Tesla (TSLA) is making an artificial intelligence (AI) pivot that is deepening with a controversial bet on CEO Elon Musk's own company, xAI. The firm recently disclosed a $2 billion investment in the AI startup as part of a $20 billion funding round. This moves comes despite shareholders rejecting the proposal a few months before in November 2025 and board chair Robyn Denholm opposing the deal.

Announced in Tesla's fourth-quarter 2025 earnings release, the investment will deepen the firm's AI strategy under "Master Plan IV" but raises conflict-of-interest concerns with ongoing lawsuits that already allege Musk is diverting Tesla resources to his private company. It may also be the first of many investments to come, as Musk pivots Tesla from being mainly an electric vehicle (EV) manufacturer toward an "AI in the physical world" company.

A Closer Look at Tesla

Before looking at the deal itself, let's consider what Tesla reported in Q4 2025. The company posted $24.9 billion in sales during the fourth quarter, down 3% year-over-year (YOY). Non-GAAP EPS declined by 17% YOY to $0.50, while operating income fell by 11% to $1.4 billion.

Revenue came in slightly below forecasts, but it gets worse when looking at the specific segments at play. Automotive revenue declined 11% during the period and deliveries were down 16% YOY. It was only due to the energy storage and services segments surging by 25% and 18%, respectively, that Tesla managed to satisfy analysts.

With Tesla still struggling to make a full recovery, investing in xAI raises questions. Most AI startups are aggressively burning cash, and this one is no different. So, the $2 billion investment from Tesla does not look like a good idea to many shareholders.

Could This Deal Help Tesla Down the Line?

The initial vote back in November was surprisingly close, with 1.06 billion votes in favor and 916.3 million against the deal. What's more, despite the investment now going through, TSLA stock hasn't made any meaningful moves in either direction as of yet. After all, $2 billion is not too much money for a company with a $1.58 trillion market capitalization. Tesla had $44 billion in cash on its balance sheet as of the Q4 report.

With that in mind, this investment could actually help Tesla by giving the company more leverage over xAI and reinforcing bulls who are convinced that Tesla's AI endeavors matter more than its EVs. xAI has a lot of talent under its wing, and the firm has frontier models that compete with AI models from Alphabet (GOOGL), OpenAI, and Anthropic. The startup's tech is already integrated into Tesla products, such as Optimus robots. Hence, if it costs Tesla a few billion dollars to keep the company alive, it's worth the money.

Musk could have helped fund xAI by selling TSLA stock directly, which would have likely been bad for shareholders and wouldn't give Tesla any leverage in the AI firm. All things considered, Tesla investing directly in xAI appears to be good news.

Where the "Good News" Can Take TSLA Stock

AI clearly matters more for Tesla's existing shareholders than electric vehicles do. And when EVs do come into the picture, they are heavily dependent on automation. The biggest argument for Tesla's EVs is that they can become an autonomous self-driving fleet used by millions. To make that happen, Tesla needs AI.

