Builders FirstSource, Inc. (BLDR), based in Irving, Texas, manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers. Valued at $13.7 billion by market cap, the company has approximately 570 distribution and manufacturing locations, a presence in 43 states, and 90 of the top 100 Metropolitan Statistical Areas.

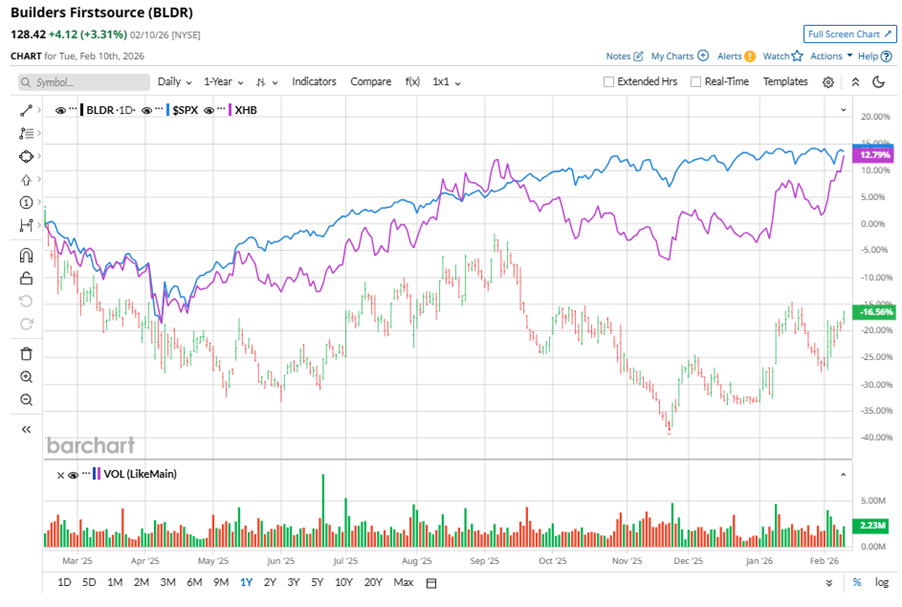

Shares of building products supplier giant have underperformed the broader market over the past year. BLDR has declined 17.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.4%. However, in 2026, BLDR stock is up 24.8%, surpassing the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, BLDR’s underperformance is also apparent compared to the SPDR S&P Homebuilders ETF (XHB). The exchange-traded fund has gained about 13.4% over the past year. However, the stock’s gains on a YTD basis outshine the ETF’s 16.9% returns over the same time frame.

BLDR's struggles came from a weak housing market, low sales, and margin pressure, hurting investor confidence over the past year. However, this year, the stock's rising on better housing data and hopes for policy support (like rate cuts) and housing starts revival. Acquisitions drove some growth, but organic sales and commodity deflation dragged it down.

For the current fiscal year, ended in December 2025, analysts expect BLDR’s EPS to decline 38.9% to $7.06 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

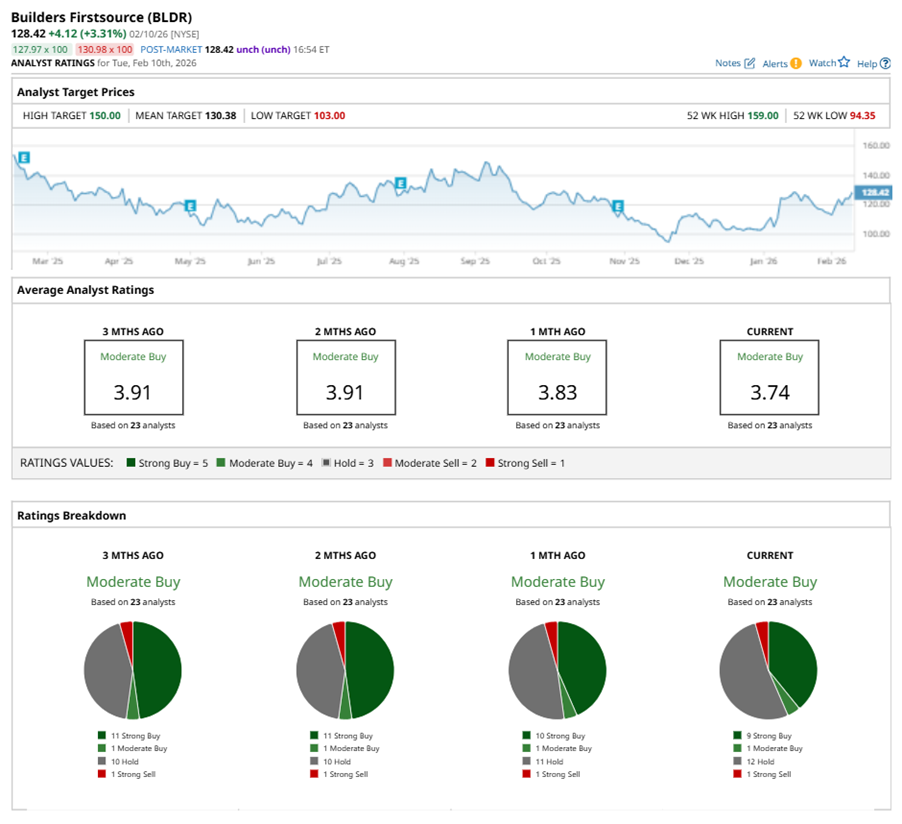

Among the 23 analysts covering BLDR stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” 12 “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with 10 analysts suggesting a “Strong Buy.”

On Feb. 2, DA Davidson kept a “Neutral” rating on BLDR and lowered the price target to $111.

The mean price target of $130.38 represents a 1.5% premium to BLDR’s current price levels. The Street-high price target of $150 suggests an upside potential of 16.8%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart