Over the last six months, Abercrombie and Fitch’s shares have sunk to $120.99, producing a disappointing 19.9% loss - a stark contrast to the S&P 500’s 9.4% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy ANF? Find out in our full research report, it’s free.

Why Are We Positive On ANF?

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE: ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Abercrombie and Fitch has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 13.2%.

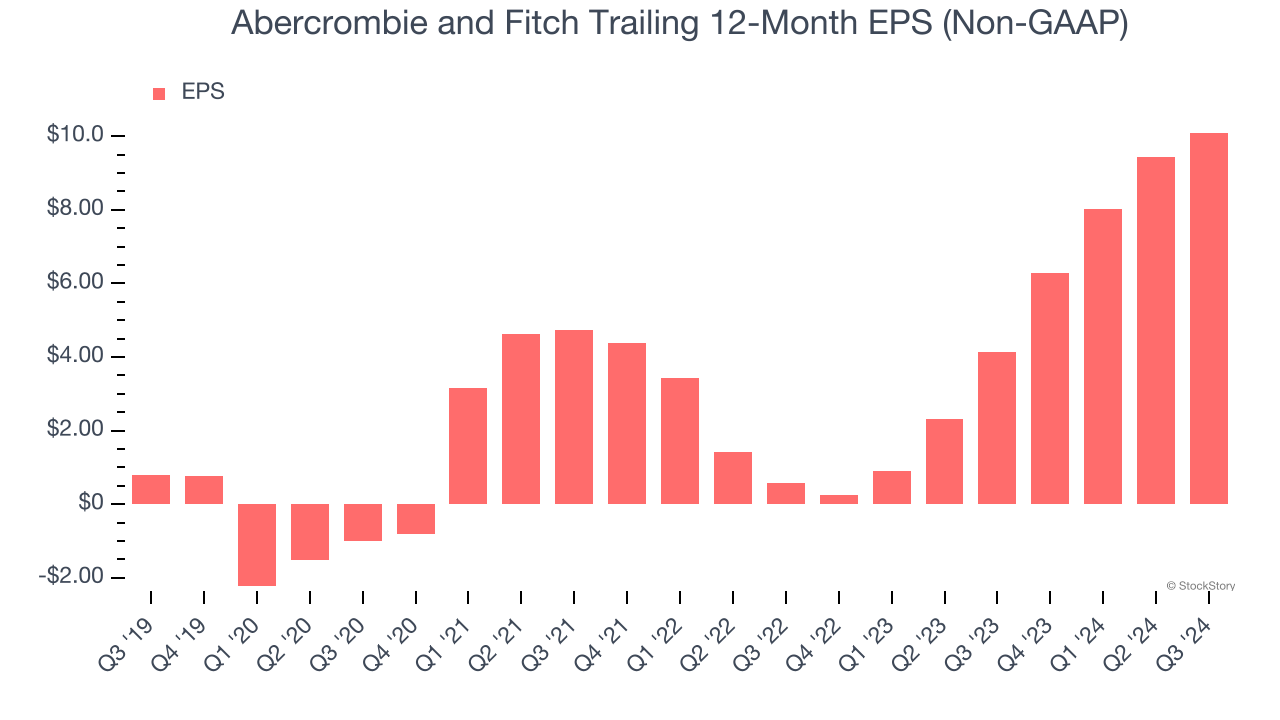

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Abercrombie and Fitch’s EPS grew at an astounding 65.7% compounded annual growth rate over the last five years, higher than its 6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

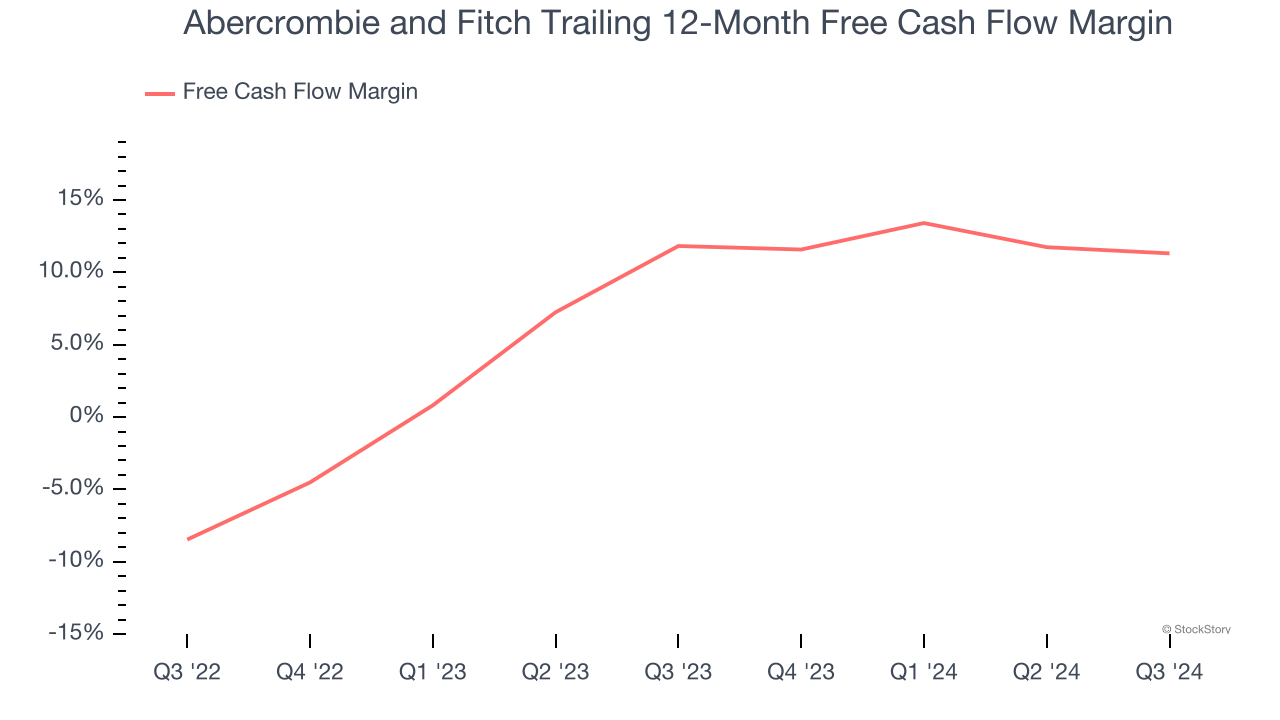

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Abercrombie and Fitch has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 11.5% over the last two years.

Final Judgment

These are just a few reasons why Abercrombie and Fitch ranks highly on our list. With the recent decline, the stock trades at 11.8× forward price-to-earnings (or $120.99 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Abercrombie and Fitch

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.