The past six months have been a windfall for NetApp’s shareholders. The company’s stock price has jumped 42.1%, hitting $122.35 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy NetApp, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is NetApp Not Exciting?

Despite the momentum, we're cautious about NetApp. Here are two reasons you should be careful with NTAP and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

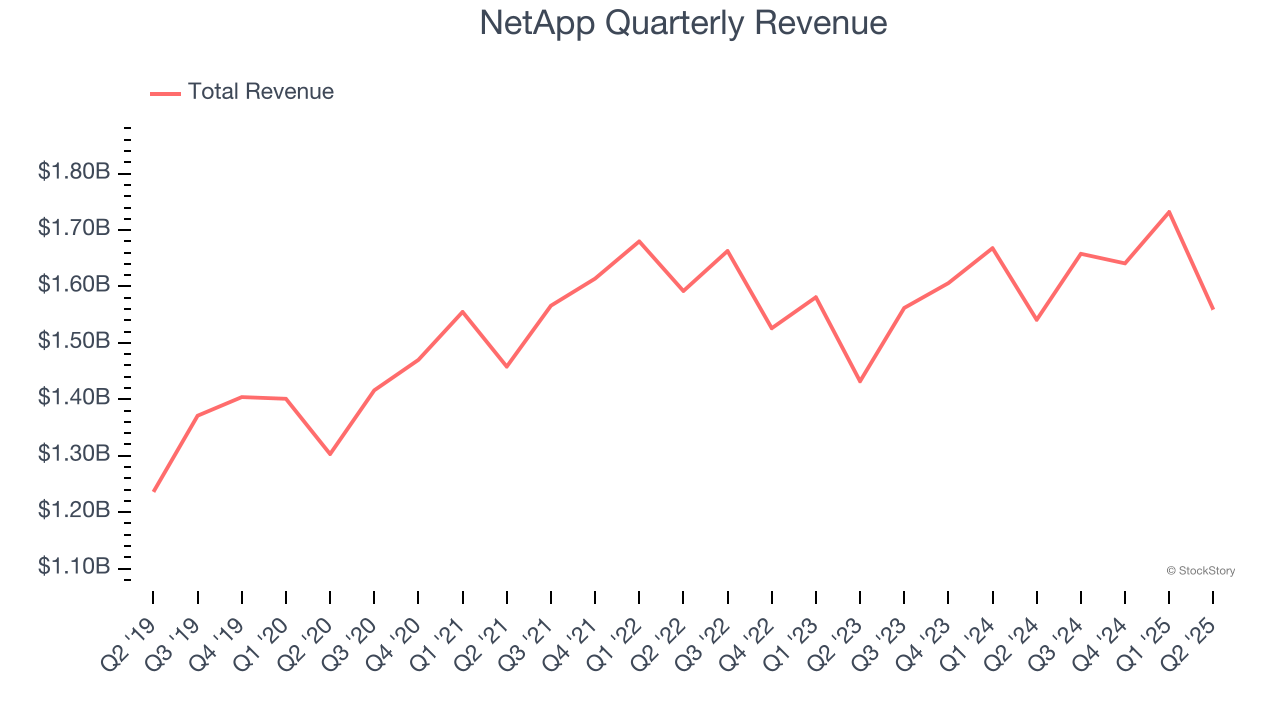

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, NetApp’s 3.8% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the business services sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect NetApp’s revenue to rise by 4.1%, close to its 3.8% annualized growth for the past five years. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

Final Judgment

NetApp isn’t a terrible business, but it isn’t one of our picks. Following the recent rally, the stock trades at 15.1× forward P/E (or $122.35 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than NetApp

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.