As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at personal care stocks, starting with Medifast (NYSE: MED).

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 11 personal care stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 16.1% below.

In light of this news, share prices of the companies have held steady as they are up 4% on average since the latest earnings results.

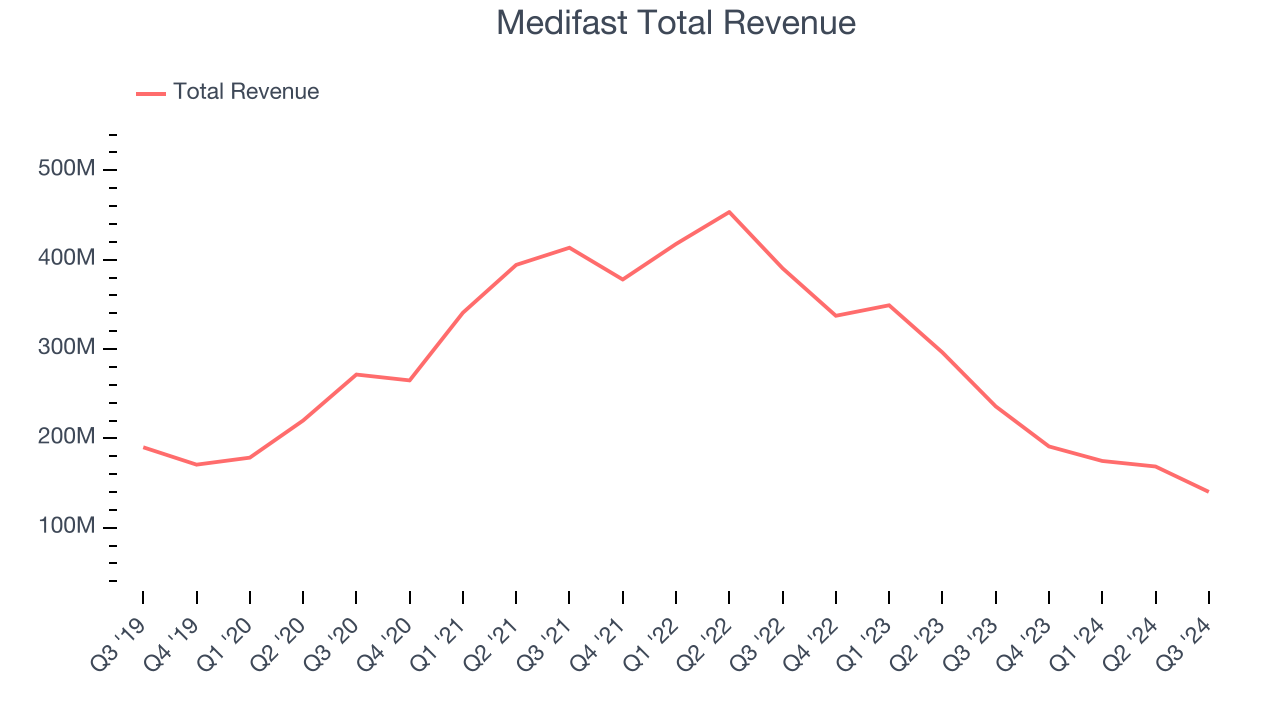

Slowest Q3: Medifast (NYSE: MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $140.2 million, down 40.6% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a strong quarter for the company with optimistic earnings guidance for the next quarter and an impressive beat of analysts’ earnings estimates.

“Medical innovation has transformed the weight loss industry, so at Medifast we’re creating a health and wellness business of the future by meeting the unique needs of customers regardless of their approach to their health goals,” said Dan Chard, Chairman & CEO.

Medifast delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 6% since reporting and currently trades at $19.90.

Is now the time to buy Medifast? Access our full analysis of the earnings results here, it’s free.

