SYDNEY, May 06, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”), today published its monthly update for April 2025.

April Highlights

- Mining capacity increased to 40 EH/s mid-month

- On track for 50 EH/s by June 30

- Miners scheduled to ship from Southeast Asia (during 90-day pause on reciprocal tariffs)

- AI Cloud Services revenue continuing to grow

- Horizon 1 AI Data Center on track for H2 2025 delivery

- Customer and financing workstreams progressing

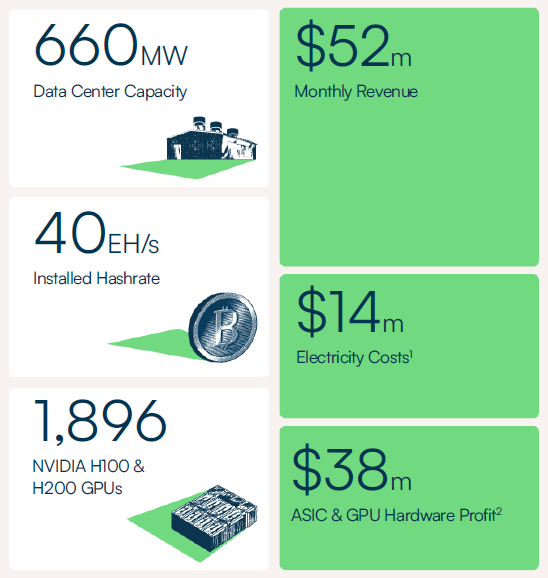

| Key Metrics | Apr 25 | Mar 25 | Feb 25 | |

| Bitcoin Mining | ||||

| Average operating hashrate | 36.6 EH/s | 30.3 EH/s | 28.7 EH/s | |

| Bitcoin mined3 | 579 BTC | 533 BTC | 459 BTC | |

| Revenue (per Bitcoin) | $86,522 | $85,012 | $95,570 | |

| Electricity cost (per Bitcoin)1 | ($24,381) | ($20,460) | ($28,341) | |

| Revenue | $50.1m | $45.3m | $43.9m | |

| Electricity costs1 | ($14.1m) | ($10.9m) | ($13.0m) | |

| Hardware profit2 | $36.0m | $34.4m | $30.9m | |

| Hardware profit margin4 | 72% | 76% | 70% | |

| AI Cloud Services | ||||

| Revenue | $2.0m | $1.6m | $1.2m | |

| Electricity costs1 | ($0.04m) | ($0.05m) | ($0.04m) | |

| Hardware profit2 | $2.0m | $1.5m | $1.1m | |

| Hardware profit margin4 | 98% | 97% | 96% | |

Management Commentary

“We’re proud to have expanded our mining capacity to 40 EH/s during the month, further cementing IREN as one of the largest-scale, lowest-cost producers of Bitcoin.” said Daniel Roberts, Co-Founder and Co-CEO of IREN.

We remain on track to reach 50 EH/s within the next two months, with mining hardware shipments scheduled from Southeast Asia during the 90-day pause on reciprocal tariffs. Strong cashflows from our existing operations continue to support our efforts to secure financing for growth across our AI business verticals.

With limited liquid-cooled capacity currently available in the U.S. to support the rollout of NVIDIA’s Blackwell GPUs, our Horizon 1 project scheduled for 2025 commissioning represents a key catalyst for IREN’s entry into the AI data center market. It also lays the foundation for scalable liquid-cooling deployments across our broader platform.

We look forward to updating the market on the progress of these key projects at our upcoming earnings presentation.”

