Silver hit an all-time high of $121.60 per ounce on Jan. 29, 2026, then sank to $74 in a single session, a drop so extreme it was called “the wildest week in metals ever.” Even after that sharp selloff, the March 2026 silver futures contract (SIH26) is still up more than 18% year-to-date (YTD), and the iShares Silver Trust (SLV) is up roughly 150% over the past 12 months.

The reasons behind the move are still in place. The silver market is heading into what the Silver Institute expects to be a sixth straight year of supply deficit, with a total shortfall of nearly 820 million ounces. At the same time, Fresnillo (FNLPF), the world’s largest primary silver producer, recently cut its 2026 output guidance to 42 to 46.5 million ounces, down from its earlier 45 to 51 million ounce forecast, which suggests supply is not catching up anytime soon.

That mix is helping set up short squeezes in silver mining stocks. A widely watched short squeeze in silver has already led to margin calls on naked short positions and forced buying across the silver futures market. That same pressure is starting to show up in silver equities. Short interest in silver miners has climbed to a recent high, and there has been clear short covering in names like First Majestic Silver (AG) and Discovery Silver (DSVSF). Meanwhile, Silvercorp Metals (SVM) is still posting record financial results even with bearish bets remaining elevated.

With volatility in the metal still extreme and positioning in select miners getting stretched, could these three silver stocks be next in line for a meaningful short-covering rally? Let’s find out.

First Majestic Silver (AG)

First Majestic Silver is a primary silver producer with operating mines in Mexico and the U.S. The company makes most of its money by producing and selling silver, plus a meaningful amount of by-product gold, and it uses exploration and M&A to extend mine life and increase output when metal prices are strong. AG is up 306% over the past 52 weeks and up 41% YTD.

AG stock also looks priced more for growth than for value. Its forward P/E is 68.72x versus the sector’s 19.17x, which means the market is paying a big premium for expected earnings growth.

On the operations side, the latest update shows why bearish positioning can get crowded and then turn painful. In Q4 2025, First Majestic produced a record 4.2 million silver ounces, up 77% YoY, including 1.5 million ounces attributable to Los Gatos.

Silver-equivalent production increased to 7.8 million ounces, up 37% YoY, and the company ran an aggressive drilling program of 57,305 meters to keep feeding its project pipeline. Management also raised its dividend framework to 2% of net quarterly revenues starting in 2026, which signals confidence in cash generation as production scales.

That growth push is backed by both deals and the drill bit. The Gatos Silver transaction added a 70% joint-venture interest in the Los Gatos underground mine, while work continues on exploration and mine planning at Santa Elena’s Santo Niño and Navidad targets. At the same time, First Majestic agreed to sell the Del Toro asset to Sierra Madre for up to $60 million, a step that can tighten the company’s focus and support balance-sheet flexibility.

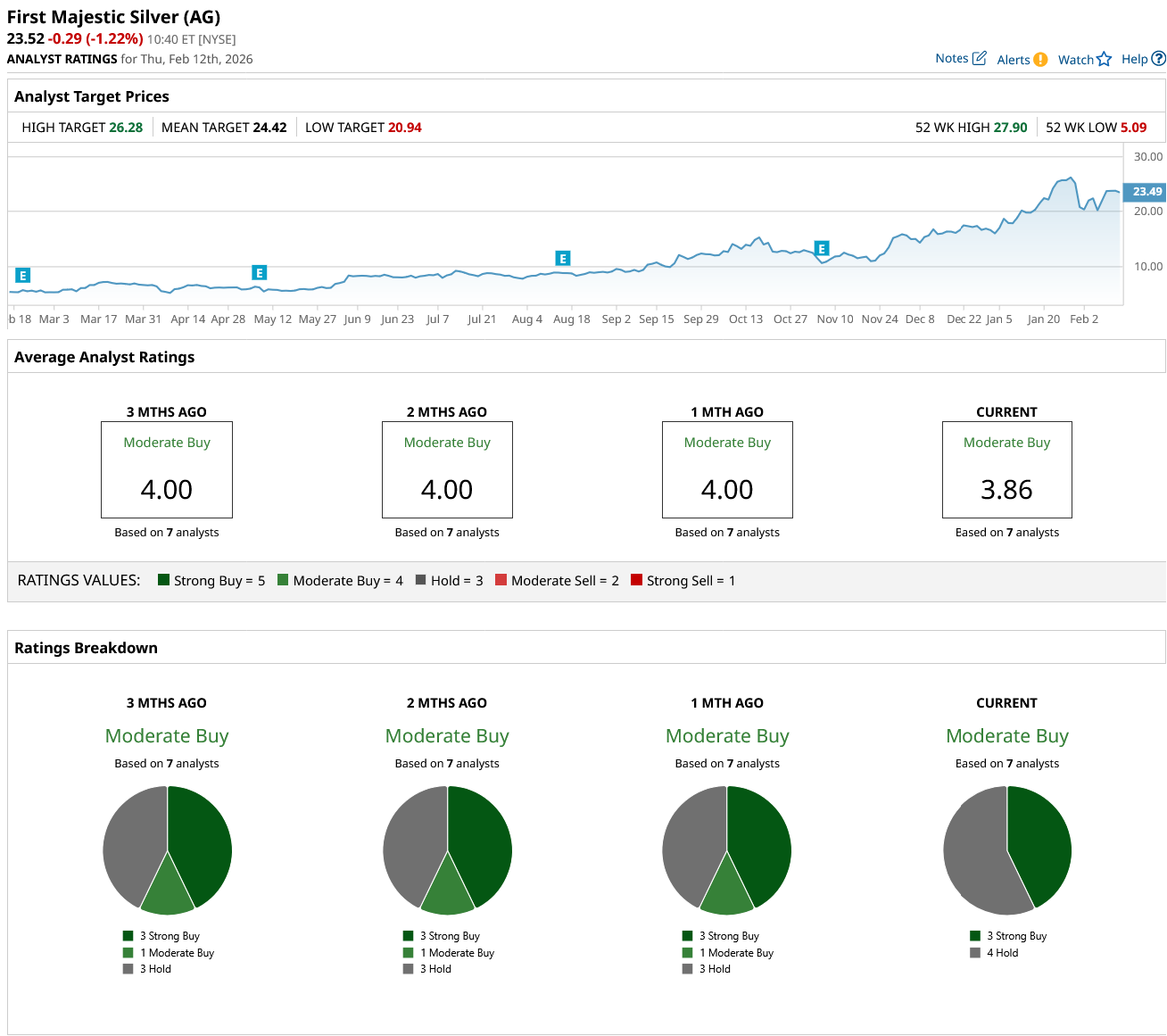

Wall Street’s view is positive but not aggressive on the numbers. A “Moderate Buy” consensus among seven analysts and a $24.42 mean target versus a current price of $23.52 points to only an approximately 4% upside on paper.

Discovery Silver (DSVSF)

Discovery Silver is a precious-metals miner with a straightforward plan. It runs producing assets to generate cash flow while also building out a longer-term growth pipeline through exploration, resource conversion, and careful capital spending.

The stock is up 625% over the past 52 weeks and up 32% YTD. A move like that can set up fast, liquidity-driven spikes, especially when short interest is high.

Operationally, Discovery’s Q4 2025 update showed strong results from its Timmins platform. It produced 66,718 ounces of gold, poured 67,010 ounces, and sold 64,479 ounces at an average realized price of $4,157 per ounce sold, alongside “excellent” exploration results across its operations and district drilling at Owl Creek.

For the short-squeeze angle, the balance sheet matters too. The company ended 2025 with about $410 million in cash and also put in place a $250 million revolving credit facility with a $100 million accordion feature, which gives it funding flexibility and reduces the kind of financing pressure shorts often point to.

The big shift behind the market’s re-rating was the April 15, 2025, acquisition of Newmont’s Porcupine Complex. That deal turned Discovery into a Canadian gold producer with multiple operations in and around Timmins, Ontario, one of the world’s best-known gold camps, and it also delivered a dominant land position with meaningful remaining resource and exploration upside.

Then in October 2025, Discovery signed a Resource Development Agreement with Taykwa Tagamou Nation, creating a framework for consultation and economic benefits, which helps support operating continuity at a time when sentiment is stretched and shorts are active.

Silvercorp Metals (SVM)

Silvercorp Metals is a cash-generative silver producer that earns most of its money from silver, with meaningful by-product credits from lead and zinc. That mix can help keep costs under control when metal prices swing.

Momentum has been strong. SVM is up 222% over the past 52 weeks and up 34% YTD.

On valuation, Silvercorp’s forward P/E of 20.82x versus the sector’s 19.17x suggests the stock is only slightly more expensive than peers based on expected earnings.

The latest quarter backed up the move. In Q3 fiscal 2026, revenue rose to a record $126.1 million, up 51% YoY, with realized silver at $49.0/oz after smelter deductions and silver making up 72% of revenue. Cash costs net of by-product credits were negative $3.02/oz, and AISC was $12.86/oz. Adjusted net income came in at $47.9 million, or $0.22 per share, and operating cash flow totaled $132.9 million, lifting cash plus short-term investments to $462.8 million, which gives the company room to fund growth without rushing to dilute shareholders.

On the growth side, Silvercorp signed a deal in January 2026 to acquire 70% of the Tulkubash/Kyzyltash gold projects, including a Phase 1 4 Mt/y heap-leach plan targeting about 110,000 oz of gold per year starting in 2027-2028. It also moved El Domo in Ecuador forward, with the budget updated to $284 million and first production now guided for July 1, 2027. Improved metallurgy lifted modeled copper recovery by 5.4% and gold recovery by 6.2%.

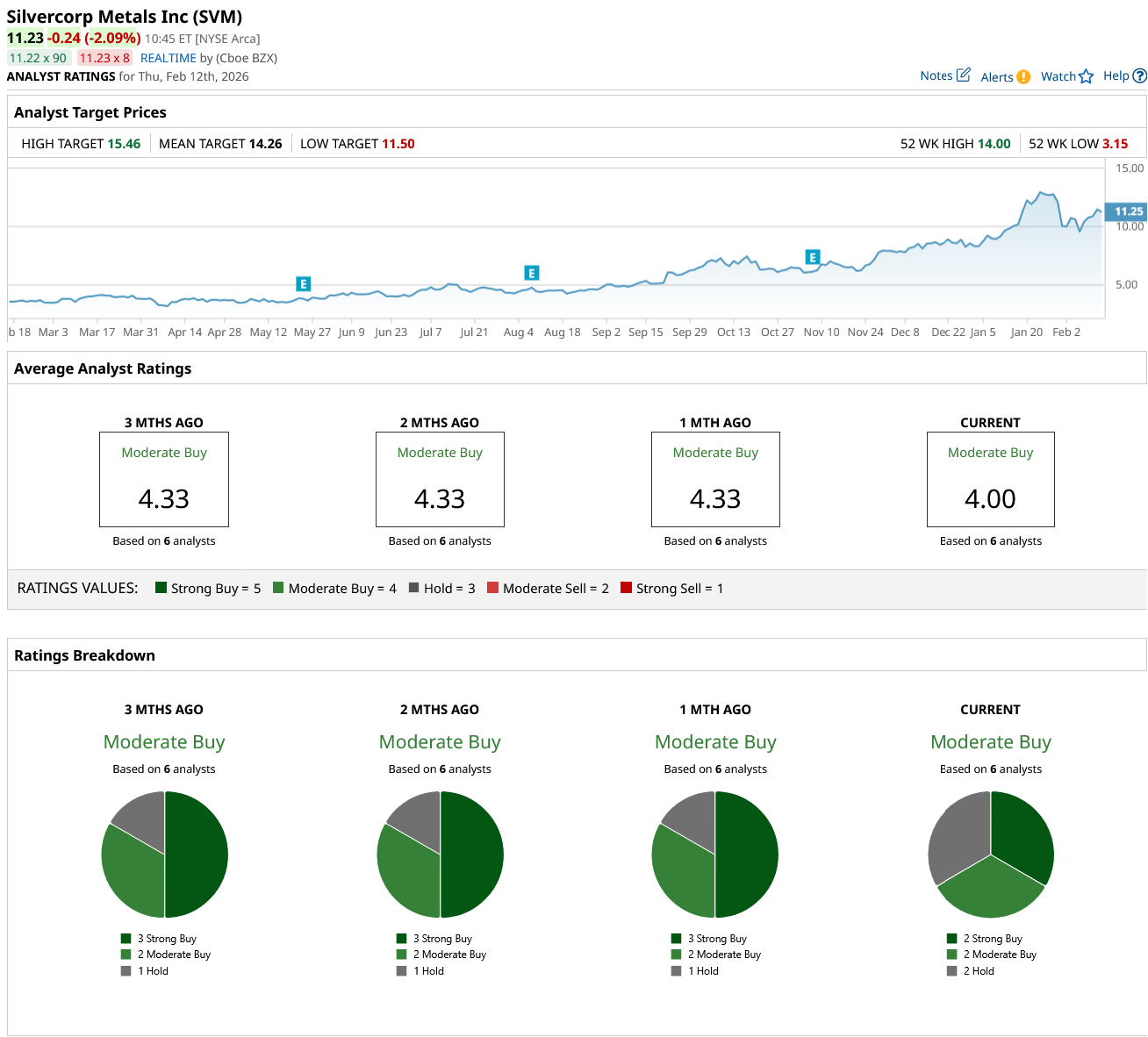

Analysts remain positive with a “Moderate Buy” consensus among six analysts, and the $14.26 average target implies about 27% upside from $11.23.

Conclusion

At this point, the squeeze setup in silver miners looks very real, but it’s still a trade, not a sure thing. If silver holds above recent lows and futures positioning keeps forcing short covering, AG, DSVSF, and SVM all look skewed to the upside rather than the downside over the next stretch, with the higher‑beta names likely to overshoot on good news. If the metal cracks again or liquidity dries up, though, these same charts can unwind brutally fast. In other words, the path is noisy, but the balance of probabilities still leans to higher prices, not lower.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Does Alphabet’s $31.5 Billion Bond Sale Really Mean for GOOGL Stock Investors?

- As Salesforce Acquires AI Startup Cimulate, Should You Buy, Sell, or Hold CRM Stock?

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead

- 200 Years Later, This Stock Is Still Setting New All-Time Highs