Lyft (LYFT) just reported record profitability in its latest quarter while announcing a substantial $1 billion share repurchase program, signaling confidence in its financial health and future growth. Despite these positive developments, shares are tumbling this week primarily due to guidance that fell short of expectations amid disruptions from a brutal winter storm.

This market reaction comes as LYFT stock has already declined 50% from its 52-week high, raising questions about investor sentiment. Is this drop an overreaction to temporary weather-related setbacks? With the stock trading at levels that appear increasingly attractive relative to its fundamentals and peers, could Lyft now be too cheap for value-oriented investors to ignore? Let's take a closer look.

About Lyft Stock

Lyft is a leading ride-sharing platform that connects drivers with passengers via its mobile app, offering services like standard rides, shared rides, and premium options, while also expanding into bike and scooter rentals. Headquartered in San Francisco, California, the company operates primarily in the U.S. and Canada, competing fiercely with Uber Technologies (UBER) in a market challenged by regulatory hurdles, driver shortages, and economic pressures. LYFT stock has been depressed due to persistent profitability concerns, intense competition, and macroeconomic factors like inflation impacting consumer spending on discretionary travel.

Shares are down approximately 82% from their initial public offering (IPO) price of $72 in 2019, reflecting years of operational losses and market volatility. In 2026, the stock is down 33% year-to-date (YTD), underperforming the S&P 500 ($SPX), which has gained less than 1% over the same period. This lag highlights investor caution amid broader market optimism.

In terms of valuation, Lyft's trailing price-to-earnings (P/E) ratio stands at 48, higher than its historical average of around 45 but elevated compared to the transportation industry's 39 average, indicating some premium pricing based on past earnings. However, the forward P/E of 25 times is somewhat lower than the industry average of 29, suggesting expectations of stronger future earnings growth. The price-to-sales (P/S) ratio of 1.07 is also below the industry average of 1.5, pointing to undervaluation relative to revenue generation.

These metrics, combined with a low PEG ratio of 1.05, imply that LYFT stock is undervalued, especially as profitability improves, making it potentially attractive for long-term investors despite current pressures.

Lyft Posts Another Strong Quarter

Lyft's fourth-quarter earnings showcased robust operational momentum despite some headline misses. The company delivered gross bookings of $5.1 billion, up 19% year-over-year (YOY) and surpassing analyst estimates of $5.06 billion, driven by an 18% YOY increase in active riders to 51.3 million and a record 946 million rides. Adjusted EBITDA reached $154.1 million, a 37% improvement from the prior year and beating expectations of $147.1 million, marking the company's most profitable quarter ever.

On earnings, Lyft reported adjusted EPS of $0.16, exceeding the consensus of $0.12 by 33%, though reported EPS was a $0.20 loss due to one-time items. Revenue came in at $1.59 billion, up 3% YOY but missing estimates of $1.76 billion. However, adjusting for a $168 million negative impact from legal, tax, and regulatory reserves, revenue would have been around $1.8 billion, implying underlying strength.

This performance continues a trend of beating EPS expectations over the past four quarters where the firm routinely exceeds estimates by double-digit percentages. Over these periods, Lyft has consistently grown rider engagement and efficiency, with driver hours hitting records for 12-straight quarters.

The $1 billion buyback program underscores management's belief in undervaluation. However, Q1 2026 guidance disappointed, with adjusted EBITDA projected at $120 million to $140 million (below the $140 million expected), attributed to severe winter weather disrupting operations and seasonal costs.

Despite this, full-year 2025 free cash flow of $1.12 billion beat estimates, positioning Lyft for sustained growth in a recovering mobility sector.

What Do Analysts Expect for LYFT Stock?

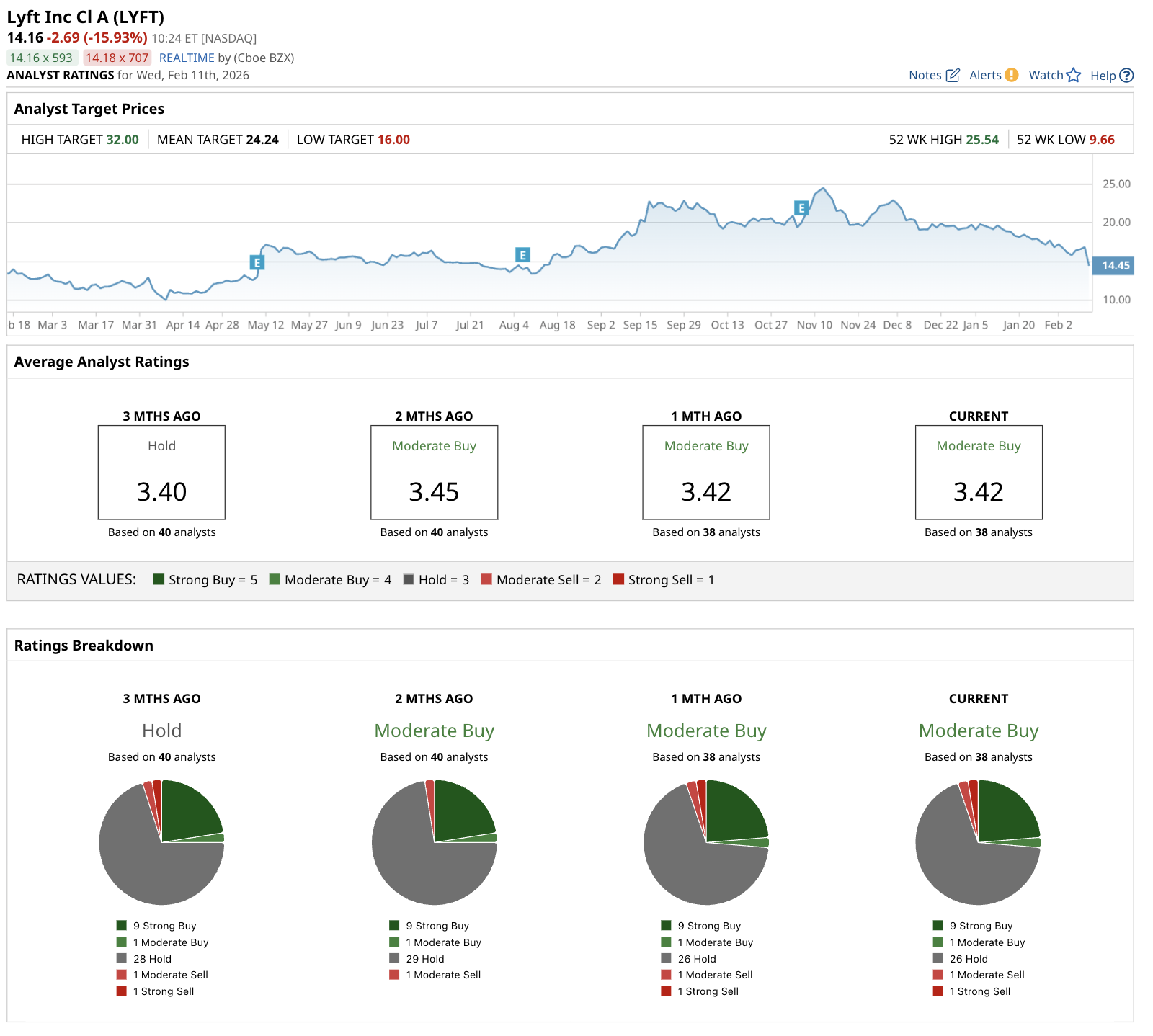

Analyst consensus on LYFT stock leans toward a “Moderate Buy” rating, based on coverage from 38 analysts. The rating breakdown includes nine "Strong Buy" ratings, one "Moderate Buy," 26 “Hold” ratings, one "Moderate Sell," and one “Strong Sell” rating, reflecting a cautiously optimistic view amid competitive pressures and economic uncertainties. Few notable changes have occurred, with most analysts reiterating their "Hold" recommendations but cutting price targets..

The mean price target of $22.64 represents potential upside of 74% from current levels. This implies that analysts see room for recovery as Lyft executes on international expansion, partnerships, and autonomous vehicle integrations, potentially driving earnings growth in 2026 and beyond. In short, LYFT stock is just too cheap to ignore.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart