What a time it’s been for Carlyle. In the past six months alone, the company’s stock price has increased by a massive 58.5%, reaching $58 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy CG? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Does Carlyle Spark Debate?

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ: CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Two Positive Attributes:

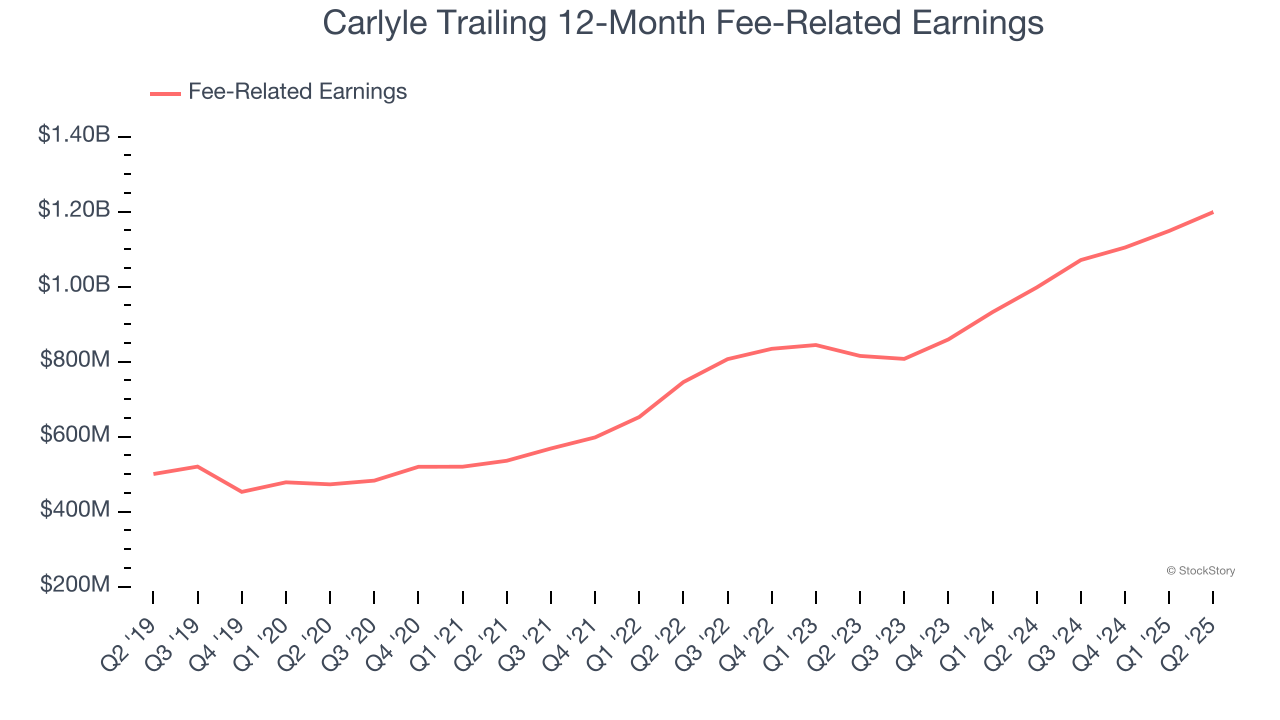

1. Strong Fee-Related Earnings Performance

While revenue growth captures attention, the quality of that growth is what truly drives shareholder value. For asset management firms, fee-related earnings represent the stable, predictable profits from their core fee-based services, excluding the more unpredictable elements like performance fees and investment returns. This metric reveals the sustainable earnings power of the business.

Carlyle’s annual fee-related earnings growth over the last five years was 20.5%, a solid result.

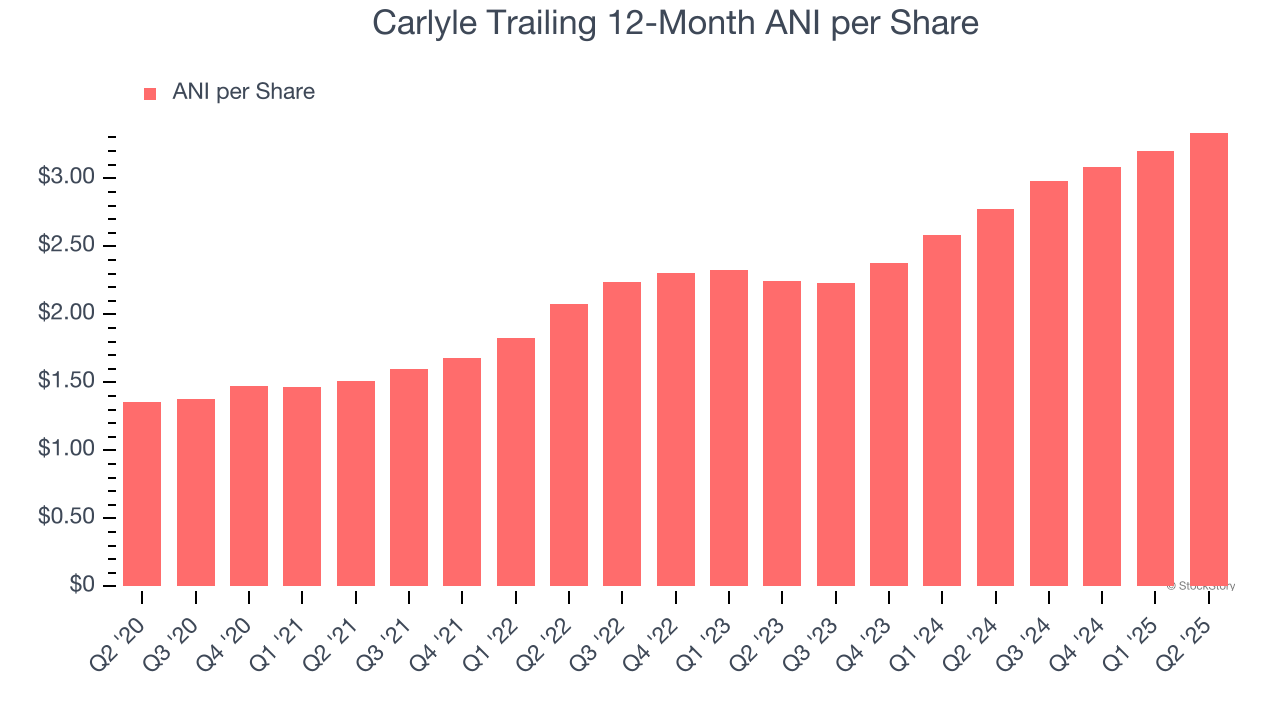

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Carlyle’s EPS grew at a remarkable 19.8% compounded annual growth rate over the last five years, higher than its 11.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

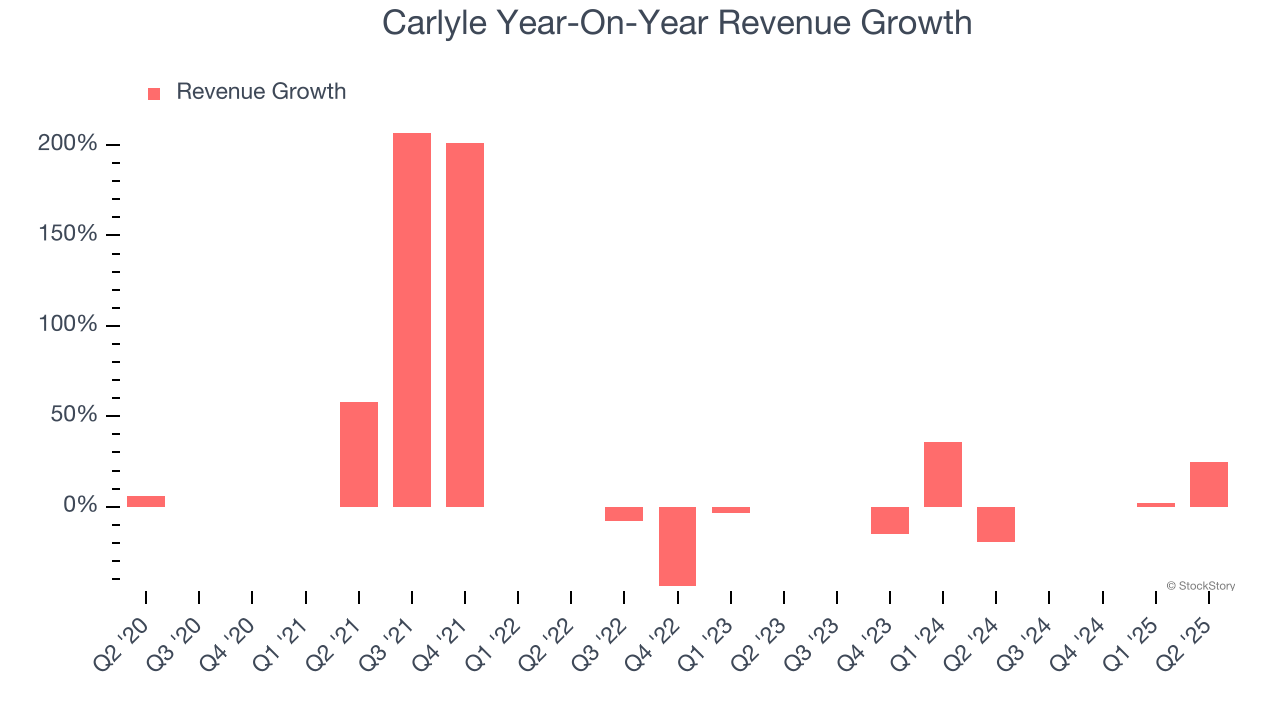

Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Carlyle’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.9% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

Carlyle’s positive characteristics outweigh the negatives, and after the recent rally, the stock trades at 13.3× forward P/E (or $58 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.