AbbVie has had an impressive run over the past six months as its shares have beaten the S&P 500 by 12.4%. The stock now trades at $229.70, marking a 23.7% gain. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy ABBV? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does ABBV Stock Spark Debate?

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE: ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

Two Positive Attributes:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $59.64 billion in revenue over the past 12 months, AbbVie is one of the most scaled enterprises in healthcare. This is particularly important because therapeutics companies are volume-driven businesses due to their low margins.

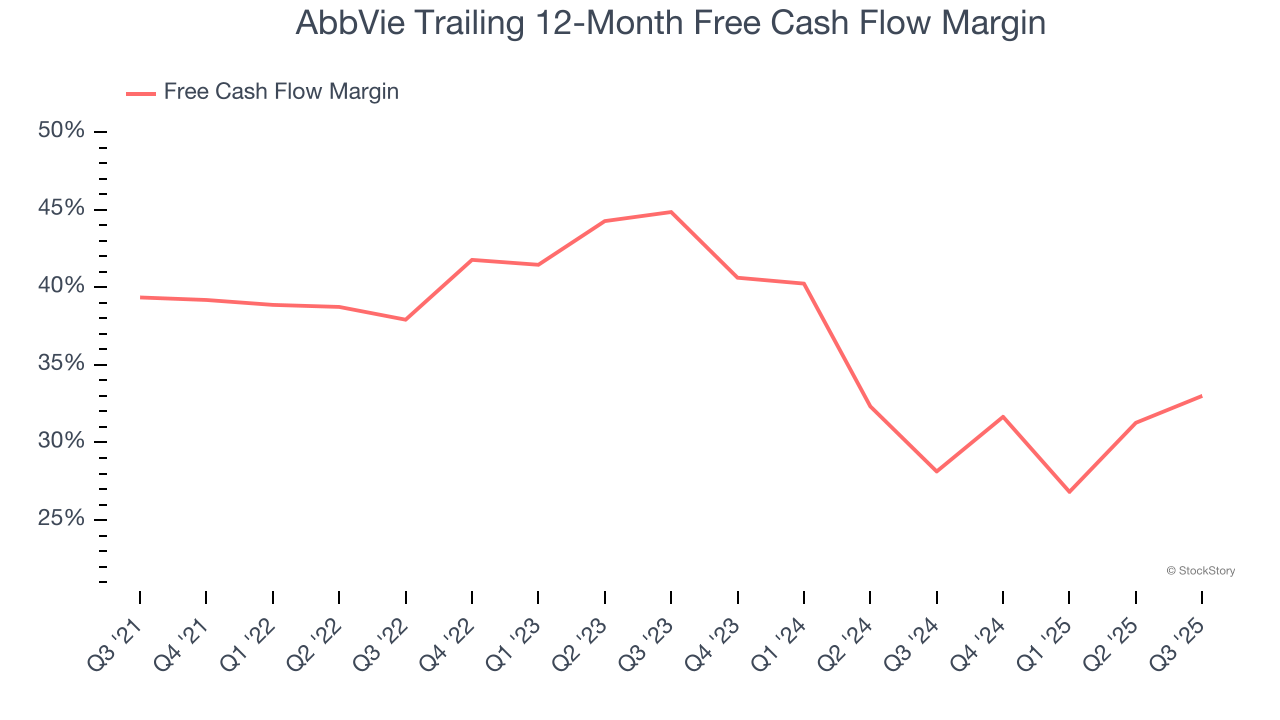

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AbbVie has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 36.6% over the last five years.

One Reason to be Careful:

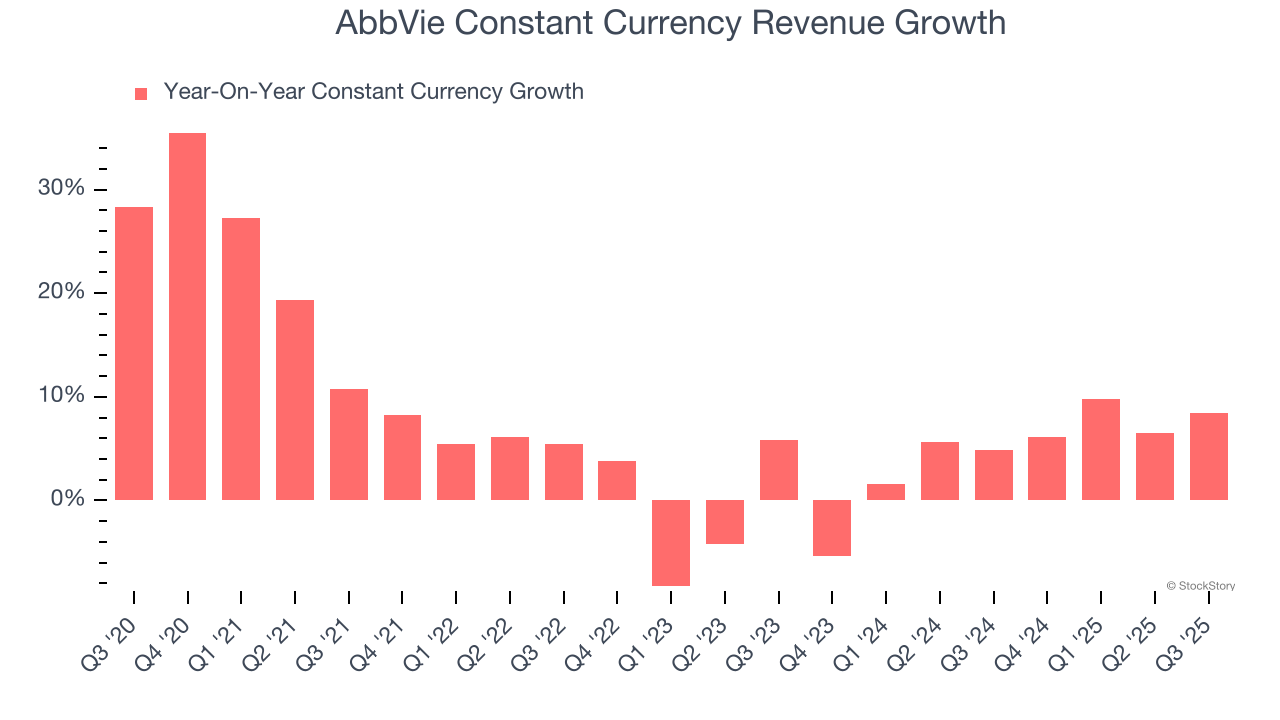

Weak Constant Currency Growth Points to Soft Demand

We can better understand Therapeutics companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of AbbVie’s control and are not indicative of underlying demand.

Over the last two years, AbbVie’s constant currency revenue averaged 4.7% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

AbbVie’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 16.7× forward P/E (or $229.70 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than AbbVie

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.