Technical Commentary

Bitcoin Mining

- Maintaining strong and resilient margins – underpinned by our best-in-class efficiency (15 J/TH), low electricity costs and energy market intelligence & algorithms (2.9c/kWh Childress power price)1

- 40 EH/s installed, on track for 50 EH/s in H1 2025 – expected to generate Illustrative Adjusted EBITDA of $588m at 50 EH/s based on current mining economics5

AI Cloud Services

- Revenue grew 27% month-on-month, driven by ramp-up of existing customer contracts

- Fleet near full utilization, with annualized run-rate revenue now $28 million6

AI Data Centers

- Customer and financing workstreams progressing for Horizon 1 (50MW IT load deployment at Childress), with a range of structures under consideration

- Working collaboratively with suppliers to manage tariff impacts, with no material change to Horizon 1 capex guidance of $300-$350m currently anticipated

Events

- Q3 FY25 Results Presentation

5:00pm ET, May 14, 2025 (Register here) - Jefferies Power x Coin Conference

(Webcast replay here) - Macquarie Asia Conference

May 14-15, 2025 - B Riley Annual Investor Conference

May 20-22, 2025 - Bitcoin 2025 Conference

May 27-29, 2025

Kent Draper, CCO, presenting at Jefferies Power x Coin Conference (Apr 2025)

Project Update

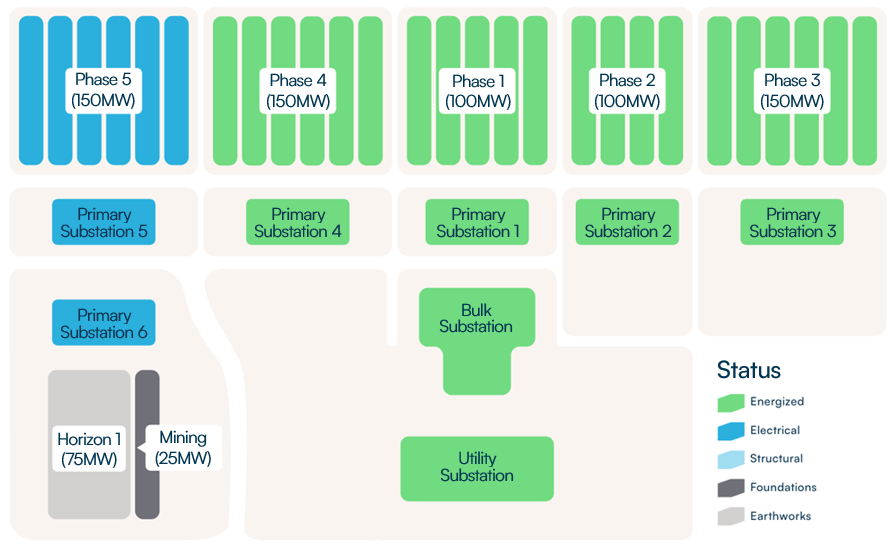

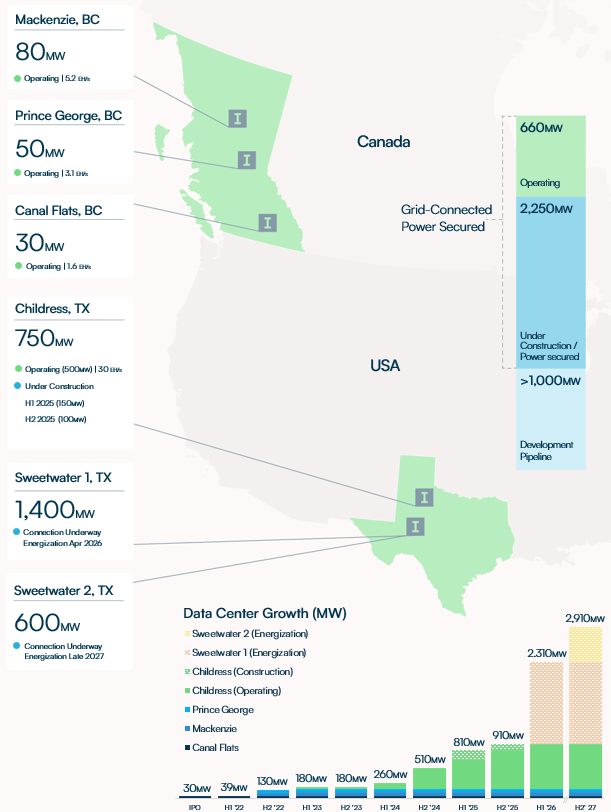

Childress (750MW)

- Phase 1-4 (500MW) now fully operational

- Phase 5 (150MW) structures nearing completion, with substation transformer installation commencing in coming weeks

- Horizon 1 (50MW IT load) on track for H2 2025 commissioning

Sweetwater 1 (1.4GW)

- General site-works underway

- Energization April 2026

Sweetwater 2 (600MW)

- Design work underway on a direct fiber loop connecting Sweetwater 1 & 2 to create 2GW Sweetwater data center hub

- Energization late 2027

Childress Phases 1-4 (Apr 2025)

Childress Phase 5 Construction (Apr 2025)

Childress Project Status

Site Overview

Assumptions and Notes

- Electricity costs are presented on a net basis and calculated as IFRS electricity charges, ERS revenue (included in other income) and ERS fees (included in other operating expenses). Figures are based on current internal estimates and exclude REC purchases.

- Hardware profit is calculated as revenue less electricity costs. Hardware profit is a non-IFRS financial measure and is provided in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. Refer to the Forward-Looking Statements disclaimer.

- Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining pool fees).

- Hardware profit margin for Bitcoin Mining and AI Cloud Services is calculated as revenue less electricity costs, divided by revenue (for each respective revenue stream) and excludes all other costs.

- Illustrative Adj. EBITDA = illustrative mining revenue less assumed net electricity costs, overheads and REC costs, and does not include working capital movements. Source: CoinWarz Bitcoin Mining Calculator. Illustrative calculations and inputs assume hardware operates at 100% uptime, 853 EH/s global hashrate, $0.035/kWh electricity costs, 3.125 BTC block reward, 0.1 BTC transaction fees and 0.16% pool fees, 765MW (power consumption), $104m (overheads), $16m (REC costs), and $95k Bitcoin price. Illustrative Adj. EBITDA is for illustrative purposes only and should not be considered projections of IREN’s operating performance. Inputs are based on assumptions, including historical information, which are likely to be different in the future and users should input their own assumptions. There is no assurance that any illustrative outputs will be achieved within the timeframes presented or at all, or that mining hardware will operate at 100% uptime. The above should be read strictly in conjunction with the forward-looking statements disclaimer in this press release.

- AI Cloud Services annualized run-rate revenue for utilized GPUs as of May 5, 2025.

Contacts

| Media Gillian Roberts Aircover Communications +1 818 395 2948 gillian.roberts@aircoverpr.com Jon Snowball Sodali & Co +61 477 946 068 +61 423 136 761 | Investors Mike Power IREN mike.power@iren.com |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at

