Charles Schwab Ranks Highest in Digital Experience Satisfaction

As more retirement plan customers rely on digital channels for their primary means of interaction, digital experiences will be critical in supporting actions that support their future financial wellbeing and confidence. According to the J.D. Power 2024 U.S. Retirement Plan Digital Experience Study,SM released today, most retirement plan digital experiences still have a lot of room for improvement. Just 21% of retirement websites and mobile apps are living up to customer expectations for a valuable digital experience, significantly lagging those of other industries and putting assets under management at risk.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240912786850/en/

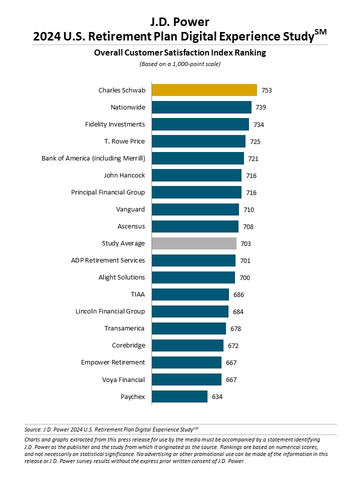

J.D. Power 2024 U.S. Retirement Plan Digital Experience Study(SM) (Graphic: Business Wire)

“In many cases, the entire customer engagement with their retirement plan provider has become a digital experience,” said Craig Martin, managing director and global head of wealth and lending intelligence at J.D. Power. “Expectations for digital are heavily influenced by customers’ entire universe of digital experiences and plan providers have not kept pace with other sectors. Falling behind on digital can have very real consequences for engaging and influencing perceptions and behaviors. Financial wellness has become a critical focus for many retirement plan providers striving to be more than just a basic product provider. Customers who are digitally disengaged are very unlikely to recognize or see value in these efforts, which means a lot of wasted time and resources—as well as reduced business expansion opportunities.”

Following are some key findings of the 2024 study:

- Retirement plan digital experience lags other industries in key areas: Overall satisfaction with retirement plan digital experiences increases to 703 (on a 1,000-point scale), an 18-point increase from 2023. Despite the improvement, retirement plan apps and websites underperform those of other service industries—including insurance, automotive finance, utilities and banking—when it comes to ease of use and ability to find information. Critical gaps relate to ease of finding information, tools and other usage challenges.

- One in five digital experiences do not meet basic expectations: J.D. Power has created a digital experience hierarchy that assesses retirement plan website and mobile app experiences based on specific elements that define three performance levels: foundational, functional and valuable. Foundational experiences focus on basic design, security and key information access. Functional experiences center on ease of use and navigation. Valuable experiences relate to creating more personalization and delivering these experiences proactively. On both ends of the spectrum, 21% of customers’ digital experiences fail to meet the basic criteria for a foundational experience and only 21% have digital experiences that are classified as valuable.

- Strong digital experiences drive strong bottom line: The study shows that customers are nearly twice as likely to keep assets with their current provider in the event of a job change if that provider offers a valuable digital experience, and 40% are more likely to roll money over from other retirement accounts if they have a great digital experience. The digital experience also can affect customer perceptions of the retirement plan provider’s brand image.

Study Ranking

Charles Schwab ranks highest in retirement plan digital satisfaction, with a score of 753. Nationwide (739) ranks second and Fidelity Investments (734) ranks third.

The U.S. Retirement Plan Digital Experience Study, formerly known as the U.S. Retirement Plan Participant Satisfaction Study, measures customer satisfaction across four factors: information/content; navigation; speed; and visual appeal. The study is based on responses of 5,638 retirement plan participants and was fielded from May through July 2024.

For more information about the U.S. Retirement Plan Digital Experience Study, visit https://www.jdpower.com/business/financial-services/us-retirement-plan-digital-experience-study.

See the online press release at http://www.jdpower.com/pr-id/2024100.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20240912786850/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com