Inclusive gym franchise company (NYSE: PLNT) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 5.3% year on year to $292.2 million. Its GAAP profit of $0.50 per share was also 9.3% above analysts’ consensus estimates.

Is now the time to buy Planet Fitness? Find out by accessing our full research report, it’s free.

Planet Fitness (PLNT) Q3 CY2024 Highlights:

- Revenue: $292.2 million vs analyst estimates of $285.3 million (2.5% beat)

- EPS: $0.50 vs analyst estimates of $0.46 (9.3% beat)

- EBITDA: $123.1 million vs analyst estimates of $117 million (5.2% beat)

- Gross Margin (GAAP): 59.9%, up from 57.9% in the same quarter last year

- Operating Margin: 27.8%, up from 26.1% in the same quarter last year

- EBITDA Margin: 42.1%, up from 40.3% in the same quarter last year

- Free Cash Flow Margin: 26.7%, up from 25.3% in the same quarter last year

- Same-Store Sales rose 4.3% year on year (8.4% in the same quarter last year)

- Market Capitalization: $7.16 billion

"We delivered solid results in the quarter, including more than 5 percent revenue growth, approximately 3 percent net income growth and approximately 10 percent Adjusted EBITDA growth, and are raising our outlook for certain key financial targets," said Colleen Keating, Chief Executive Officer.