https://iren.com/investor/ir-resources/email-alerts.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or IREN’s future financial or operating performance. For example, forward-looking statements include but are not limited to the Company’s business strategy, expected operational and financial results, and expected increase in power capacity and hashrate. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “target”, “will,” “estimate,” “predict,” “potential,” “continue,” “scheduled” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause IREN’s actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward looking statements, including, but not limited to: Bitcoin price and foreign currency exchange rate fluctuations; IREN’s ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet its capital needs and facilitate its expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require IREN to comply with onerous covenants or restrictions, and its ability to service its debt obligations, any of which could restrict its business operations and adversely impact its financial condition, cash flows and results of operations; IREN’s ability to successfully execute on its growth strategies and operating plans, including its ability to continue to develop its existing data center sites, including to design and deploy direct-to-chip liquid cooling systems, and to diversify and expand into the market for high performance computing (“HPC”) solutions it may offer (including the market for cloud services (“AI Cloud Services”) and potential colocation services; IREN’s limited experience with respect to new markets it has entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services and potential colocation services); expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services and potential colocation services) that IREN offers; IREN’s ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to its strategy to expand into markets for HPC solutions (including AI Cloud Services and potential colocation services); IREN’s ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of its HPC solutions (including AI Cloud Services and potential colocation services) and other counterparties; the risk that any current or future customers, including customers of its HPC solutions (including AI Cloud Services and potential colocation services), or other counterparties may terminate, default on or underperform their contractual obligations; Bitcoin global hashrate fluctuations; IREN’s ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; IREN’s reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and its ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; IREN’s participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to IREN; any variance between the actual operating performance of IREN’s miner hardware achieved compared to the nameplate performance including hashrate; IREN’s ability to curtail its electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which IREN operates; the availability, suitability, reliability and cost of internet connections at IREN’s facilities; IREN’s ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services and potential colocation services) it offers, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining as well as hardware for other applications, including any current or future HPC solutions (including AI Cloud Services and potential colocation services) IREN offers); delays, increases in costs or reductions in the supply of equipment used in IREN’s operations; IREN’s ability to operate in an evolving regulatory environment; IREN’s ability to successfully operate and maintain its property and infrastructure; reliability and performance of IREN’s infrastructure compared to expectations; malicious attacks on IREN’s property, infrastructure or IT systems; IREN’s ability to maintain in good standing the operating and other permits and licenses required for its operations and business; IREN’s ability to obtain, maintain, protect and enforce its intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends IREN expects to drive growth in its business materialize to the degree it expects them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at IREN’s sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to IREN’s property and infrastructure and the risk that any insurance IREN maintains may not fully cover all potential exposures; ongoing proceedings relating to the default by two of the Company’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default, and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; IREN's failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of IREN's compliance and risk management methods; any laws, regulations and ethical standards that may relate to IREN’s business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services it offers, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws; IREN’s ability to attract, motivate and retain senior management and qualified employees; increased risks to IREN’s global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect IREN’s business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response; IREN’s ability to remain competitive in dynamic and rapidly evolving industries; damage to IREN’s brand and reputation; expectations relating to Environmental, Social or Governance issues or reporting; the costs of being a public company; the increased regulatory and compliance costs of IREN ceasing to be a foreign private issuer and an emerging growth company, as a result of which we will be required, among other things, to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC commencing with our next fiscal year, and we will also be required to prepare our financial statements in accordance with U.S. GAAP rather than IFRS, and to modify certain of our policies to comply with corporate governance practices required of a U.S. domestic issuer; that we do not currently pay any cash dividends on our ordinary shares, and may not in the foreseeable future and, accordingly, your ability to achieve a return on your investment in our ordinary shares will depend on appreciation, if any, in the price of our ordinary shares; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 20-F filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Preliminary Financial Information

The financial information presented in this investor update is not subject to the same closing procedures as our unaudited quarterly financial results and our audited annual financial results, and has not been reviewed or audited by our independent registered public accounting firm. The preliminary financial information included in this investor update does not represent a comprehensive statement of our financial results or financial position and should not be viewed as a substitute for unaudited financial statements prepared in accordance with International Financial Reporting Standards. Accordingly, you should not place undue reliance on the preliminary financial information included in this investor update.

Non-IFRS Financial Measures

This investor update includes non-IFRS financial measures, including electricity costs (presented on a net basis), hardware profit and illustrative adjusted EBITDA. We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. There are a number of limitations related to the use of non-IFRS financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. The Company believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.

Electricity costs are calculated as our IFRS Electricity charges, ERS revenue (included in Other income) and ERS fees (included in Other operating expenses), and excludes the cost of RECs. Hardware Profit is calculated as revenue less electricity costs (excludes all other site, overhead and REC costs). Illustrative Adjusted EBITDA is calculated as illustrative mining revenue less assumed net electricity costs, overheads and REC costs, and does not include working capital movements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7a5b4fa7-7c06-4f16-82f5-29b64b6d58ba

https://www.globenewswire.com/NewsRoom/AttachmentNg/618785d5-bbc1-4a89-b524-967990bfe745

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf6714ad-ba1f-4d7d-92f7-f8c9cb11824a

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f0dfb31-9da9-4cf0-a8fe-7ebb26d00910

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d8236c5-0453-4542-867d-6c0e7898bab9

https://www.globenewswire.com/NewsRoom/AttachmentNg/e62e10ea-ed87-47b0-8f25-f3aa730b6367