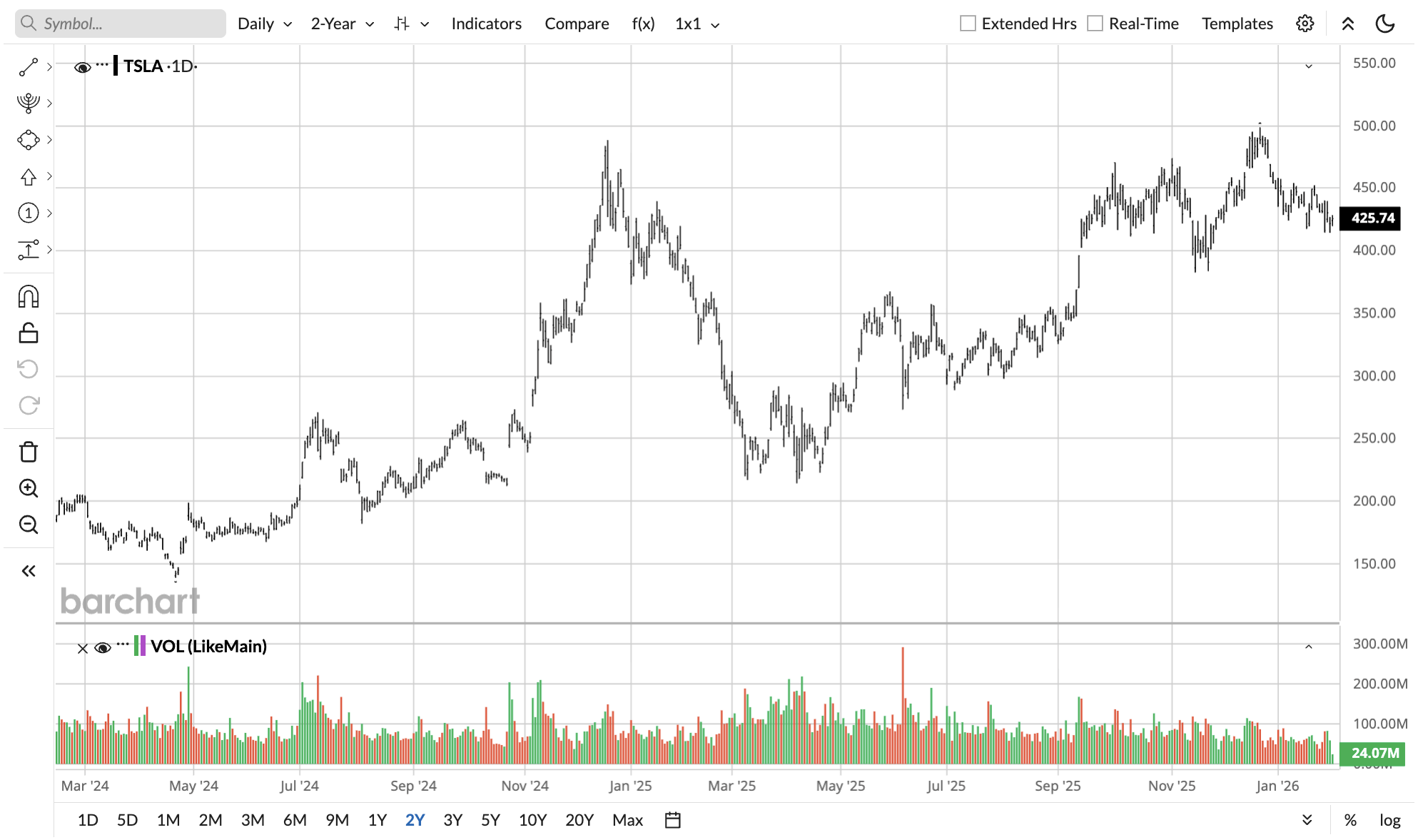

Thus, this xAI deal may have a positive impact on TSLA stock. Near-term performance depends more on the broader market and AI sentiment in general. Tesla is fundamentally overvalued. If AI sentiment wanes, shares could end the year below the $400 mark. Remember, 4.5% of every dollar you put into the Nasdaq-100 goes into Tesla, regardless of what you think about the stock.

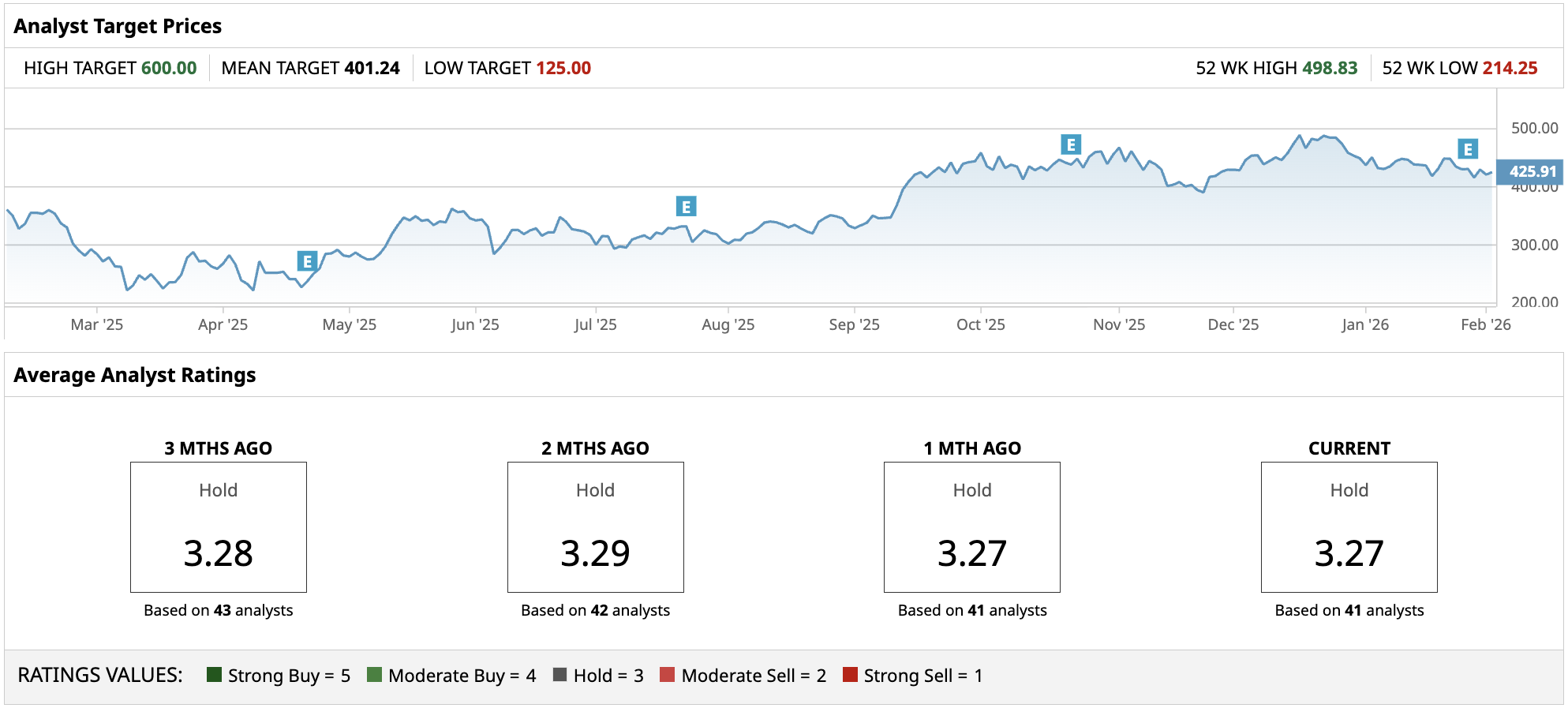

If the broader market keeps surging, I foresee TSLA stock staying rangebound in the $400 to $500 band, or moving slightly above $500 by the end of the year. The average analyst sees it a hair above $400 next year, based on the mean price target of $402.74.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As AMD Stock Breaks Below Key Support on Earnings Selloff, Should You Buy the Dip?

- ‘You Don’t Need to Have a PhD in Computer Science’ to Make a Great Living as AI Disrupts the Economy as We Know It. The Good and Bad of Nvidia CEO Jensen Huang’s Latest Prediction.

- Cisco Just (Finally) Set New All-Time Highs. Is CSCO Stock a Buy for February 2026?

- 30,000 Layoffs Could Soon Hit at Oracle. What Does That Mean for ORCL Stock?