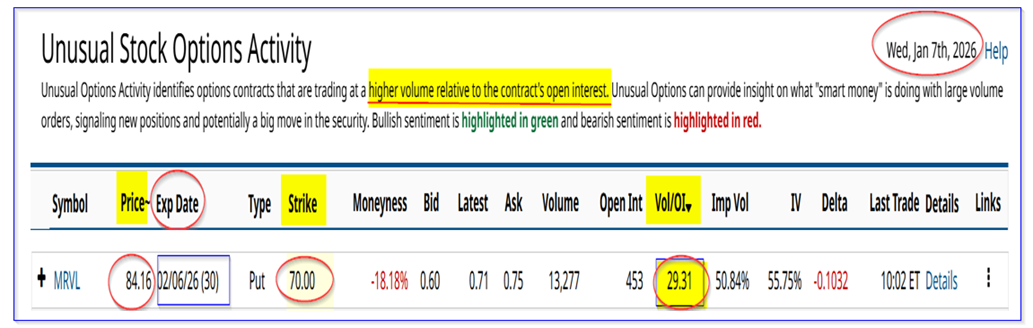

This heavy put options trading can be seen in today's Barchart Unusual Stock Options Activity Report.

It shows that over 13,000 put contracts have traded at the $70.00 exercise price, $14.32 below today's price (i.e., out-of-the-money), for expiry on Feb. 6, 2026. That means that buyers of these puts think MRVL stock is going to crater over the next month - i.e., a 17% drop.

More likely, the initiators of this trade are investors who are selling short these puts. That way, they gain a potentially cheap entry point into MRVL stock, as well as income.

For example, the $0.68 midpoint premium represents almost a 1% income yield over the next month (i.e., $0.68/$70.00 = 0.97%). However, there is only a 10% chance that MRVL will fall to this point, based on the low -0.1032 delta ratio.

The point is that some investors are clearly bullish on MRVL stock by shorting these puts. Let's look at why that might be.

Strong Free Cash Flow and FCF Margins

On Dec. 2, 2025, Marvell Technology reported strong revenue and free cash flow (FCF) for its fiscal Q3 ended November 1, 2025.

For example, its revenue rose 37% YoY and up +3.4% QoQ. Moreover, FCF was $508.8 million, 10.3% higher YoY, based on Stock Analysis figures. Moreover, on a trailing 12-month basis (TTM), its FCF was $1.581 billion, up 10.7% YoY.

More importantly, its FCF represented 24.53% of its quarterly revenue and 20.29% on a TTM basis. These are strong FCF margins and highlight the company's extreme profitability.

It also implies that FCF next year could be even higher.

For example, analysts now project revenue for the year ending Jan. 31, 2027, will be almost $10 billion (i.e., $9.98 billion according to Seeking Alpha).

So, for example, if we assume on a conservative basis that its next 12-month (NTM) FCF margin will be 21%, it implies FCF could be almost ⅓ higher:

$10b revenue x 0.21 = $2.1 billion FCF NTM

$2.1 / $1.581 LTM FCF = 1.328 -1 = +32.8% higher FCF

That also implies a much higher stock price target (PT).

Higher Price Targets (PTs) for MRVL Stock

For example, let's assume that the market eventually values MRVL stock with at least a 2.1% FCF yield. After all, its present market cap is $72.53 billion, according to Yahoo! Finance, giving it an LTM FCF yield of 2.18%:

$1.581b TTM FCF / $72.53 mkt cap = 0.0218

So, assuming the market values the projected $2.1 billion NTM FCF with a 2.1% FCF yield:

$2.1b / 0.021 = $100 billion market cap

That is 37.9% higher than today's market cap of $72.5 billion.

In other words, MRVL stock could be worth 37.9% over today's price:

$84.32 x 1.379 = $116.28 per share price target (PT)

Analysts Agree MRVL Stock is Cheap

Analysts on the Street also have higher PTs for MRVL stock. For example, 44 stock analysts surveyed by Yahoo! Finance have an average PT of $117.20.

Similarly, Barchart's mean survey PT is $116.75 per share. These are very close to my own price target of $116.28.

In addition, AnaChart.com, which tracks recent analyst write-ups, shows that 30 analysts have an average PT of $110.37.

The bottom line is that analysts see MRVL stock as deeply undervalued here.

Summary and Conclusion

As a result, despite today's lower price, likely based on a knee-jerk reaction against acquisitions, Marvel stock could provide a good buying opportunity for value investors.

This is indicated by the heavy volume in out-of-the-money (OTM) one-month expiry put options in MRVL stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart