Headquartered in Wilmington, Delaware, Incyte Corporation (INCY) discovers, develops, and commercializes innovative therapies that confront some of medicine’s toughest challenges. Commanding a market cap of roughly $19.6 billion, the company targets blood cancers, solid tumors, immune-mediated disorders, and dermatological diseases.

Over the past 52 weeks, INCY stock has surged 49%, comfortably eclipsing the S&P 500 Index ($SPX) 14.4% gain during the same period. Year-to-date (YTD), INCY stock remains marginally positive, while the broader index has gained 1.4%.

Against its sector yardstick, the State Street SPDR S&P Biotech ETF (XBI) has advanced 40% over the past year and risen 2.2% YTD, narrowly outperforming INCY stock in the shorter window.

However, on Feb. 10, the market greeted Incyte’s fourth-quarter 2025 results with a frown, sending shares down 8.2%. Ironically, the company delivered revenue growth that surpassed Wall Street expectations. The top line surged 27.8% year over year to $1.51 billion, comfortably exceeding analysts’ $1.35 billion estimate.

However, adjusted EPS reached $1.80, falling short of the $1.92 Wall Street forecast, though it increased 25.9% from the prior-year level. Management credited strong commercial execution across Jakafi and Opsalura and highlighted meaningful late-stage pipeline progress.

Looking ahead, they have anchored their outlook in anticipated launches in late 2026 and early 2027, sustained investment in pivotal trials, and potential regulatory approvals. For fiscal 2026, Incyte’s management projects total net product revenue between $4.77 billion and $4.94 billion.

Analysts, for their part, forecast fiscal 2026 diluted EPS of $6.66, implying 19.4% year over year growth. Importantly, Incyte has topped EPS estimates in three of the past four quarters, while missing in just one.

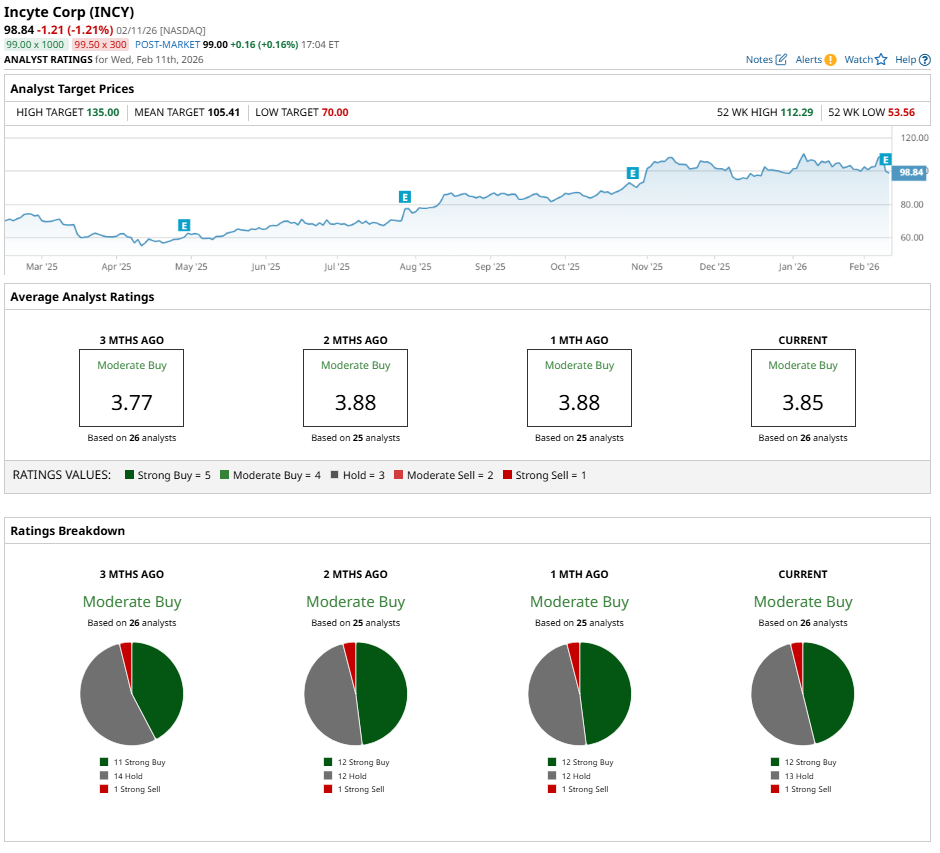

Wall Street sentiment remains firmly supportive, assigning INCY stock an overall “Moderate Buy” rating. Among 26 analysts, 12 issue a “Strong Buy,” 13 recommend “Hold,” and one assigns a “Strong Sell.”

Importantly, analyst sentiment has improved from three months ago, when 11 analysts carried a “Strong Buy” stance.

Recent price-target revisions underscore the steady confidence. On Feb. 6, Piper Sandler’s Allison Bratzel reiterated her “Overweight” rating and lifted her price target to $110 from $102. That same day, Stifel’s Stephen Willey nudged his price target higher to $120 from $119 and maintained a firm “Buy” rating.

Moreover, HC Wainwright’s Mitchell S. Kapoor also reaffirmed a “Buy” rating on Feb. 5 and held the price target at $135.

Taken together, these targets provide a crisp sentiment snapshot. The average price target of $105.41 suggests 6.6% upside from current levels, while HC Wainwright & Co’s Street-high $135 target signals 36.6% gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Outperforming Dividend Stock Increased Its 2026 Payout by 20%: Should You Buy?

- Astera Labs Plunges Below Key Support Levels. Should You Buy the Dip in ALAB Stock?

- Can a New CEO Save Workday Stock from the Software Apocalypse?

- A Crypto Collapse Sends Robinhood Stock Back into Oversold Territory. Should You Buy the Dip?