Industrial and safety product distributor Distribution Solutions (NASDAQ: DSGR) announced better-than-expected revenue in Q3 CY2025, with sales up 10.7% year on year to $518 million. Its non-GAAP profit of $0.40 per share was in line with analysts’ consensus estimates.

Is now the time to buy Distribution Solutions? Find out by accessing our full research report, it’s free for active Edge members.

Distribution Solutions (DSGR) Q3 CY2025 Highlights:

- Revenue: $518 million vs analyst estimates of $501.5 million (10.7% year-on-year growth, 3.3% beat)

- Adjusted EPS: $0.40 vs analyst estimates of $0.40 (in line)

- Adjusted EBITDA: $48.46 million vs analyst estimates of $50.17 million (9.4% margin, 3.4% miss)

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow was $40.04 million, up from -$23.02 million in the same quarter last year

- Market Capitalization: $1.38 billion

Bryan King, CEO and Chairman, said, "Our third-quarter results demonstrate the strength and resilience of our business model, even as inflation, tariffs, and higher interest rates continue to challenge parts of the U.S. economy. We delivered double-digit revenue growth of 10.7% in the quarter, supported by strong momentum in organic average daily sales which grew 6.0%, as well as revenue contributions from our recent acquisitions. Sales growth was realized across each of our segments, particularly strong at Gexpro Services and the Canada Branch Division. Supported by four quarters of organic top-line revenue growth quarter-over-quarter, we’re entering the final stretch of the year with solid momentum and confidence in our growth strategy.

Company Overview

Founded in 1952, Distribution Solutions (NASDAQ: DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Revenue Growth

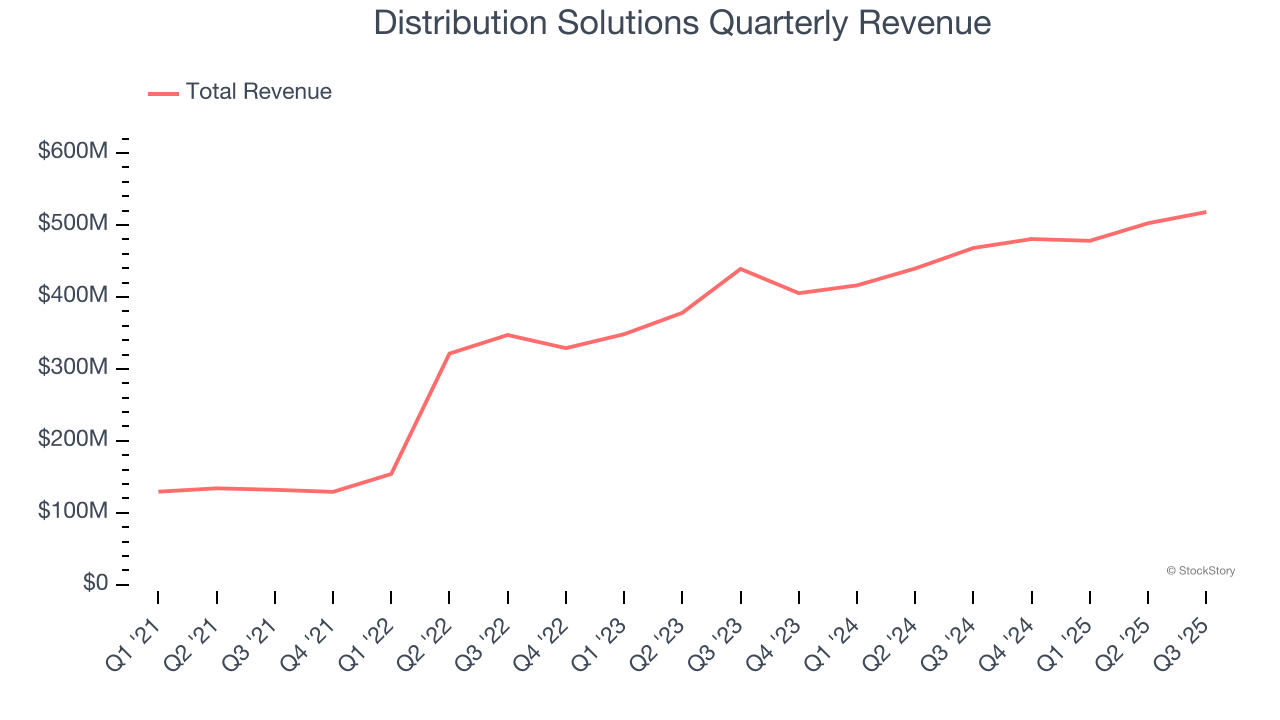

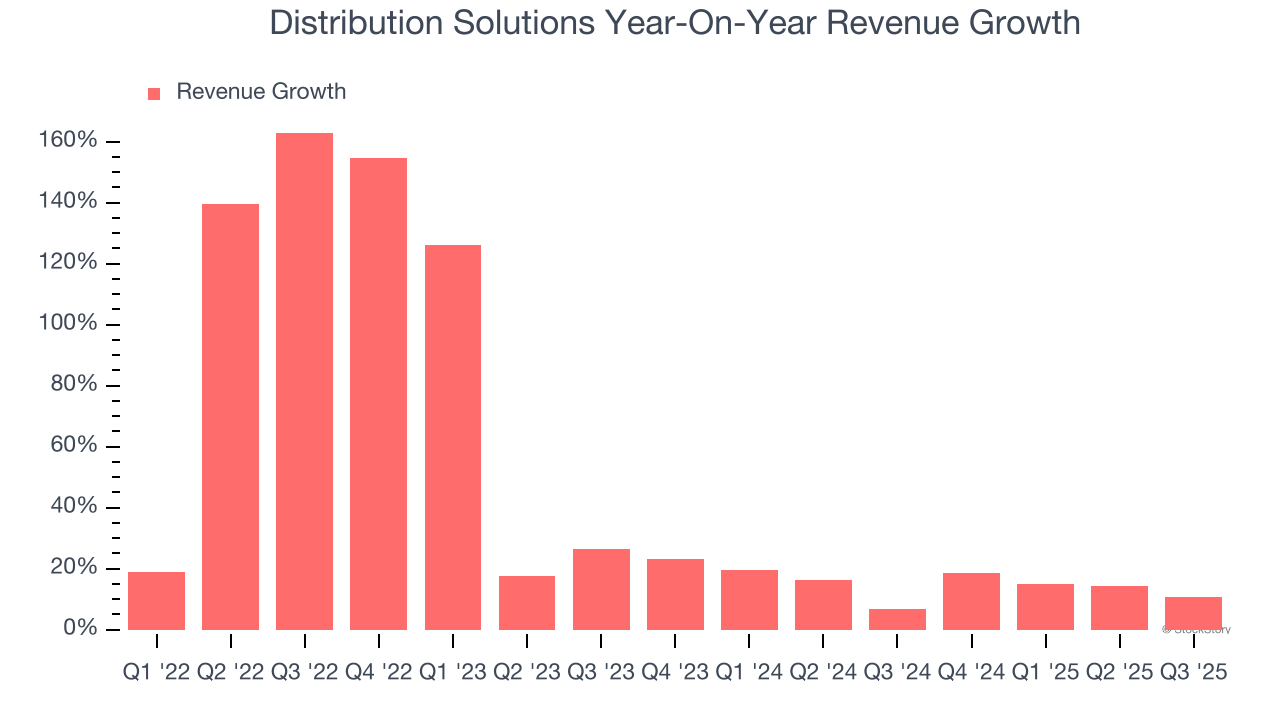

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last four years, Distribution Solutions grew its sales at an incredible 39.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Distribution Solutions’s annualized revenue growth of 15.1% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Distribution Solutions reported year-on-year revenue growth of 10.7%, and its $518 million of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

