RE/MAX has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 6.8% to $10.16 per share while the index has gained 9.4%.

Is now the time to buy RE/MAX, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We're swiping left on RE/MAX for now. Here are three reasons why RMAX doesn't excite us and a stock we'd rather own.

Why Do We Think RE/MAX Will Underperform?

Short for Real Estate Maximums, RE/MAX (NYSE: RMAX) operates a real estate franchise network spanning over 100 countries and territories.

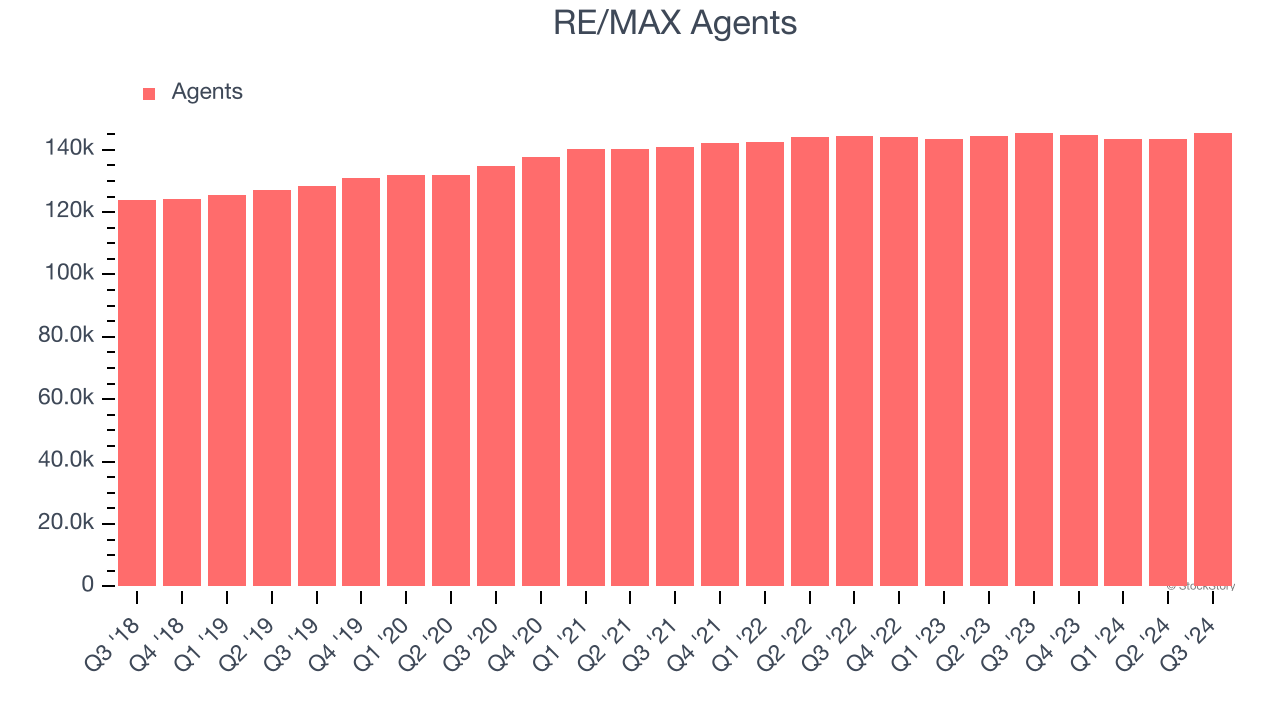

1. Inability to Grow Agents Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like RE/MAX, our preferred volume metric is agents). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, RE/MAX failed to grow its agents, which came in at 145,483 in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests RE/MAX might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

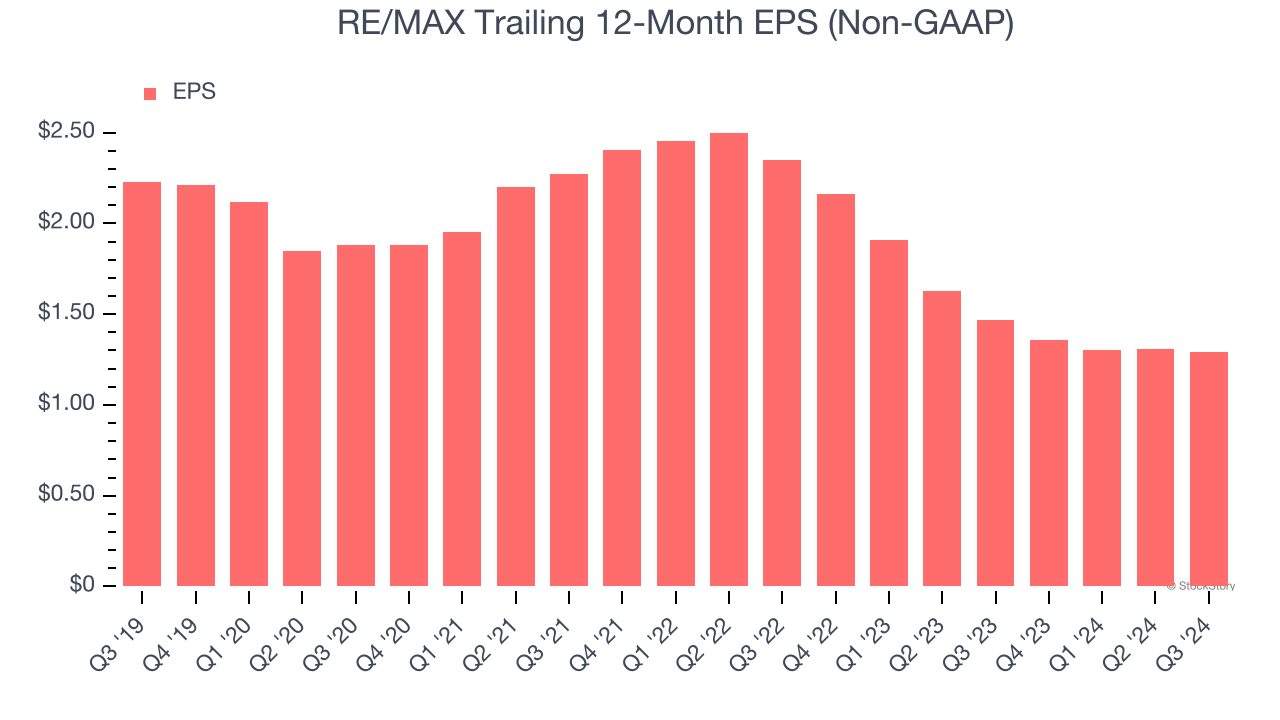

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for RE/MAX, its EPS declined by 10.4% annually over the last five years while its revenue grew by 3.3%. This tells us the company became less profitable on a per-share basis as it expanded.

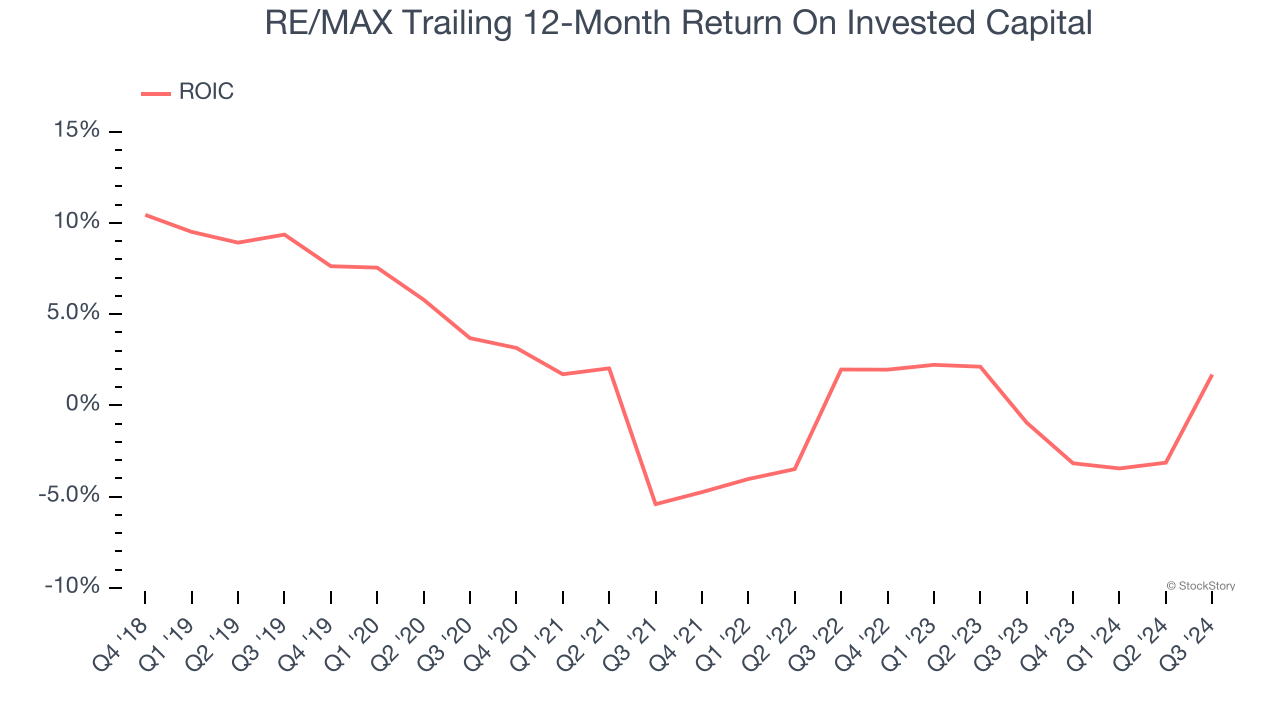

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

RE/MAX historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

We see the value of companies helping consumers, but in the case of RE/MAX, we’re out. That said, the stock currently trades at 8× forward price-to-earnings (or $10.16 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of RE/MAX

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.