Shareholders of Brinker International would probably like to forget the past six months even happened. The stock dropped 20.6% and now trades at $143.26. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Brinker International, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Brinker International Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons we avoid EAT and a stock we'd rather own.

1. Lack of New Restaurants, a Headwind for Revenue

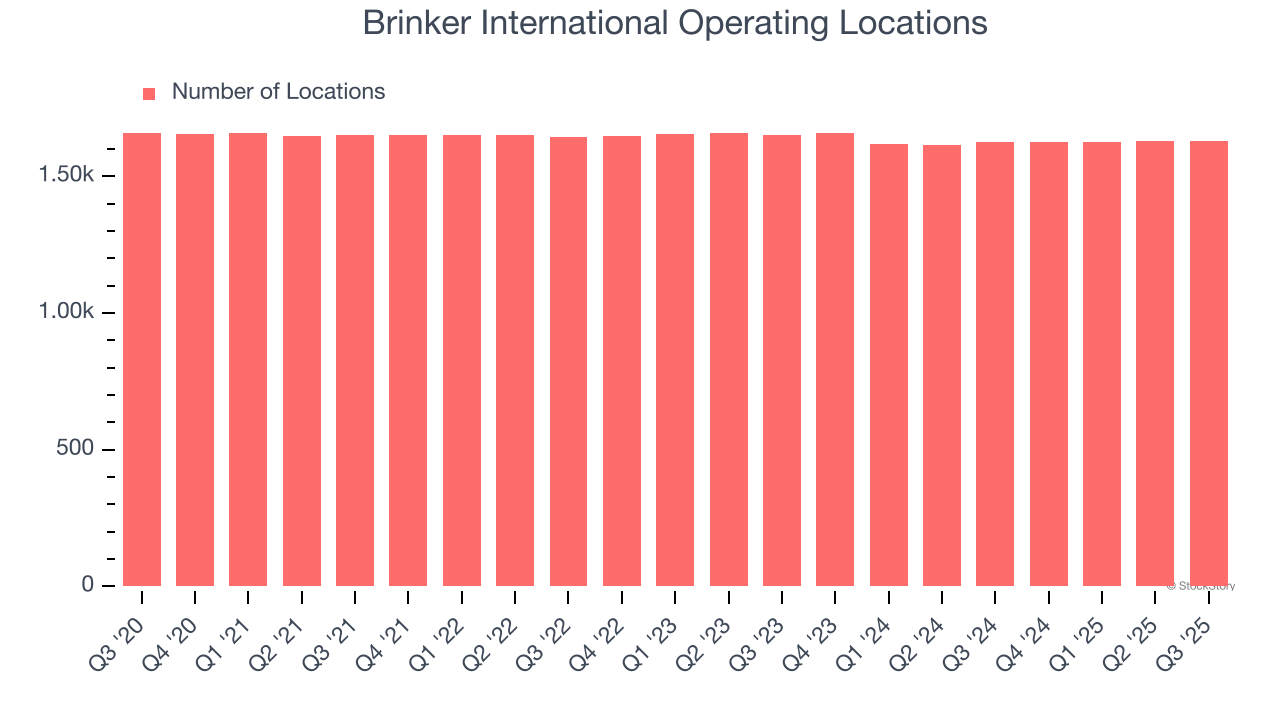

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Brinker International listed 1,630 locations in the latest quarter and has kept its restaurant count flat over the last two years while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Brinker International’s revenue to rise by 3.5%, a deceleration versus This projection is underwhelming and implies its menu offerings will face some demand challenges.

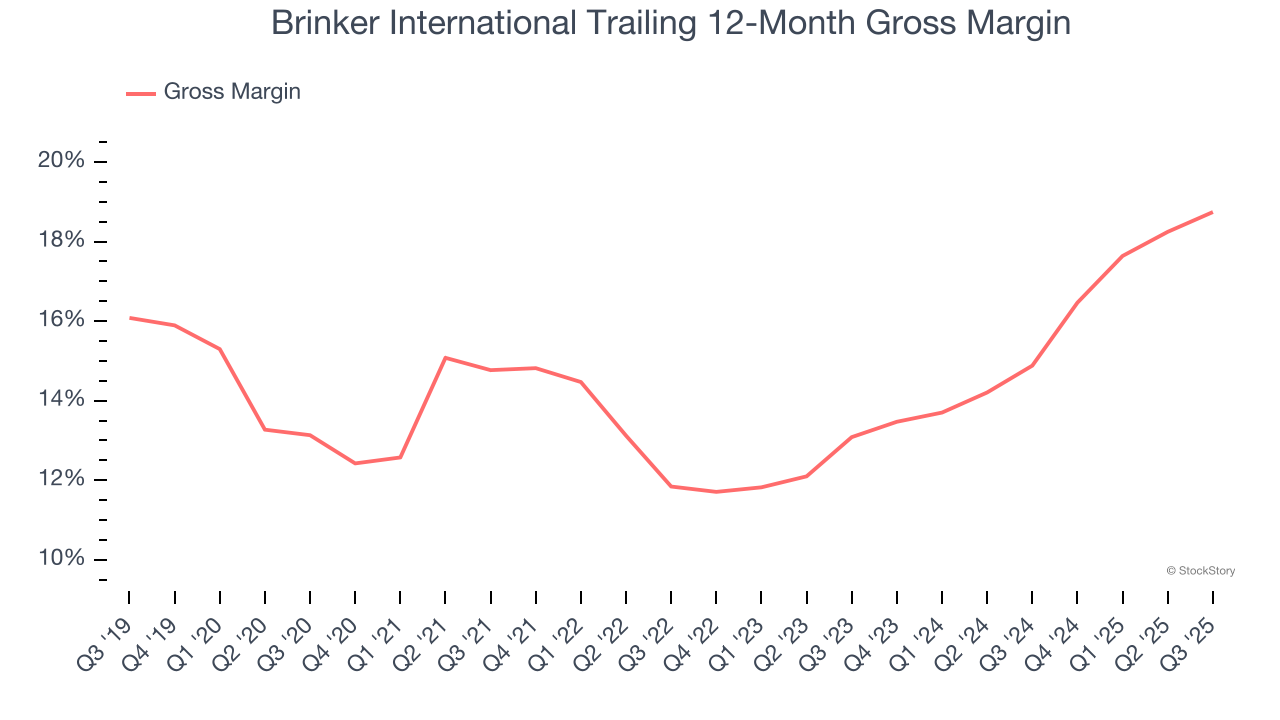

3. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Brinker International has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 17% gross margin over the last two years. That means Brinker International paid its suppliers a lot of money ($82.99 for every $100 in revenue) to run its business.

Final Judgment

Brinker International isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 14.1× forward P/E (or $143.26 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.