With a market cap of $88 billion, Texas-based Waste Management, Inc. (WM) is the largest integrated waste services and environmental solutions company in North America. It provides comprehensive waste and recycling services to residential, commercial, industrial, and municipal customers across the United States and Canada, including waste collection, transfer, disposal, recycling, and landfill gas-to-energy operations.

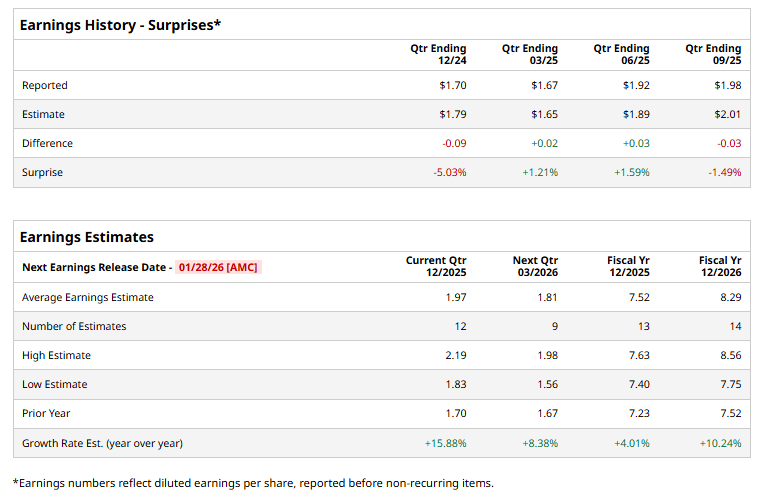

The company is expected to release its fiscal Q4 2025 results after the market closes on Wednesday, Jan. 28. Ahead of this event, analysts project WM to report an adjusted EPS of $1.97, a 15.9% growth from $1.70 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the company to report adjusted EPS of $7.52, up 4% from $7.23 in fiscal 2024. Looking forward, adjusted EPS is projected to rise 10.2% year over year to $8.29 in fiscal 2026.

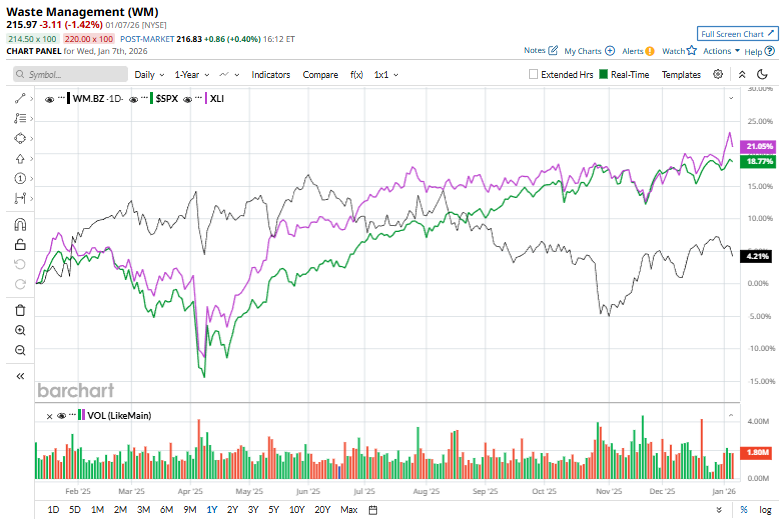

WM stock has risen 6.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.1% return and the Industrial Select Sector SPDR Fund's (XLI) 20.2% gain over the same period.

Waste Management shares climbed 1.5% after the company announced a 14.5% dividend increase for 2026, extending its streak of annual dividend growth to 23 consecutive years and highlighting strong, resilient cash flow generation. The new quarterly dividend of $0.945 per share, or $3.78 annually, implies a yield of about 1.7% at current price levels, above the S&P 500 average. In addition, the company authorized a new $3 billion share repurchase program and plans to return roughly 90% of free cash flow to shareholders over the next year, reflecting management’s confidence in the business and its capital return strategy.

Analysts' consensus view on WM stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 28 analysts covering the stock, 18 suggest a "Strong Buy," one gives a "Moderate Buy," and nine provide a "Hold" rating. The average analyst price target for Waste Management is $248.54, indicating a potential upside of 15.1% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart