E-commerce has steadily evolved into one of the market’s most compelling long-term investment themes, and for good reason. Global e-commerce revenue is projected to hit almost $3.89 trillion in 2026, growing at a steady 6.3% CAGR and reaching a stunning $5 trillion by 2030. While giants like Amazon (AMZN) tend to dominate investor attention, looking beyond the U.S. could be a smart move for those seeking broader exposure to the global digital shopping boom.

And that’s exactly where Jumia Technologies AG (JMIA) comes into focus. Often considered Africa’s leading e-commerce platform, Jumia has staged a remarkable rally in recent years, fueled by strengthening fundamentals and rising investor interest in the region’s digital commerce landscape. Although the stock has experienced some volatility this year, one Wall Street analyst believes the turbulence may be masking a much bigger opportunity.

Cantor Fitzgerald analyst Deepak Mathivanan recently initiated coverage with a bullish rating and a $18 price target, implying over 74% upside from current levels. Importantly, Mathivanan isn’t downplaying the risks. The analyst describes JMIA stock as a venture-capital (VC)-style bet in the public markets, meaning the path could be volatile, but the long-term reward potential may be substantial. So, what exactly is driving this analyst to take such a bullish stance?

About Jumia Stock

Founded in 2012, Jumia is a pan-African e-commerce platform operating in nine countries, built around the idea of using technology to make everyday goods and services easier to access. The company focuses on offering online shopping options that are designed to be convenient and affordable, while also giving local and international businesses a way to reach more customers through a digital storefront. Its ecosystem is made up of several moving parts.

The marketplace connects roughly 70,000 sellers with consumers, creating a wide product selection across different categories. Behind the scenes, a large logistics network handles the movement and delivery of packages, an important function in regions where infrastructure can be complex and varied.

The platform also includes JumiaPay, a proprietary payment service that supports transactions between buyers and sellers in select markets. Together, these elements form a digital commerce network aimed at expanding online retail access across the continent without relying solely on traditional brick-and-mortar systems. With a market capitalization of roughly $1.3 billion, Jumia hasn’t been spared from recent market jitters.

The stock has slipped about 21.62% so far in 2026 as investors grow cautious over profitability concerns and digest the company’s latest earnings update. But the short-term pullback doesn’t tell the whole story. Zoom out, and the longer-term trend looks far more impressive. Over the past year, Jumia’s stock has surged nearly 153.63%, dramatically outperforming even global e-commerce heavyweight Amazon, whose shares are down 11.58% this year.

Jumia Tanks After Q4 Earnings Report

Jumia released its fiscal 2025 fourth quarter earnings report on Feb. 10, delivering strong growth across several key metrics. Still, the market reaction was harsh, with shares tumbling nearly 15.8% the same day. On the surface, the numbers looked solid. Revenue climbed 34% year-over-year (YOY) to $61.4 million. Quarterly active customers rose 26% to three million, extending an acceleration trend seen throughout 2025.

Demand remained healthy as physical goods orders jumped 32% YOY to 7.5 million in Q4. Spending activity also picked up meaningfully. Gross Merchandise Value (GMV) reached $279.5 million, up from $206.1 million in the fourth quarter of 2024, a 36% YOY increase. Excluding South Africa and Tunisia, physical goods GMV grew even faster at 38%. Nigeria stood out in particular, with orders up 33% and GMV surging 50% YOY.

Profitability metrics showed improvement as well. Adjusted EBITDA loss narrowed significantly to $7.3 million from $13.3 million a year earlier. Loss before income tax also improved, narrowing to $9.7 million from $17.6 million in the prior-year quarter, though losses persist, underscoring that profitability challenges remain. Cash burn dropped sharply to $4.7 million in Q4 2025 versus $15.8 million in Q3, reflecting tighter working capital management.

As of Dec. 31, 2025, the company reported a liquidity position of $77.8 million, including $76.7 million in cash and cash equivalents and $1.2 million in term deposits and other financial assets. Despite operational progress and narrowing losses, investors appear uneasy about the company’s forward outlook and the timeline to profitability.

Looking ahead, Jumia expects GMV to grow 27% to 32% YOY in 2026. However, management still forecasts an adjusted EBITDA loss of $25 million to $30 million for the year. The longer-term plan remains intact, with a goal of reaching adjusted EBITDA breakeven and positive cash flow in the fourth quarter of 2026, followed by full-year profitability and positive cash flow in 2027.

How Are Analysts Viewing Jumia Stock?

Despite ongoing swings in the share price, optimism hasn’t disappeared. On Feb. 6, Cantor Fitzgerald initiated coverage on Jumia with an “Overweight” rating and an $18 price target. The firm characterizes JMIA as a “VC-style, high-risk/high-reward” play in the public markets, built around the idea that Africa remains “the final frontier for e-commerce,” where online retail penetration is still less than one-fifth of levels seen in many developed economies.

Of course, that opportunity doesn’t come without real financial risk. Jumia is still unprofitable, reporting an EBITDA loss of $66.7 million over the past twelve months. Even so, Cantor highlights the company’s internal transformation as a key inflection point. Over the last three years, Jumia has moved away from being a cash-burning, do-it-all platform and reshaped itself into a leaner, more focused e-commerce operator.

With that restructuring largely complete, Cantor believes Jumia now has a credible shot at becoming the “Amazon of Africa,” while openly acknowledging that the journey will be uneven. If management can deliver steady execution, the firm argues, the company could produce meaningful long-term returns over the next decade, a potentially outsized payoff that matches the elevated risk.

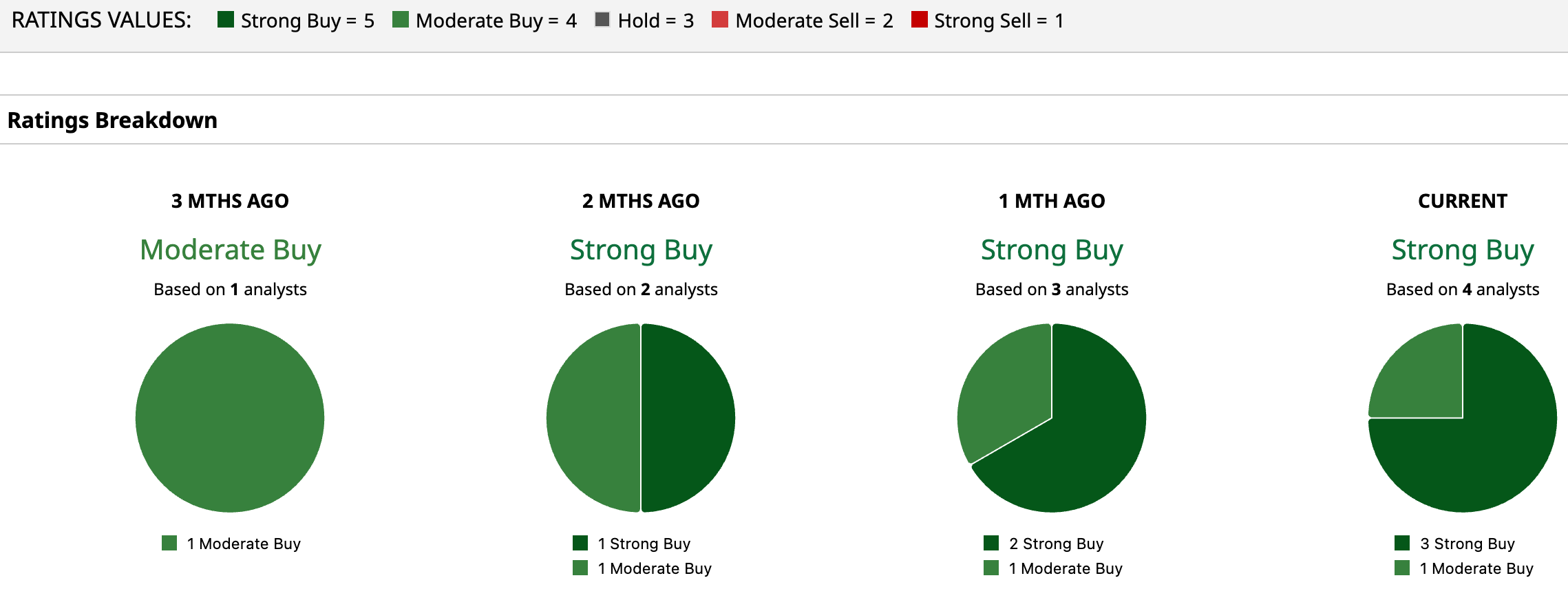

Overall, Wall Street’s stance on Jumia remains notably upbeat, with the stock earning a consensus “Strong Buy” rating. Of the four analysts currently covering the company, three recommend “Strong Buy,” while one leans toward “Moderate Buy,” reflecting broad confidence in Jumia’s long-term growth story.

The upside potential projected by analysts is equally eye-catching. The average price target of $17.25 points to roughly 76% upside from current levels. Meanwhile, Cantor Fitzgerald’s Street-high target of $18 suggests the stock could climb as much as 83.9% if its bullish thesis plays out.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart