Aerospace and defense company Kratos (NASDAQ: KTOS) fell short of the market’s revenue expectations in Q4 CY2024 as sales rose 3.4% year on year to $283.1 million. Next quarter’s revenue guidance of $290 million underwhelmed, coming in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.13 per share was 27.8% above analysts’ consensus estimates.

Is now the time to buy Kratos? Find out by accessing our full research report, it’s free.

Kratos (KTOS) Q4 CY2024 Highlights:

- Revenue: $283.1 million vs analyst estimates of $287.9 million (3.4% year-on-year growth, 1.7% miss)

- Adjusted EPS: $0.13 vs analyst estimates of $0.10 (27.8% beat)

- Adjusted EBITDA: $25.2 million vs analyst estimates of $24.46 million (8.9% margin, 3% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.27 billion at the midpoint, missing analyst estimates by 0.6% and implying 12% growth (vs 10.1% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $115 million at the midpoint, below analyst estimates of $124.9 million

- Operating Margin: 1.1%, down from 4.3% in the same quarter last year

- Free Cash Flow Margin: 11.3%, down from 17.6% in the same quarter last year

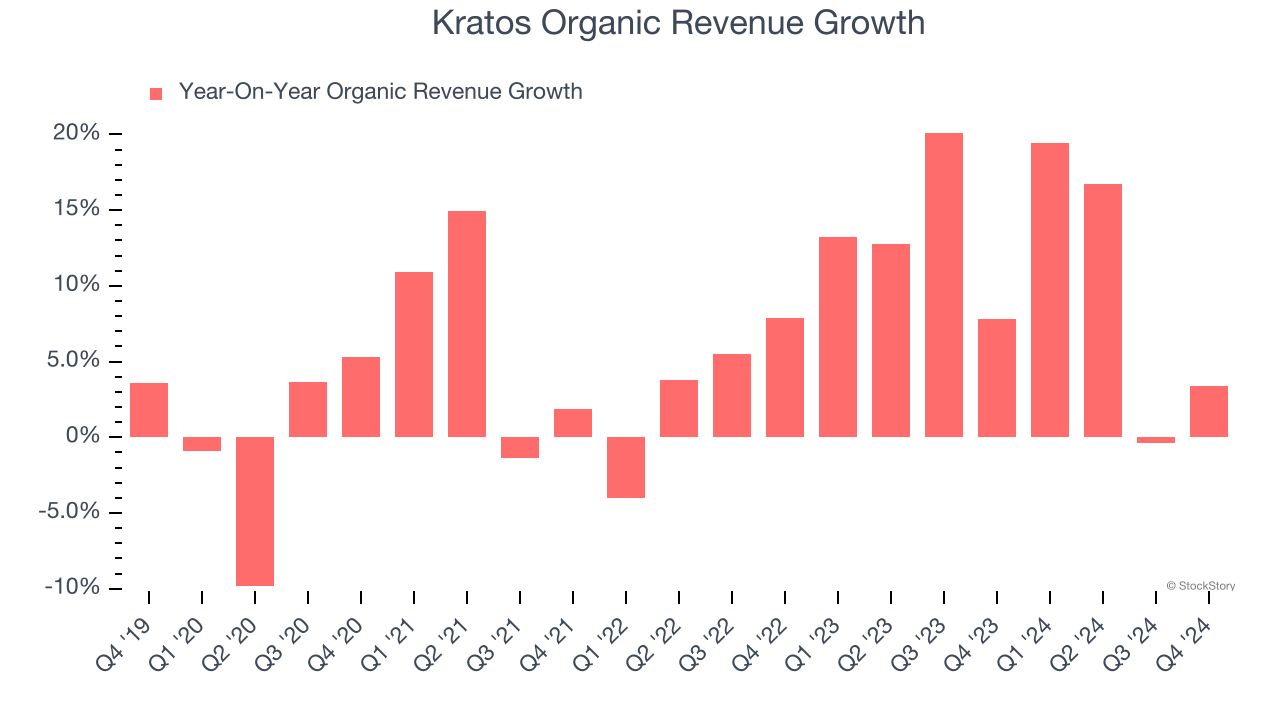

- Organic Revenue rose 3.4% year on year (7.8% in the same quarter last year)

- Market Capitalization: $3.79 billion

Eric DeMarco, Kratos’ President and CEO, said, “Kratos’ full year 2024 and fourth quarter demonstrated once again that we can significantly organically grow the business, and make sizable internally funded investments, positioning the Company for accelerating future growth, while also generating significant, positive operating cash flow. We have recently received several large new program and contract awards, including in the hypersonic, target drone, jet engine, rocket, and satellite system areas, enabling us to increase our expected revenue growth rate for 2026 to a range of 13 percent to 15 percent above our current 2025 financial forecast that we provided today, which includes 10 percent growth over 2024. Kratos’ fourth quarter 1.5 to 1.0 book to bill ratio and our $12.4 Billion opportunity pipeline also provides confidence in our expected accelerating future growth trajectory, with increased margins.”

Company Overview

Established with a commitment to supporting national security, Kratos (NASDAQ: KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Sales Growth

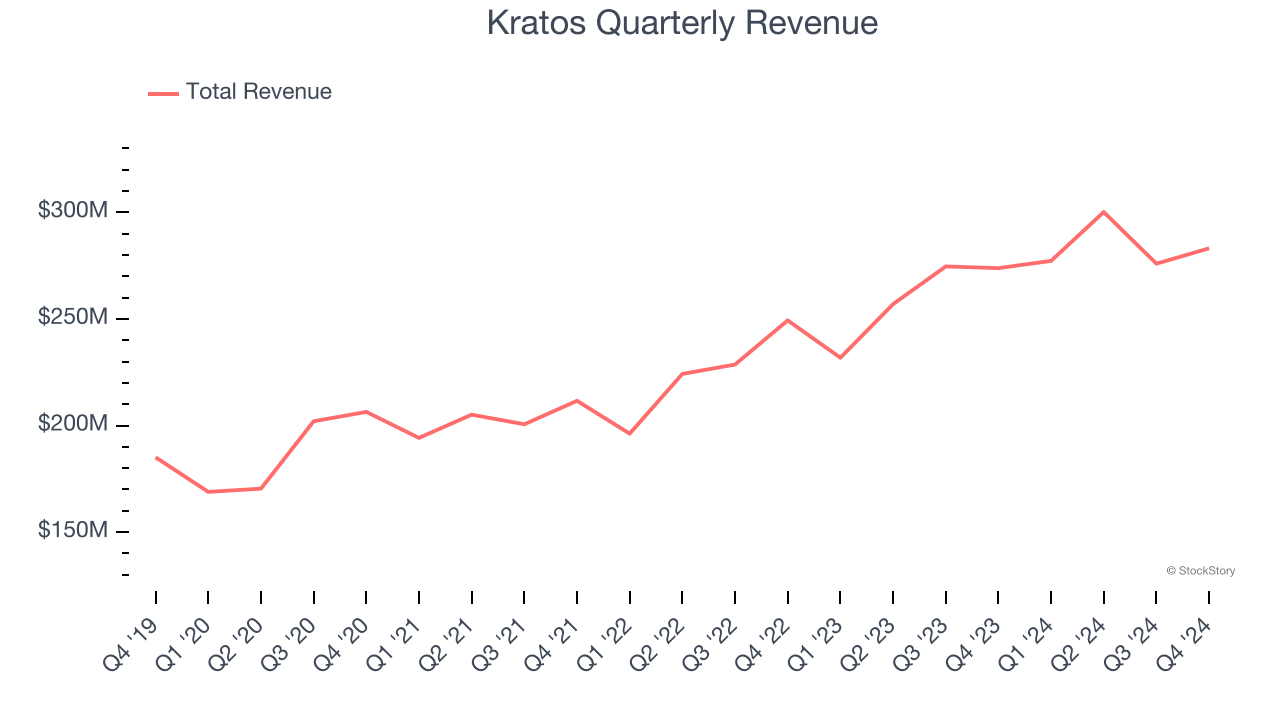

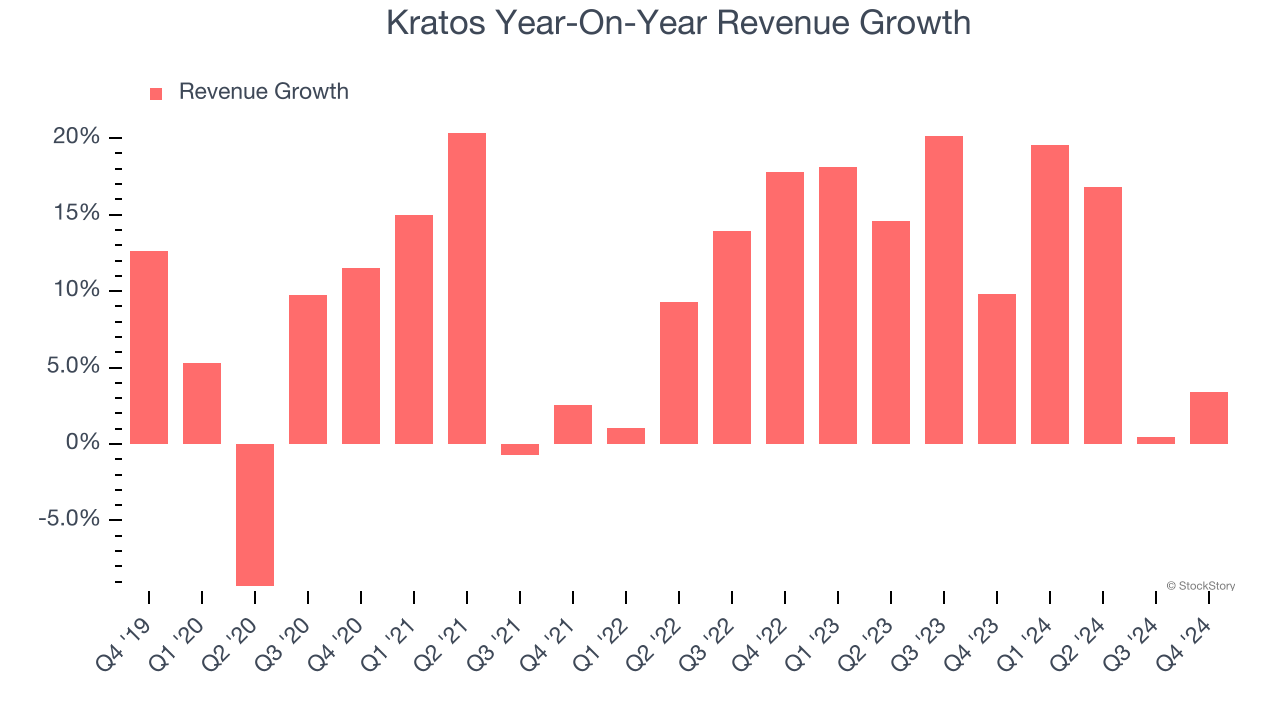

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Kratos’s sales grew at a solid 9.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Kratos’s annualized revenue growth of 12.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Kratos’s organic revenue averaged 11.6% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Kratos’s revenue grew by 3.4% year on year to $283.1 million, falling short of Wall Street’s estimates. Company management is currently guiding for a 4.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, similar to its two-year rate. Still, this projection is admirable and suggests the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

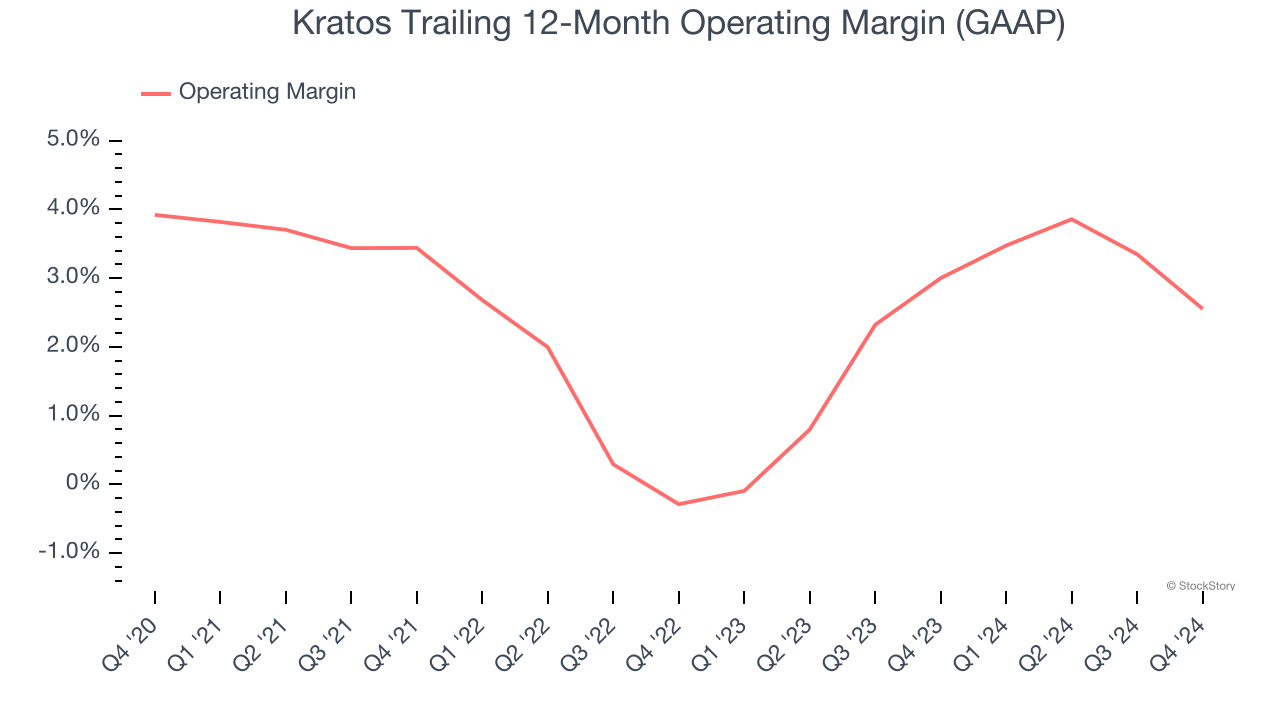

Kratos was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.5% was weak for an industrials business.

Looking at the trend in its profitability, Kratos’s operating margin decreased by 1.4 percentage points over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. . Kratos’s performance was poor no matter how you look at it - it shows costs were rising and that it couldn’t pass them onto its customers.

In Q4, Kratos generated an operating profit margin of 1.1%, down 3.2 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

