Entegris has gotten torched over the last six months - since July 2024, its stock price has dropped 21.3% to $100.53 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Entegris, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Entegris. Here are three reasons why there are better opportunities than ENTG and a stock we'd rather own.

Why Is Entegris Not Exciting?

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

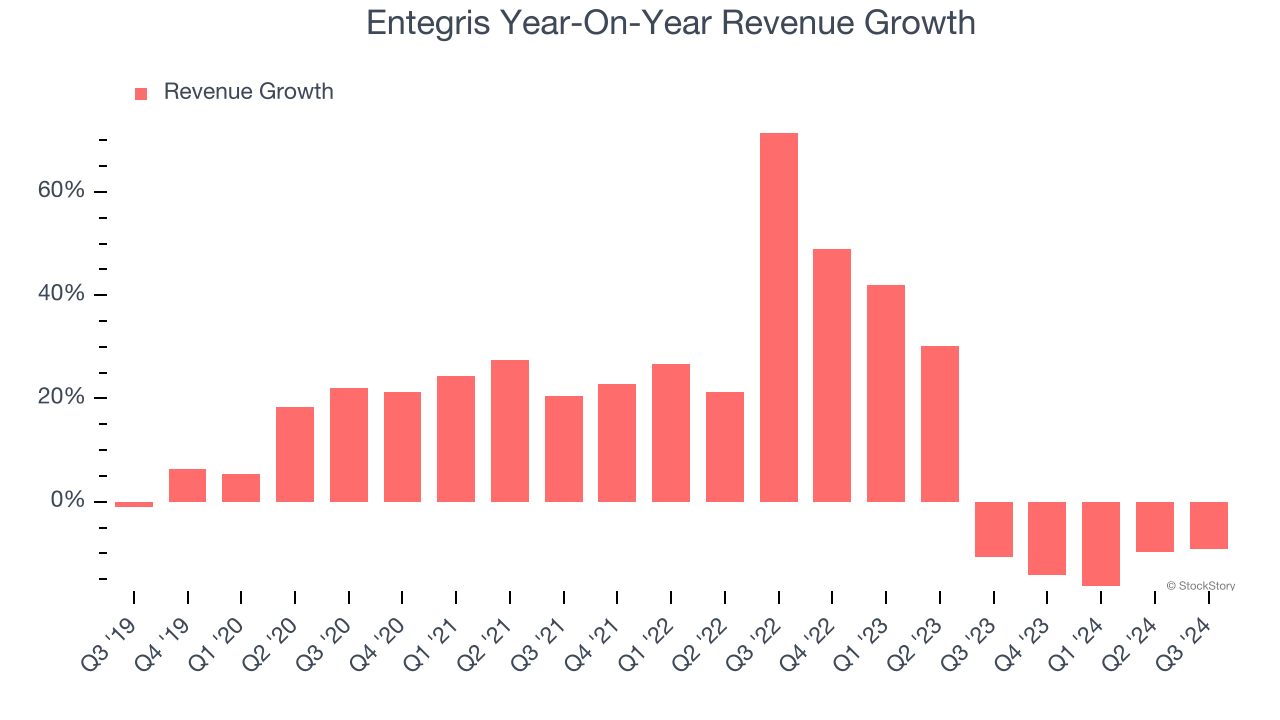

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a stretched historical view may miss new demand cycles or industry trends like AI. Entegris’s recent history shows its demand slowed significantly as its annualized revenue growth of 3.8% over the last two years is well below its five-year trend.

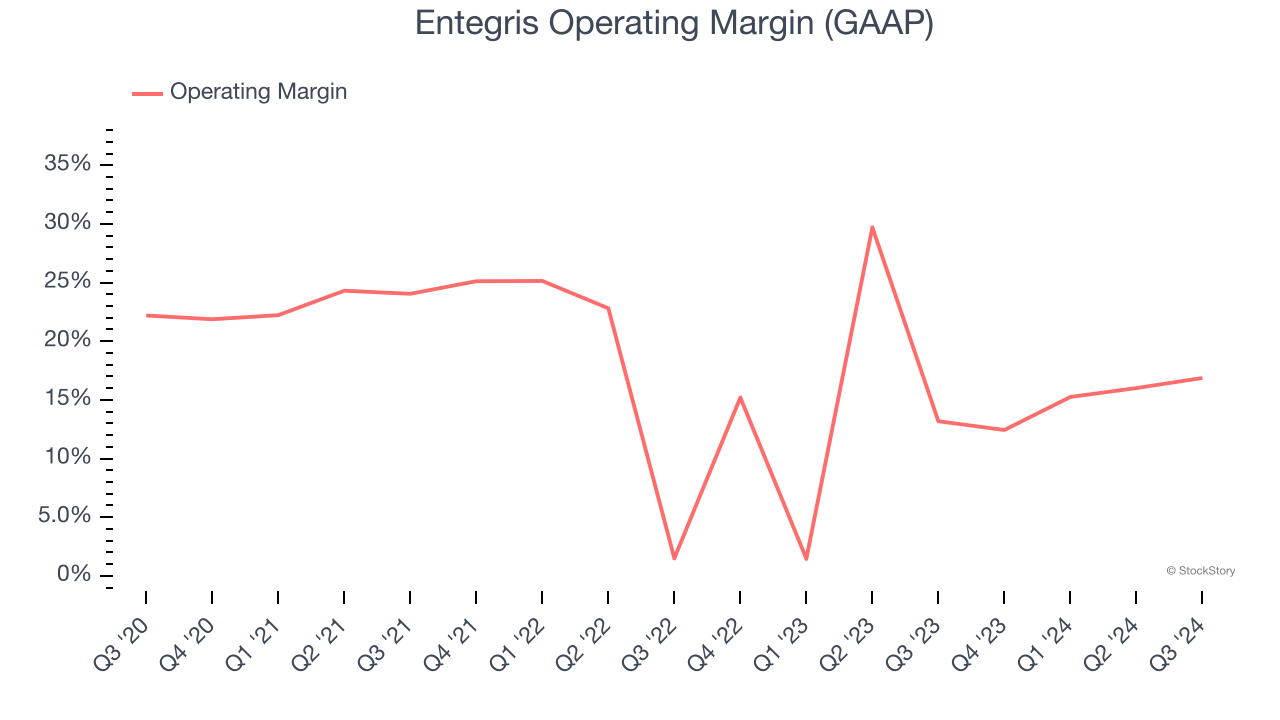

2. Operating Margin Falling

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Entegris’s operating margin decreased by 5.6 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its operating margin for the trailing 12 months was 15.1%.

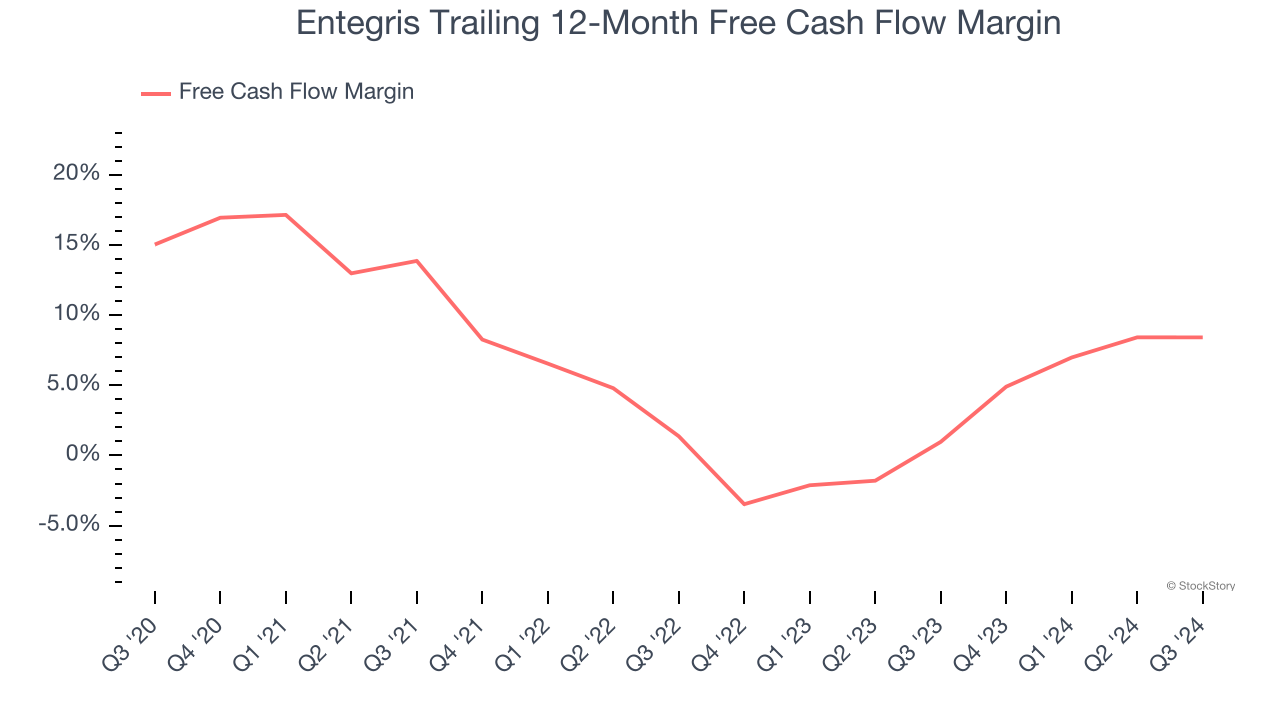

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Entegris’s margin dropped by 6.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Entegris’s free cash flow margin for the trailing 12 months was 8.4%.

Final Judgment

Entegris’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 25.7× forward price-to-earnings (or $100.53 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Entegris

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.