$125 million Green Bond resulted in nearly 12,000 metric tons of CO2 emissions avoided

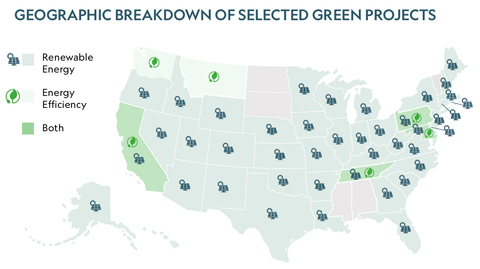

Forbright Inc. announced that proceeds of its inaugural Green Bond have been successfully allocated and resulted in nearly 12,000 metric tons of estimated annual carbon equivalent emissions avoided. In December 2021, Forbright Inc. – the holding company of Forbright Bank – issued a $125 million Green Bond. Today’s Green Bond Report demonstrates how proceeds have been distributed to renewable energy and energy efficiency projects nationwide and how the financing has made a difference in reducing greenhouse emissions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221220005503/en/

(Graphic: Business Wire)

“Our Green Bond issuance supports Forbright’s efforts to accelerate the transition to a lower carbon and more sustainable economy by financing the industries and activities most directly contributing to these goals – including renewable energy projects and energy efficiency upgrades,” said Samantha Norquist, Chief ESG Officer at Forbright Bank.

Highlights of the projects financed by Forbright’s Green Bond include roughly 2,500 residential solar loans and more than a dozen Commercial Property-Assessed Clean Energy (C-PACE) projects. The nationwide loans made solar energy more accessible and affordable to homeowners with no-money-down programs, fixed interest rates, and multiple term options. In addition, Forbright’s C-PACE program helped commercial properties transition to renewable energy, make energy efficiency upgrades like new windows or HVAC units, or install conservation projects like green roofs.

Forbright has committed to dedicating more than half of its portfolio to clean energy and sustainability-oriented projects by 2025. Already, the Bank holds approximately $380 million in green assets – as defined by its Green Financing Framework – as of September 30, 2022.

Forbright’s Green Bond issuance was the first from a U.S. financial institution with under $150 billion in consolidated total assets and only the eighth Green Bond in the United States. Forbright is the seventh U.S. bank to become a signatory to the U.N. Principles for Responsible Banking. The Bank has pledged to maintain carbon neutrality in its operational footprint and is providing incentives to its team members like bonuses for employees purchasing solar panels and electric vehicles, contributions for employees taking public transit or biking to work, and reimbursement for environmentally responsible subscriptions like composting or community supported agriculture.

All of the proceeds from the Green Bond were allocated in alignment with Forbright’s Green Financing Framework, which states that funds from the bond will only be used for projects that seek to reduce greenhouse gas emissions and reduce consumption of fossil fuels by increasing renewable energy production or installing of non-fossil fuel based energy efficient building components.

Forward Looking Statements:

This news release contains forward-looking statements related to Forbright’s sustainability commitments. The estimates and forward-looking statements involve uncertainties and do not guarantee future performance, as actual results or developments may be substantially different from the expectations described in the forward-looking statements.

About Forbright Bank:

Forbright Bank (www.forbrightbank.com), Member FDIC, Equal Housing Lender, is a full-service bank, commercial lender, and asset manager taking action to decarbonize the economy. Headquartered in Chevy Chase, Maryland, Forbright is committed to accelerating the transition to a sustainable, clean energy economy by financing the companies, investors, and innovators driving that change. With approximately $9 billion of owned and managed assets, the Bank provides specialty lending and banking services to clients across the United States.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221220005503/en/

Contacts

Ben Wakana

info@forbrightbank.com