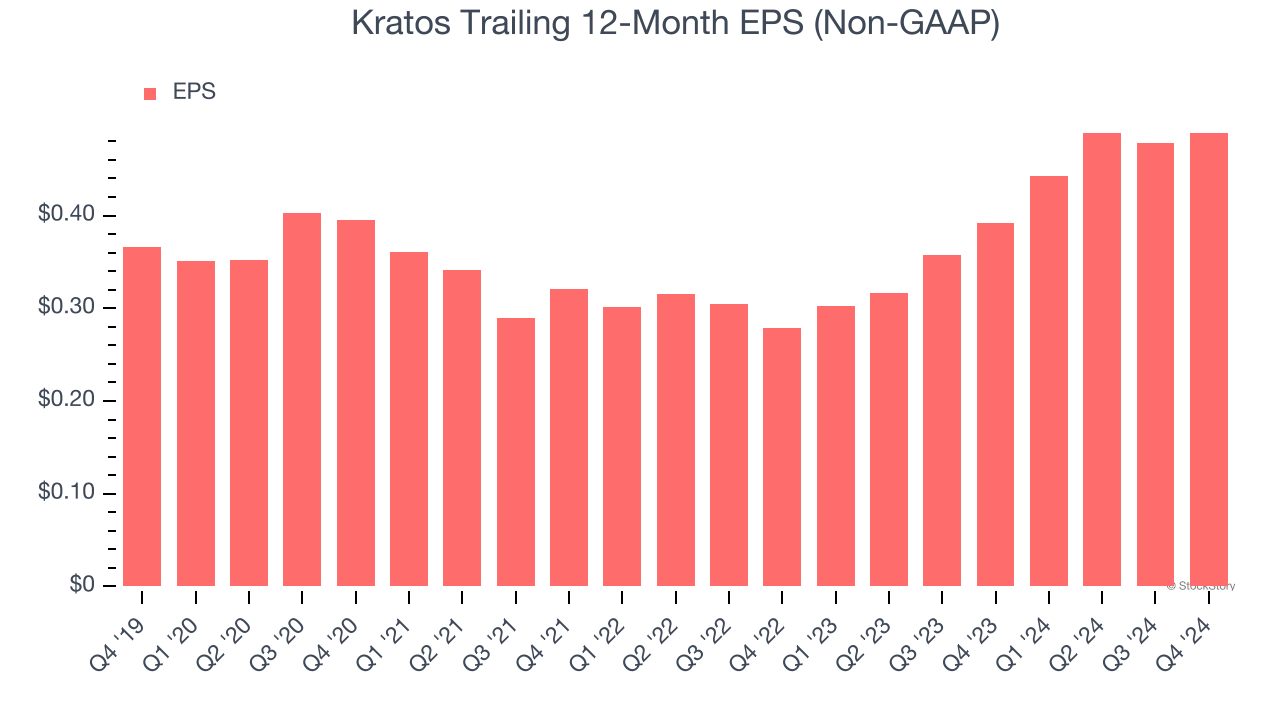

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

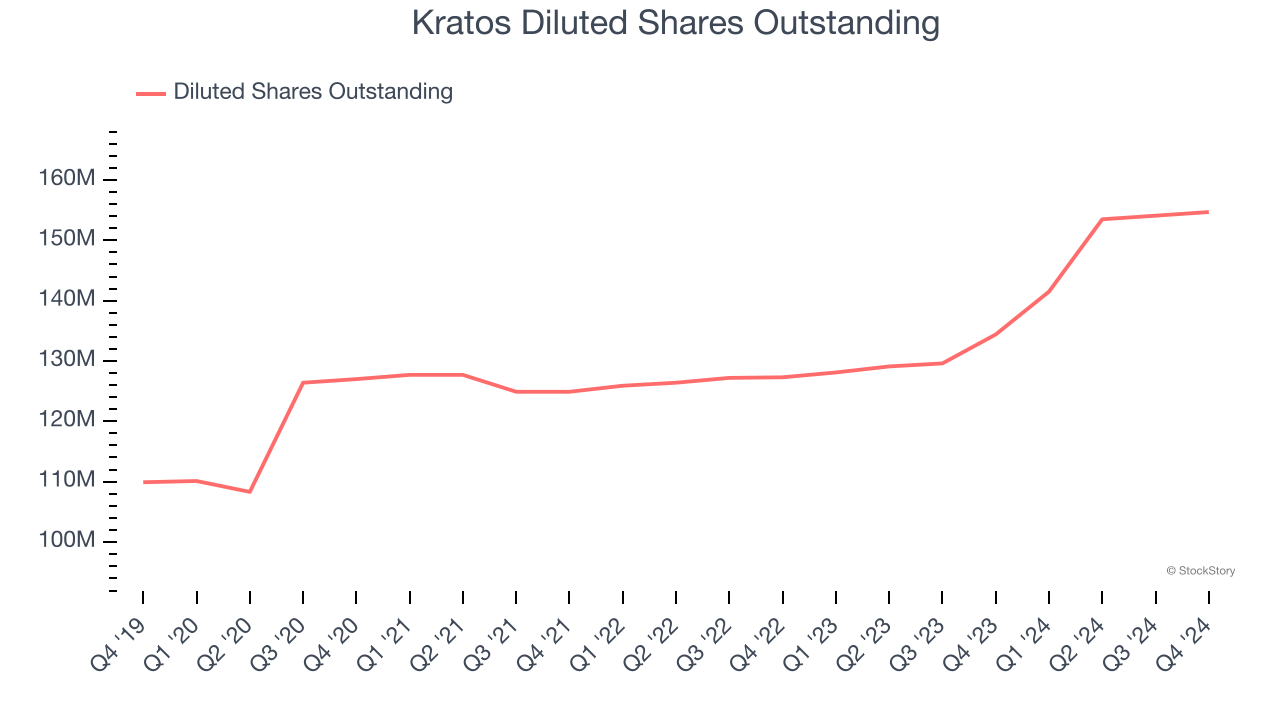

Kratos’s EPS grew at an unimpressive 6% compounded annual growth rate over the last five years, lower than its 9.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Kratos’s earnings to better understand the drivers of its performance. As we mentioned earlier, Kratos’s operating margin declined by 1.4 percentage points over the last five years. Its share count also grew by 40.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kratos, its two-year annual EPS growth of 32.4% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Kratos reported EPS at $0.13, up from $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kratos’s full-year EPS of $0.49 to grow 18.1%.

Key Takeaways from Kratos’s Q4 Results

We were impressed by how significantly Kratos blew past analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed significantly and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.3% to $23.31 immediately following the results.

Kratos’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.