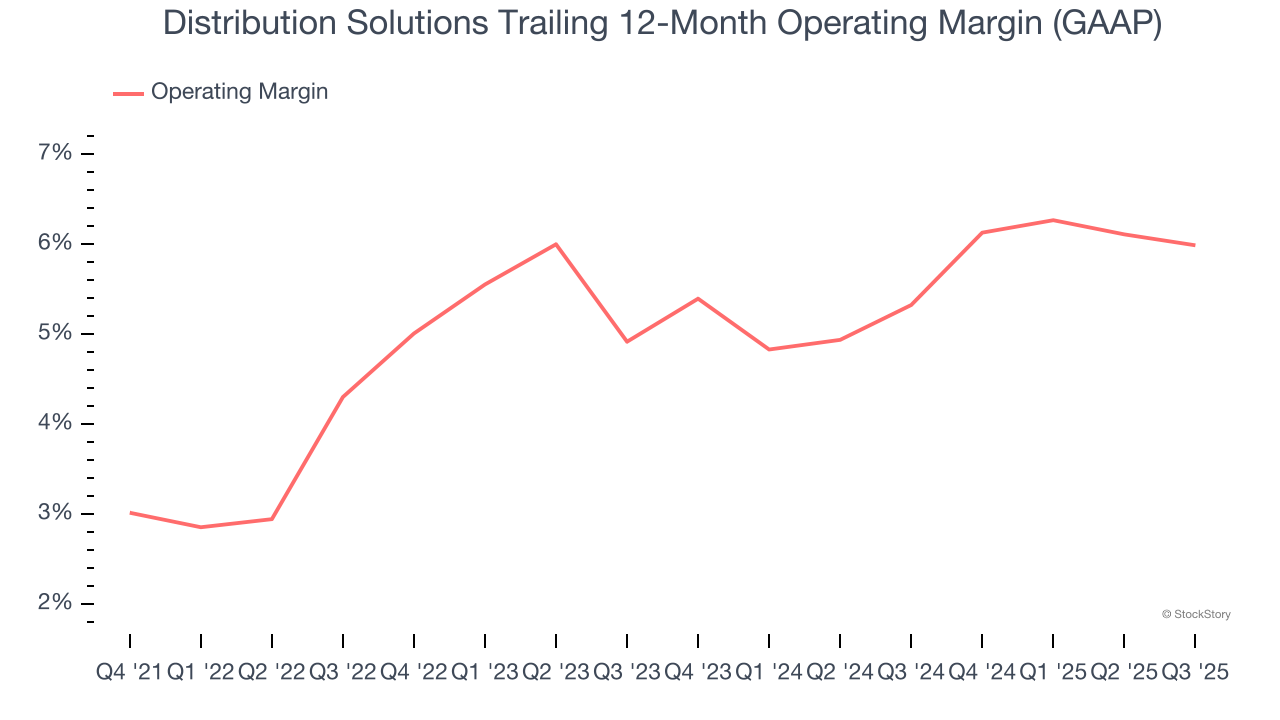

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Distribution Solutions’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5.2% over the last five years. This profitability was paltry for an industrials business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Distribution Solutions’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Distribution Solutions generated an operating margin profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Cash Is King

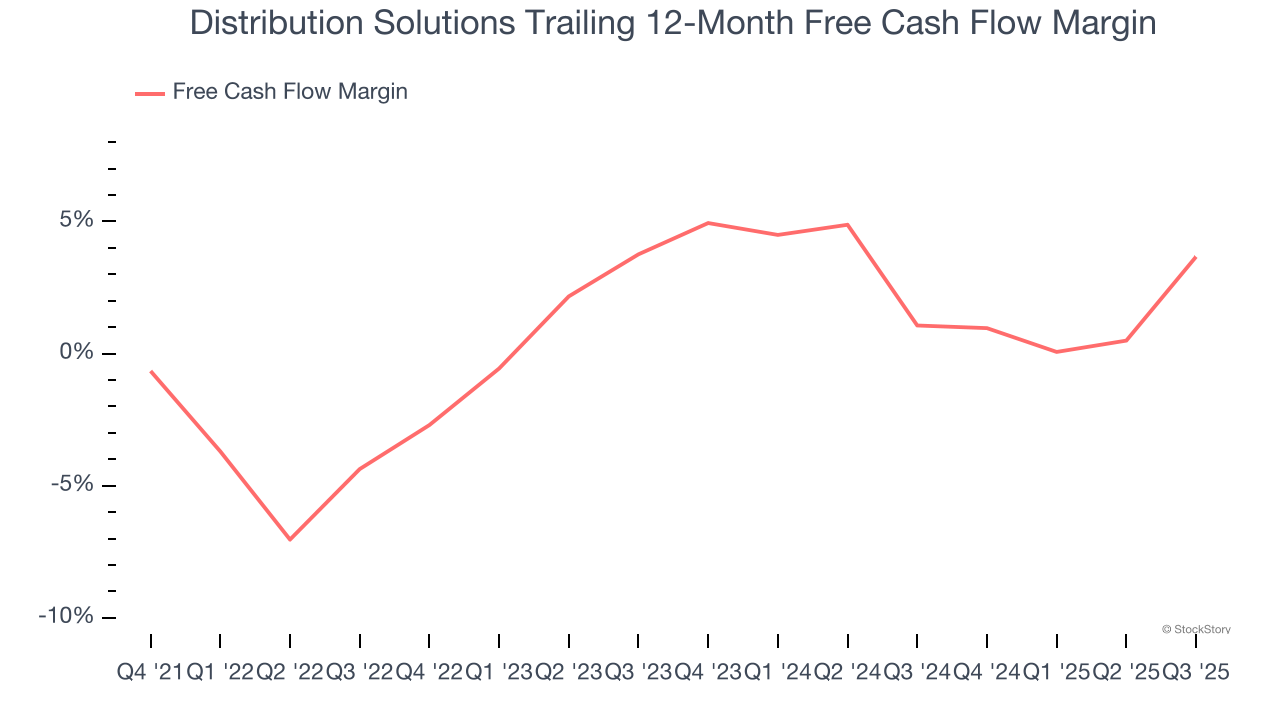

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Distribution Solutions has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.7%, lousy for an industrials business.

Taking a step back, an encouraging sign is that Distribution Solutions’s margin expanded by 1.9 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Distribution Solutions’s free cash flow clocked in at $40.04 million in Q3, equivalent to a 7.7% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Distribution Solutions’s Q3 Results

We enjoyed seeing Distribution Solutions beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $29.76 immediately after reporting.

Is Distribution Solutions an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.