Beer powerhouse Anheuser-Busch InBev (NYSE: BUD) fell short of the market’s revenue expectations in Q4 CY2024 as sales rose 2.5% year on year to $14.84 billion. Its GAAP profit of $0.61 per share decreased from $0.94 in the same quarter last year.

Is now the time to buy Anheuser-Busch? Find out by accessing our full research report, it’s free.

Anheuser-Busch (BUD) Q4 CY2024 Highlights:

- Revenue: $14.84 billion (2.5% year-on-year growth)

- Operating Margin: 25.8%, up from 23.1% in the same quarter last year

- Organic Revenue fell 1.9% year on year (6.2% in the same quarter last year)

- Sales Volumes fell 1.9% year on year, in line with the same quarter last year

- Market Capitalization: $112 billion

Company Overview

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE: BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $59.77 billion in revenue over the past 12 months, Anheuser-Busch is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. To accelerate sales, Anheuser-Busch must lean into newer products.

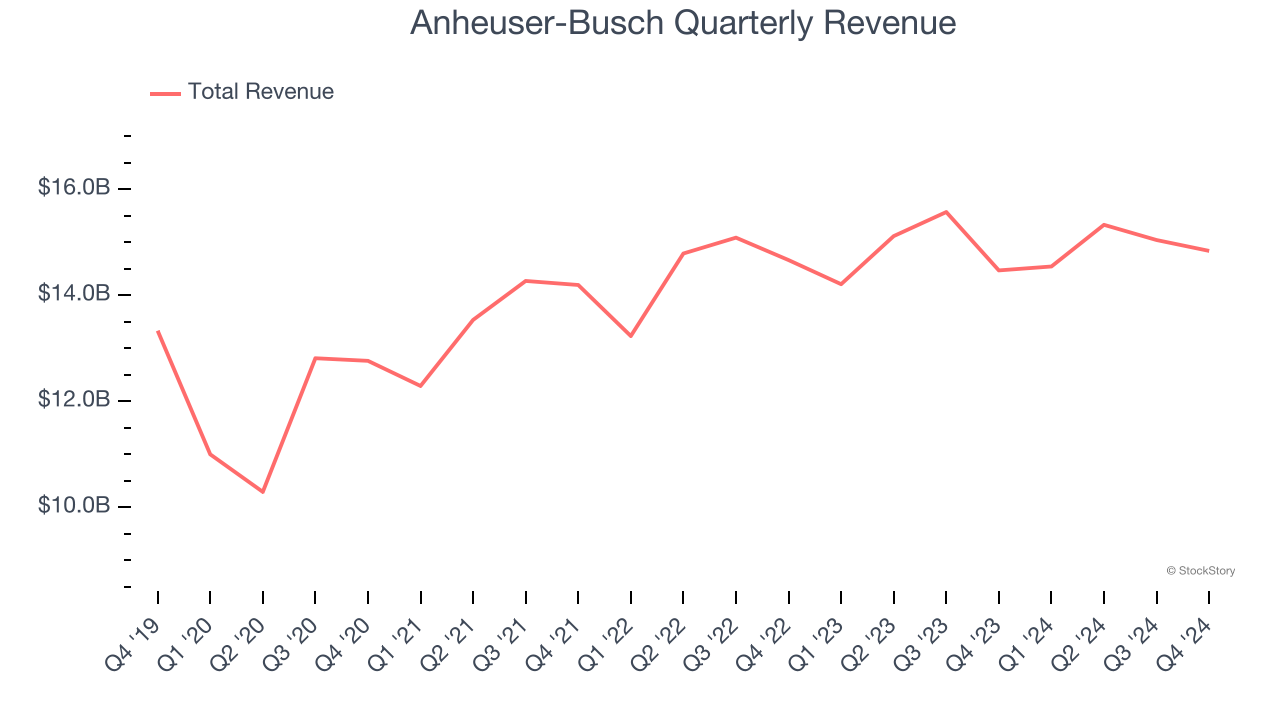

As you can see below, Anheuser-Busch grew its sales at a sluggish 3.2% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Anheuser-Busch’s revenue grew by 2.5% year on year to $14.84 billion.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Anheuser-Busch could be a hidden gem because it doesn’t get attention from professional brokers.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Anheuser-Busch generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

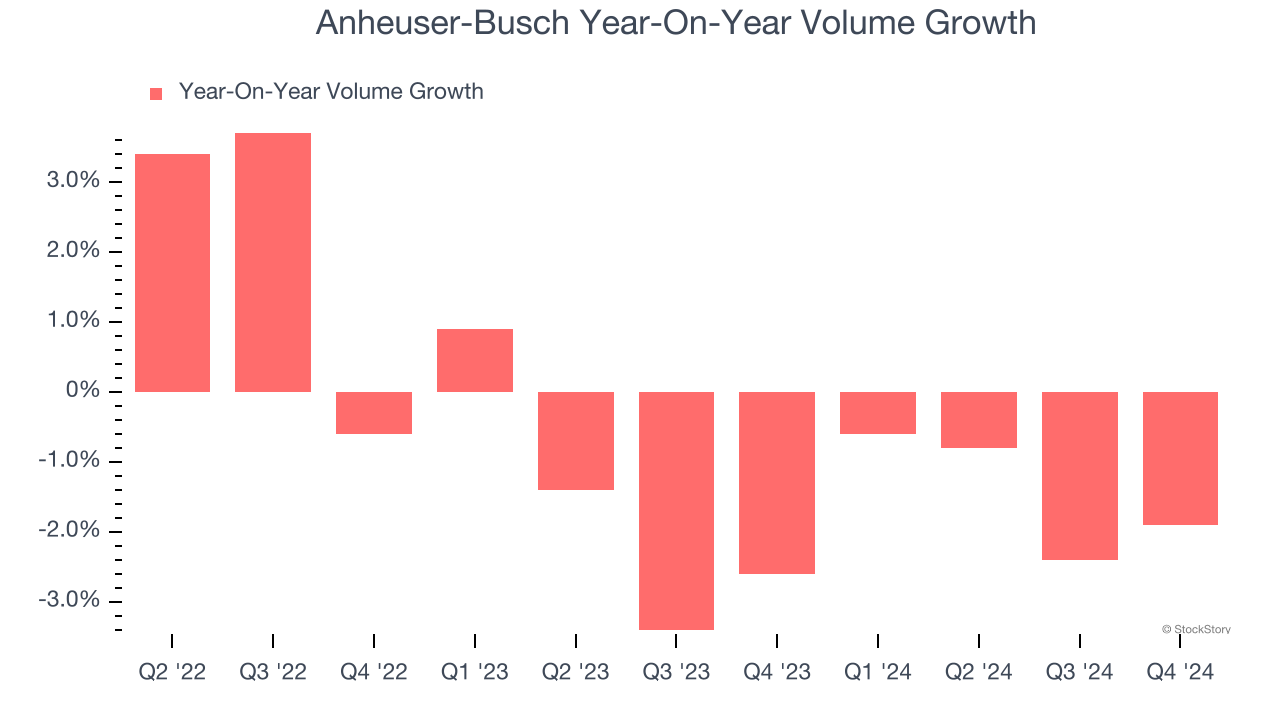

Over the last two years, Anheuser-Busch’s average quarterly sales volumes have shrunk by 1.5%. This decrease isn’t ideal as the quantity demanded for consumer staples products is typically stable. Luckily, Anheuser-Busch was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 4.6% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren’t sustainable over the long term unless the business is really really special.

In Anheuser-Busch’s Q4 2024, sales volumes dropped 1.9% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Big picture, is Anheuser-Busch a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.