What a brutal six months it’s been for MDU Resources. The stock has dropped 33.7% and now trades at $17.91, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in MDU Resources, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about MDU Resources. Here are three reasons why you should be careful with MDU and a stock we'd rather own.

Why Do We Think MDU Resources Will Underperform?

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE: MDU) provides products and services in the utilities and construction materials industries.

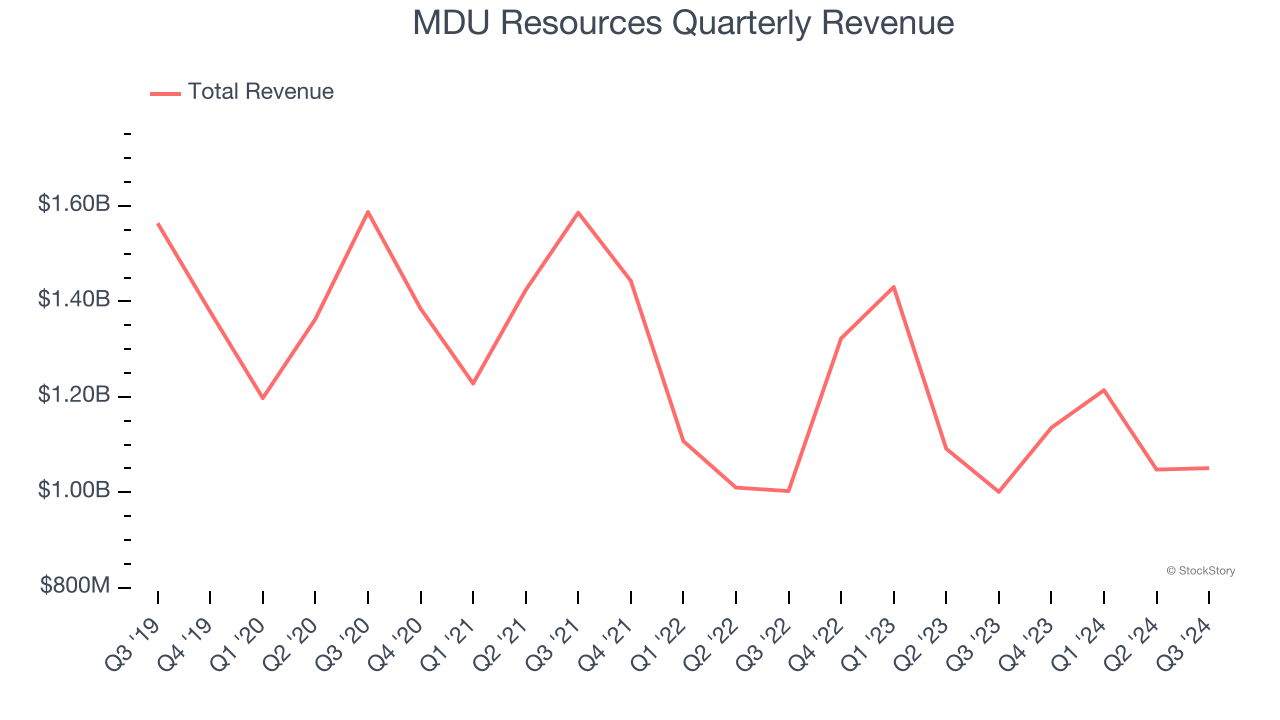

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. MDU Resources’s demand was weak over the last five years as its sales fell at a 3% annual rate. This fell short of our benchmarks and signals it’s a low quality business.

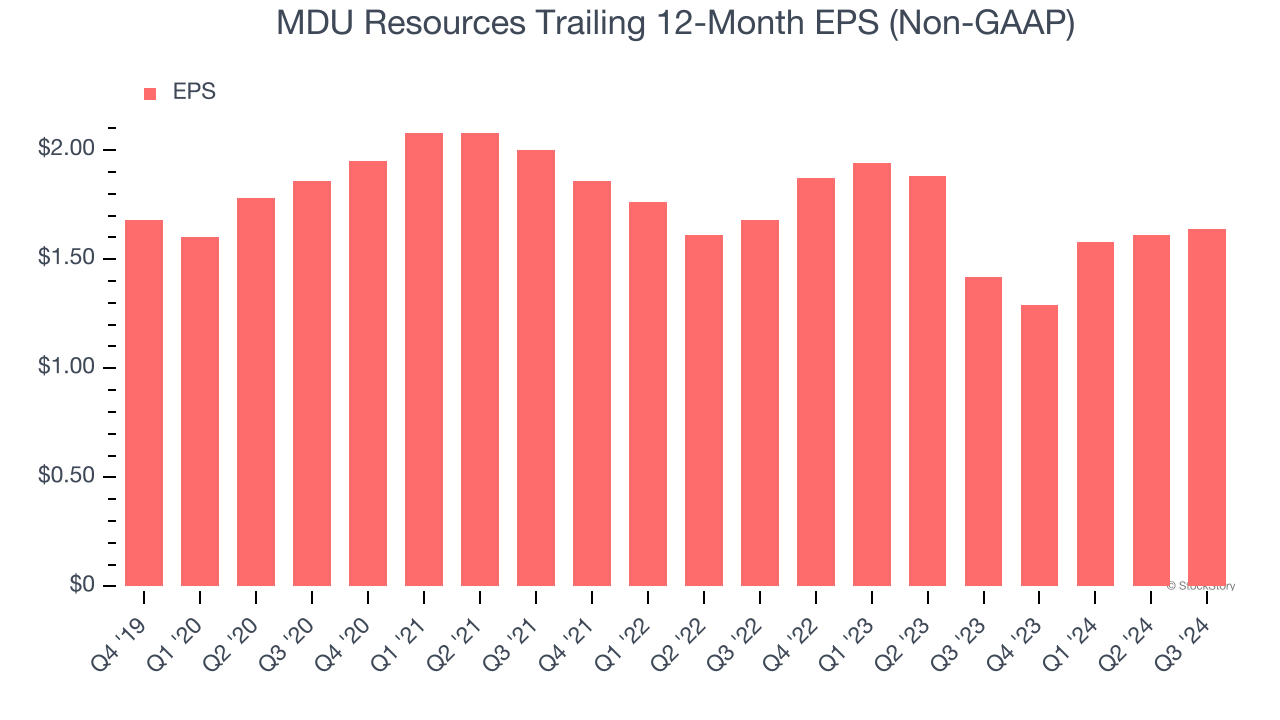

2. EPS Growth Has Stalled

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

MDU Resources’s flat EPS over the last five years was weak. On the bright side, this performance was better than its 3% annualized revenue declines.

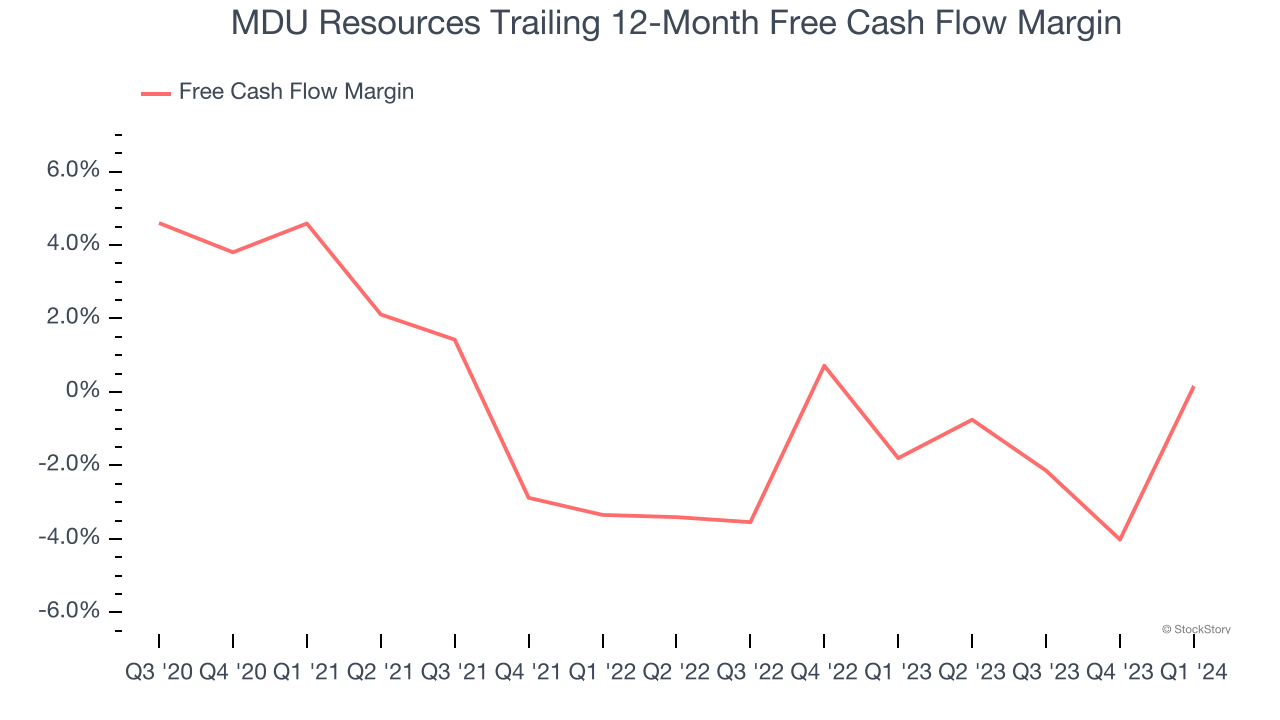

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

MDU Resources broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

MDU Resources doesn’t pass our quality test. After the recent drawdown, the stock trades at 15.6× forward price-to-earnings (or $17.91 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than MDU Resources

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.