Company Overview

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

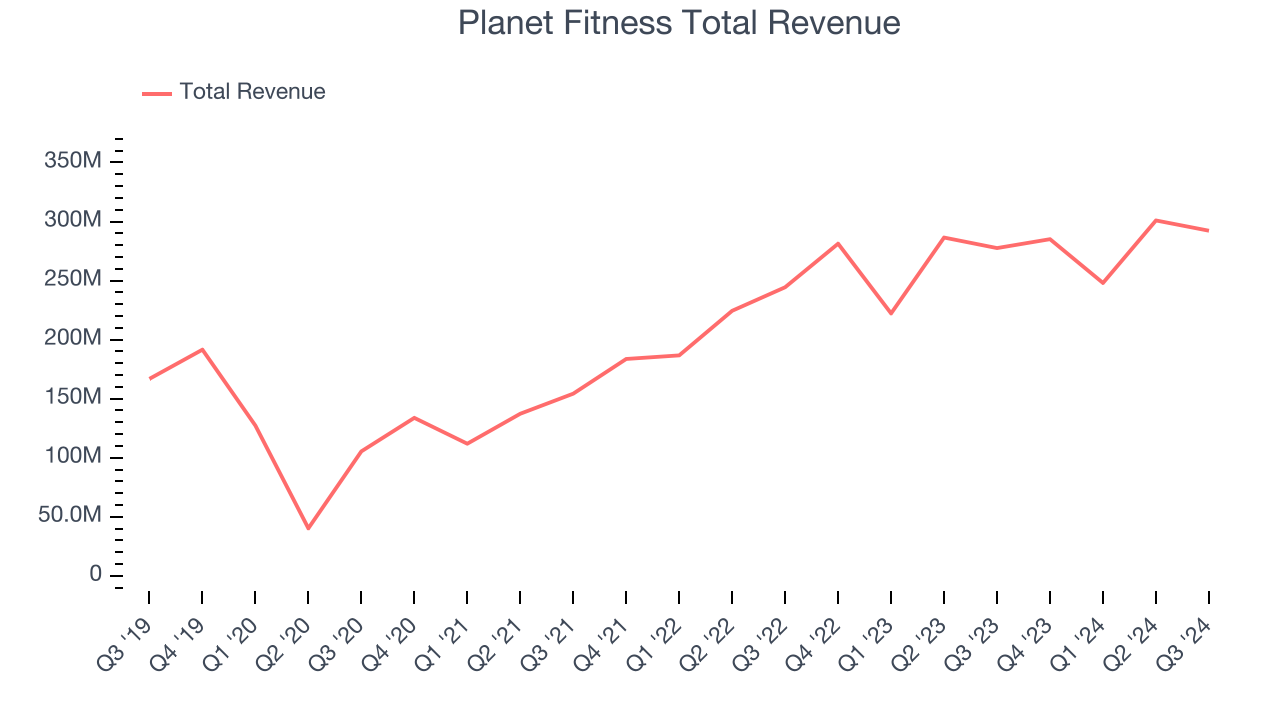

Sales Growth

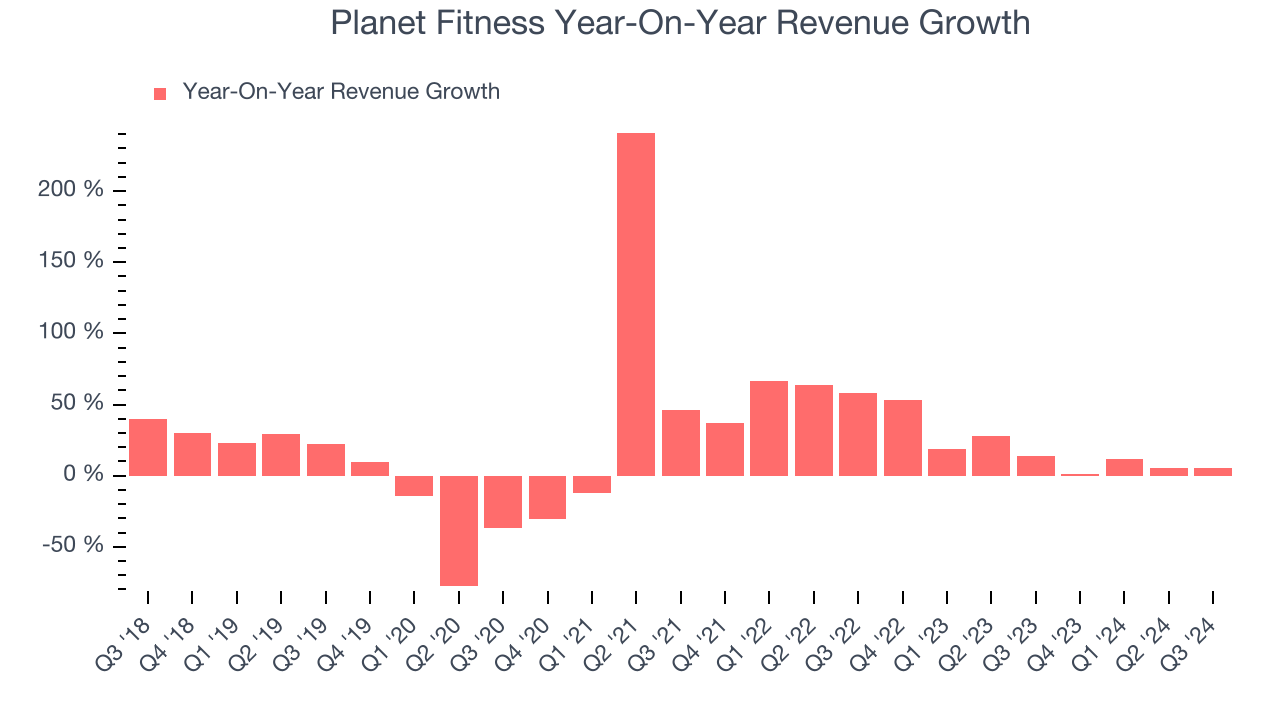

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Planet Fitness’s sales grew at a tepid 10.9% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Planet Fitness’s annualized revenue growth of 15.9% over the last two years is above its five-year trend, suggesting some bright spots. Note that COVID hurt Planet Fitness’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

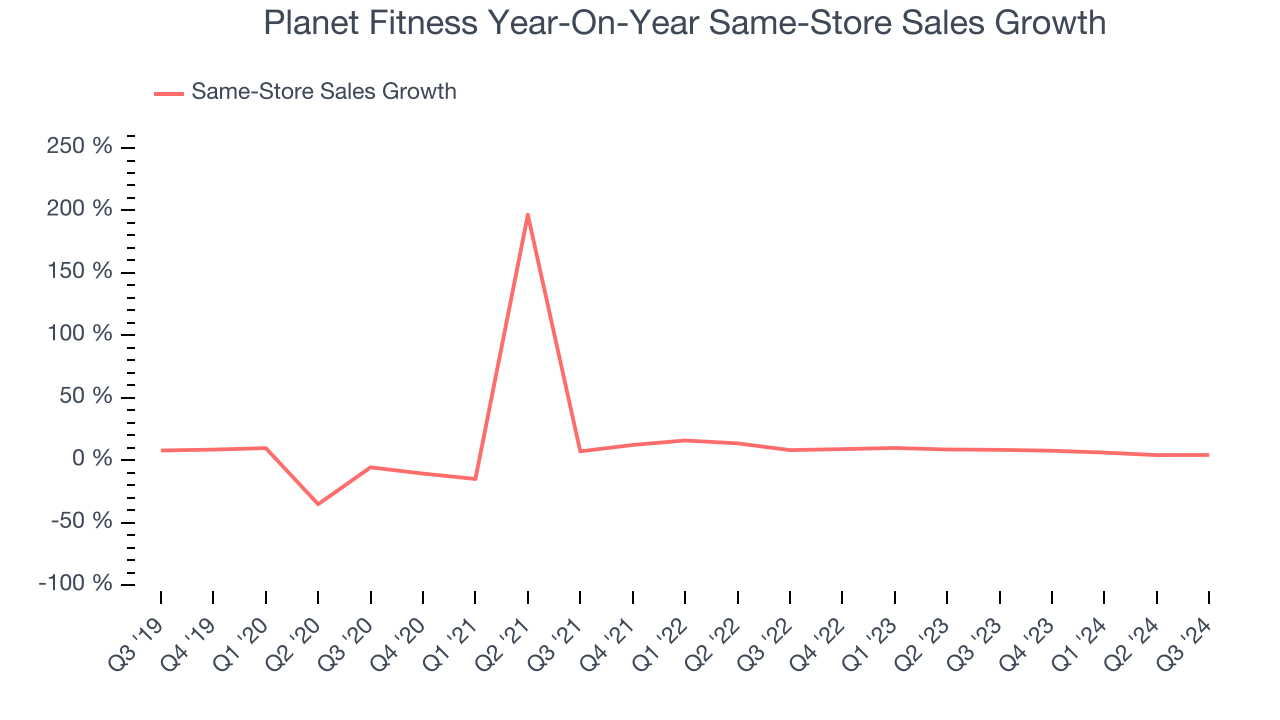

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Planet Fitness’s same-store sales averaged 7.3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Planet Fitness reported year-on-year revenue growth of 5.3%, and its $292.2 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and shows the market thinks its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

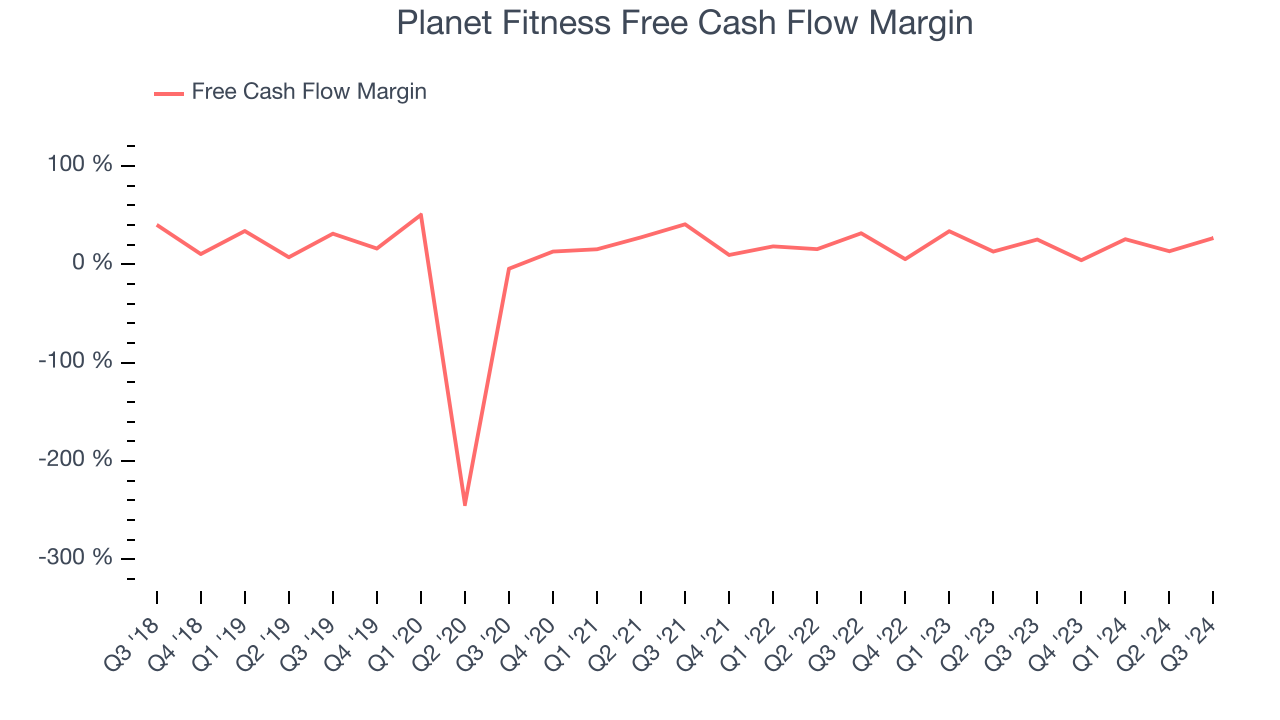

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Planet Fitness has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 17.8% over the last two years, quite impressive for a consumer discretionary business.

Planet Fitness’s free cash flow clocked in at $78.17 million in Q3, equivalent to a 26.7% margin. This result was good as its margin was 1.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Planet Fitness’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 17.2% for the last 12 months will decrease to 15.6%.

Key Takeaways from Planet Fitness’s Q3 Results

It was good to see Planet Fitness beat analysts’ revenue, EPS, and EBITDA expectations this quarter. Overall, this quarter had some key positives. The stock traded up 6.5% to $90 immediately after reporting.

Planet Fitness put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.