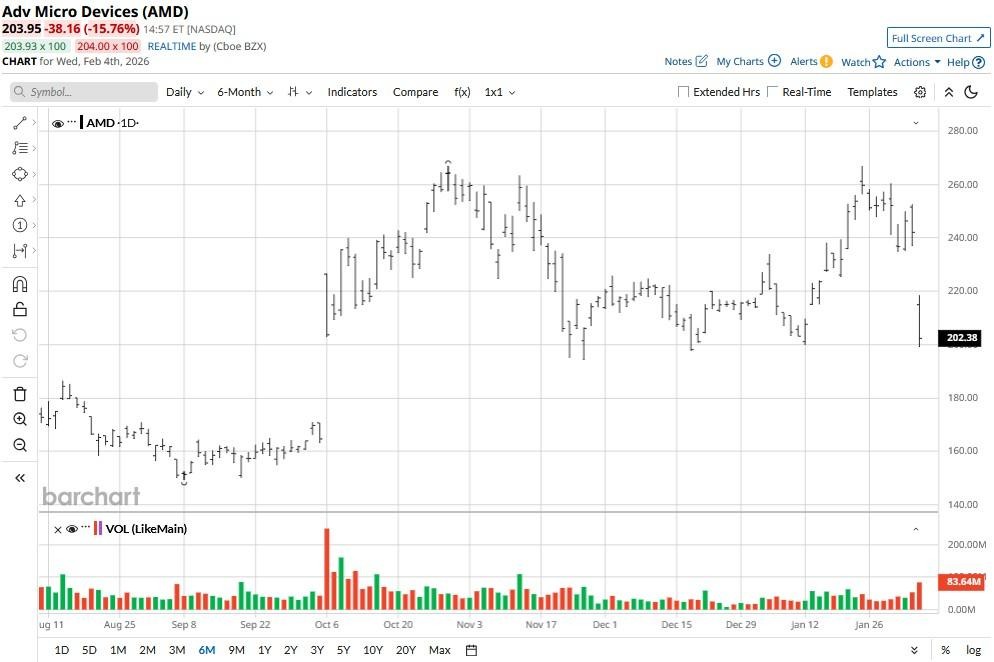

Advanced Micro Devices (AMD) shares crashed as much as 17% on Wednesday as the company’s muted Q1 guidance overshadowed record financials it reported for its fourth quarter. The post-earnings weakness pushed AMD meaningfully below its major moving averages (50-day and 100-day), indicating bears have taken control across multiple timeframes.

Versus its year-to-date high, AMD stock is now down more than 20%.

Is it Worth Buying AMD Stock on the Pullback?

Northland Capital analysts recommend buying AMD shares on the post-earnings decline primarily because they don’t see it as a fundamental breakdown but rather a case of “expectations getting ahead of reality."

According to Northland Capital, the company has already secured eight of the top 10 artificial intelligence (AI) firms as customers, which in itself is a big enough reason to stick with its stock.

Moreover, AMD confirmed in its press release that it has started shipping chips to China. This may help it come in handily above its guided range in the first quarter, according to Northland analysts.

On Wednesday, analysts maintained their “Outperform” rating on Advanced Micro Devices with a $260 price target, indicating potential upside of nearly 30% from here.

Why Else Are AMD Shares Remain Attractive in 2026?

AMD stock is worth owning on recent weakness also because the company’s data center revenue hit a record $5.4 billion in its fiscal Q4.

And the massive recent wins from OpenAI and Oracle (ORCL) will likely sustain that trajectory through the end of 2026.

With the MI350 series ramping up and the next-gen MI450 on track for a 2026 debut, Advanced Micro Devices is positioning itself as the only credible high-volume alternative to Nvidia (NVDA).

Factor in a robust 54% gross margin and a history of beats-and-raises, and this technical dip starts to look like a premium entry point for long-term believers in the AI revolution.

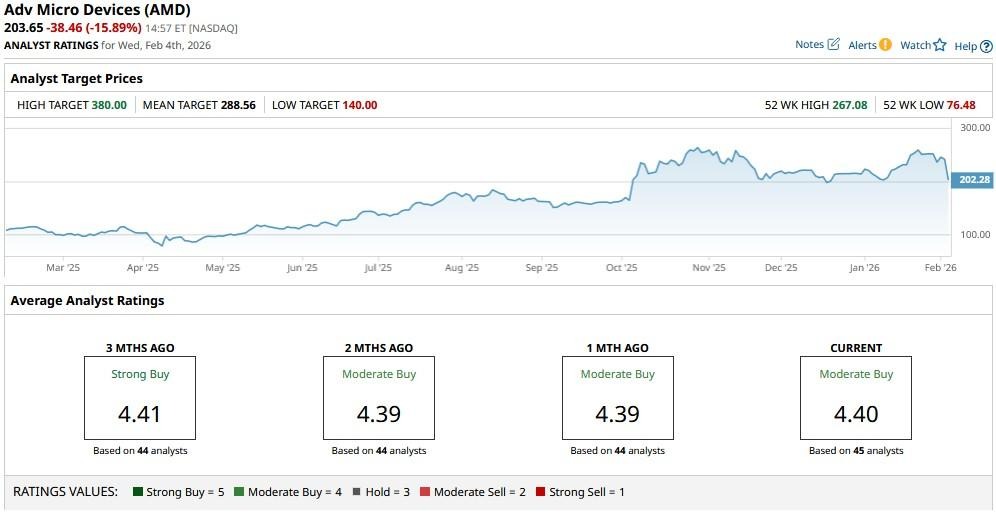

Wall Street Remains Bullish on Advanced Micro Devices

What’s also worth mentioning is that Northland Capital is actually among the more conservative Wall Street firms on Advanced Micro Devices.

The consensus rating on AMD shares sits at a “Moderate Buy,” with the mean target of $288 signaling potential upside of more than 43% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Enphase Energy Stock Just Shot Into Overbought Territory. Is It Too Late to Buy ENPH?

- Amazon Is Widely Launching Alexa+. Can That Move the Needle for AMZN Stock?

- As AMD Stock Breaks Below Key Support on Earnings Selloff, Should You Buy the Dip?

- ‘You Don’t Need to Have a PhD in Computer Science’ to Make a Great Living as AI Disrupts the Economy as We Know It. The Good and Bad of Nvidia CEO Jensen Huang’s Latest Prediction.