Healthcare software provider Health Catalyst (NASDAQ: HCAT) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 6% year on year to $79.61 million. On the other hand, next quarter’s revenue guidance of $79 million was less impressive, coming in 3.5% below analysts’ estimates. Its non-GAAP profit of $0.04 per share was 47.6% below analysts’ consensus estimates.

Is now the time to buy Health Catalyst? Find out by accessing our full research report, it’s free.

Health Catalyst (HCAT) Q4 CY2024 Highlights:

- Revenue: $79.61 million vs analyst estimates of $79.57 million (6% year-on-year growth, in line)

- Adjusted EPS: $0.04 vs analyst expectations of $0.08 (47.6% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $335 million at the midpoint, missing analyst estimates by 0.5% and implying 9.3% growth (vs 3.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $41 million at the midpoint, above analyst estimates of $38.73 million

- Operating Margin: -22%, up from -43.7% in the same quarter last year

- Free Cash Flow was -$8.36 million, down from $1.93 million in the previous quarter

- Market Capitalization: $301.2 million

“For the full year 2024, I am pleased to share that we achieved strong performance across our business, including total revenue of $307 million and Adjusted EBITDA of $26 million. Additionally, I am encouraged with our Technology segment, which had revenue of $195 million for full-year 2024 and $52 million for the fourth quarter of 2024, which represents 10% growth year-over-year. I am pleased with this progress and excited that we anticipate a continued reacceleration of topline growth for full year 2025, with our Tech segment growing faster than the total business. Likewise, I am pleased with our profitability progress and excited that we have raised our target for 2025 Adjusted EBITDA by $2 million, to approximately $41 million.” said Dan Burton, CEO of Health Catalyst.

Company Overview

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ: HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

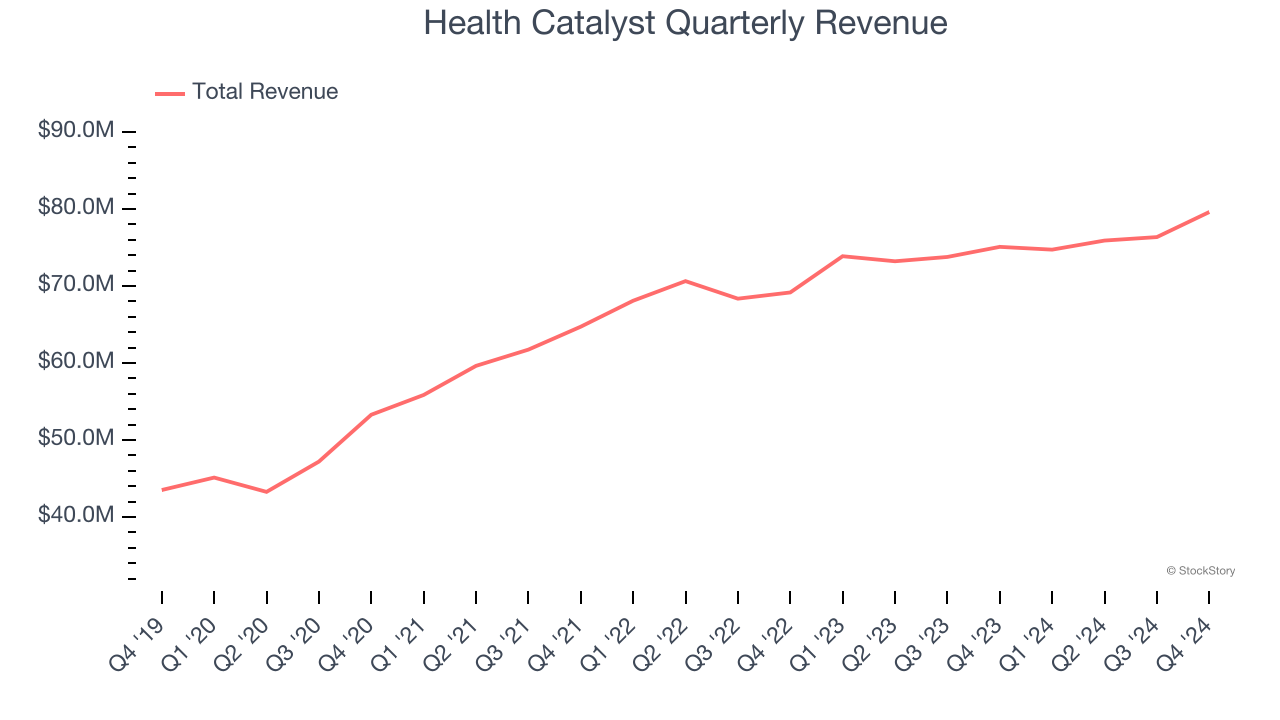

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Health Catalyst’s 8.2% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the software sector and is a rough starting point for our analysis.

This quarter, Health Catalyst grew its revenue by 6% year on year, and its $79.61 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Health Catalyst is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Health Catalyst’s Q4 Results

We were impressed by Health Catalyst’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. On the other hand, its full-year revenue guidance missed along with its EPS. Overall, this was a weaker quarter. The stock traded down 2.7% to $4.80 immediately after reporting.

Health Catalyst underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.