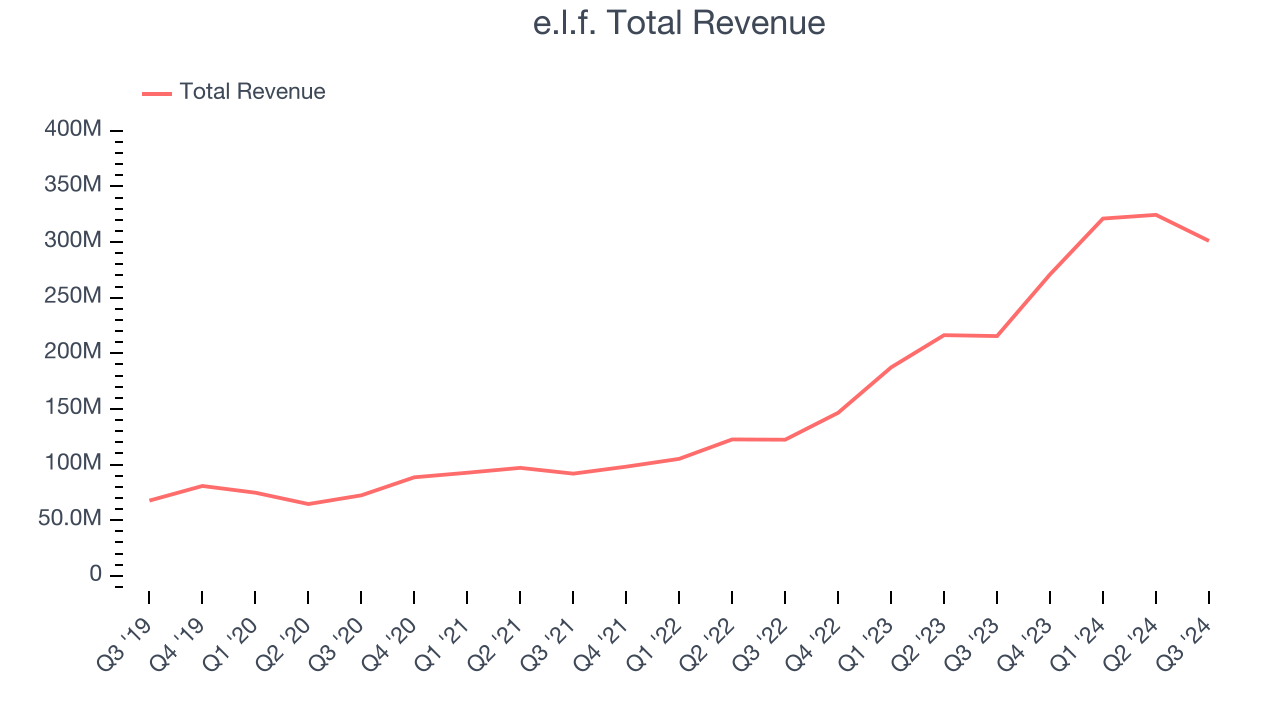

Best Q3: e.l.f. (NYSE: ELF)

e.l.f. Beauty (NYSE: ELF), which stands for ‘eyes, lips, face’, offers high-quality beauty products at accessible price points.

e.l.f. reported revenues of $301.1 million, up 39.7% year on year, outperforming analysts’ expectations by 4%. The business had a very strong quarter with an impressive beat of analysts’ earnings and EBITDA estimates.

e.l.f. scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 13.3% since reporting. It currently trades at $118.10.

Is now the time to buy e.l.f.? Access our full analysis of the earnings results here, it’s free.

Nature's Sunshine (NASDAQ: NATR)

Started on a kitchen table in Utah, Nature’s Sunshine Products (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Nature's Sunshine reported revenues of $114.6 million, up 3.1% year on year, exceeding analysts’ expectations by 5.2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ earnings and EBITDA estimates.

Interestingly, the stock is up 1.9% since the results and currently trades at $14.06.

Read our full analysis of Nature's Sunshine’s results here.

Olaplex (NASDAQ: OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $119.1 million, down 3.6% year on year. This number lagged analysts' expectations by 5.9%. Overall, it was a slower quarter as it also produced full-year revenue guidance missing analysts’ expectations and underwhelming EBITDA guidance for the full year.

Olaplex had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 9.6% since reporting and currently trades at $1.61.

Read our full, actionable report on Olaplex here, it’s free.

Estée Lauder (NYSE: EL)

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE: EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Estée Lauder reported revenues of $3.36 billion, down 4.5% year on year. This number met analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ earnings estimates but revenue guidance for next quarter missing analysts’ expectations.

The stock is down 23.5% since reporting and currently trades at $66.70.

Read our full, actionable report on Estée Lauder here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.