First BanCorp has been treading water for the past six months, recording a small return of 1.8% while holding steady at $21.20. The stock also fell short of the S&P 500’s 11.7% gain during that period.

Given the weaker price action, is now a good time to buy FBP? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Does First BanCorp Spark Debate?

Tracing its roots back to 1948 in San Juan, First BanCorp (NYSE: FBP) is a bank holding company that provides commercial banking, consumer financing, mortgage services, and insurance products across Puerto Rico, the U.S. mainland, and the Caribbean.

Two Things to Like:

1. Elite Net Interest Margin Powers Best-In-Class Loan Book

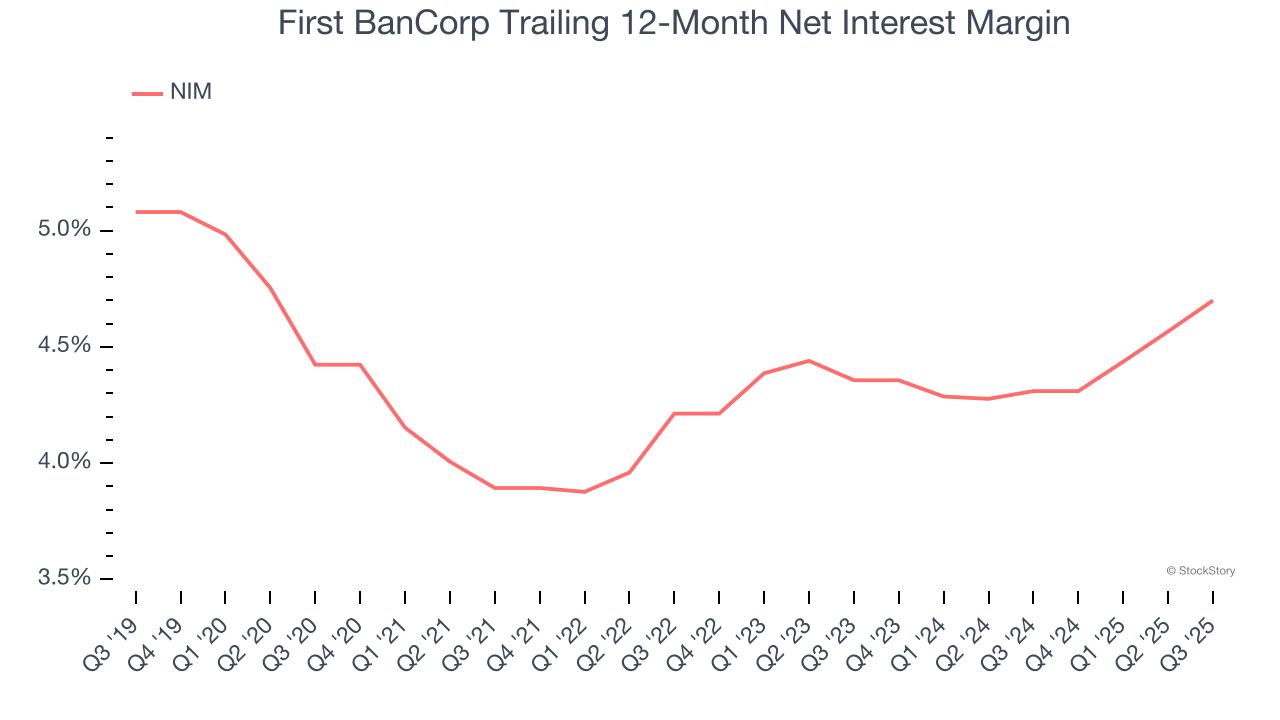

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that First BanCorp’s net interest margin averaged an elite 4.5%, indicating the company has a high-yielding loan book and a low cost of funds.

2. Outstanding Long-Term EPS Growth

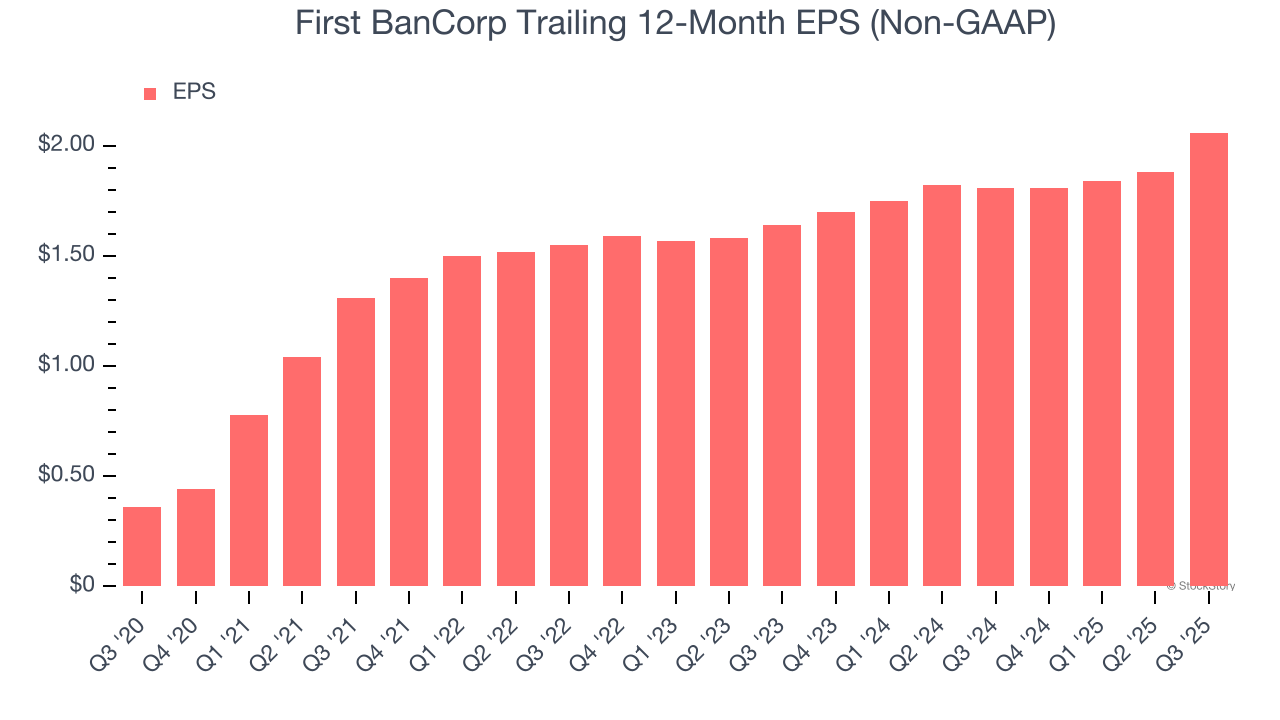

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

First BanCorp’s EPS grew at an astounding 41.7% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Net Interest Income Points to Soft Demand

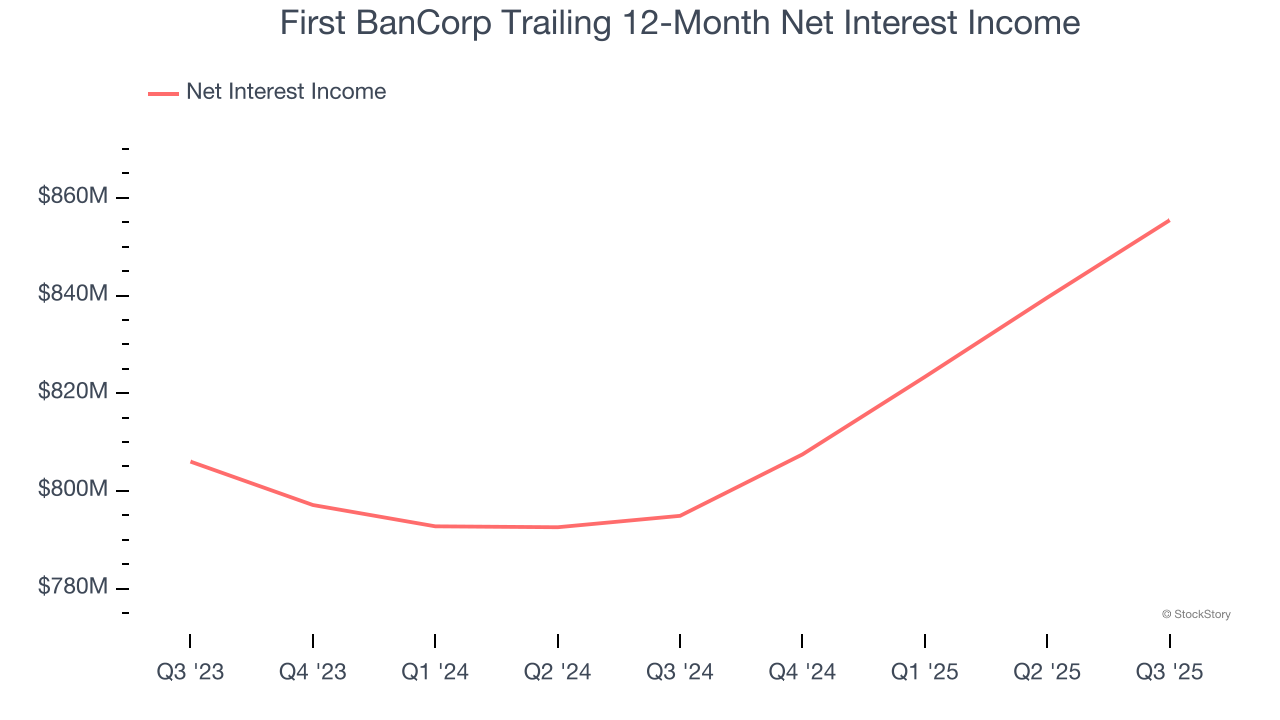

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

First BanCorp’s net interest income has grown at a 8.7% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

Final Judgment

First BanCorp’s positive characteristics outweigh the negatives. With its shares underperforming the market lately, the stock trades at 1.7× forward P/B (or $21.20 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.