Boutique fitness studio franchisor Xponential Fitness (NYSE: XPOF) reported Q4 CY2024 results topping the market’s revenue expectations, but sales fell by 7.7% year on year to $83.22 million. On the other hand, the company’s full-year revenue guidance of $320 million at the midpoint came in 6.6% below analysts’ estimates. Its non-GAAP loss of $0.19 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Xponential Fitness? Find out by accessing our full research report, it’s free.

Xponential Fitness (XPOF) Q4 CY2024 Highlights:

- Revenue: $83.22 million vs analyst estimates of $80.75 million (7.7% year-on-year decline, 3.1% beat)

- Adjusted EPS: -$0.19 vs analyst estimates of $0.45 (significant miss)

- Adjusted EBITDA: $30.81 million vs analyst estimates of $35.07 million (37% margin, 12.2% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $320 million at the midpoint, missing analyst estimates by 6.6% and implying 0.1% growth (vs 0.9% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $122.5 million at the midpoint, below analyst estimates of $139.9 million

- Operating Margin: -62.4%, down from 3.3% in the same quarter last year

- Free Cash Flow was $864,000, up from -$4.05 million in the same quarter last year

- Market Capitalization: $391.6 million

Company Overview

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

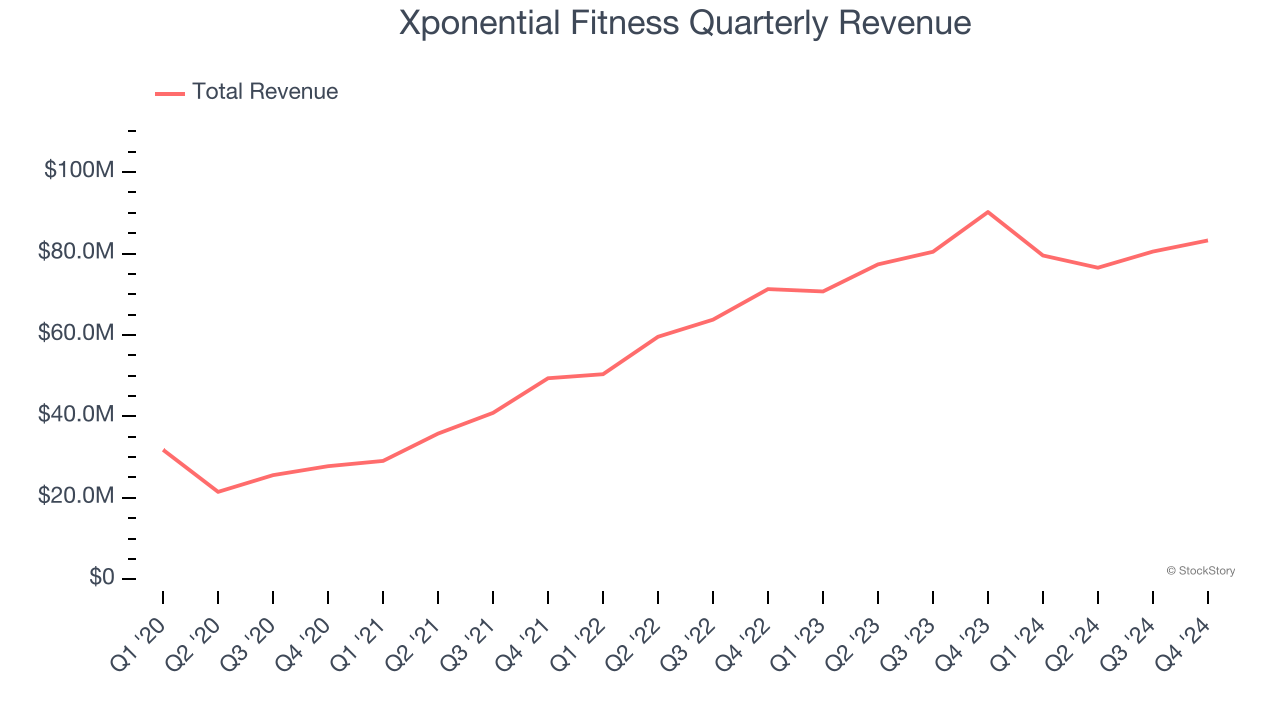

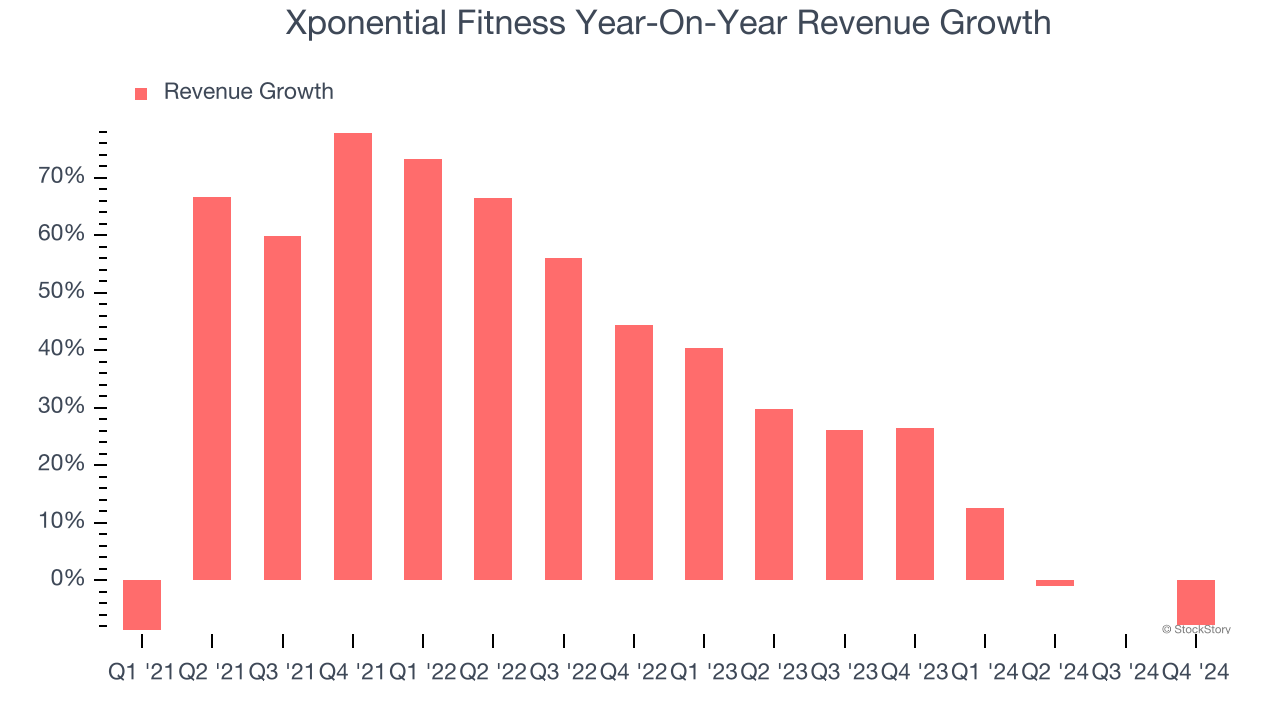

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last four years, Xponential Fitness grew its sales at an incredible 31.6% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Xponential Fitness’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 14.3% over the last two years was well below its four-year trend. Note that COVID hurt Xponential Fitness’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Franchise, Equipment, and Merchandise, which are 54.4%, 15.3%, and 7.4% of revenue. Over the last two years, Xponential Fitness’s revenues in all three segments increased. Its Franchise revenue (royalty fees) averaged year-on-year growth of 23.3% while its Equipment (workout equipment sold to franchisees) and Merchandise (apparel sold to franchisees) revenues averaged 15.5% and 3.3%.

This quarter, Xponential Fitness’s revenue fell by 7.7% year on year to $83.22 million but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

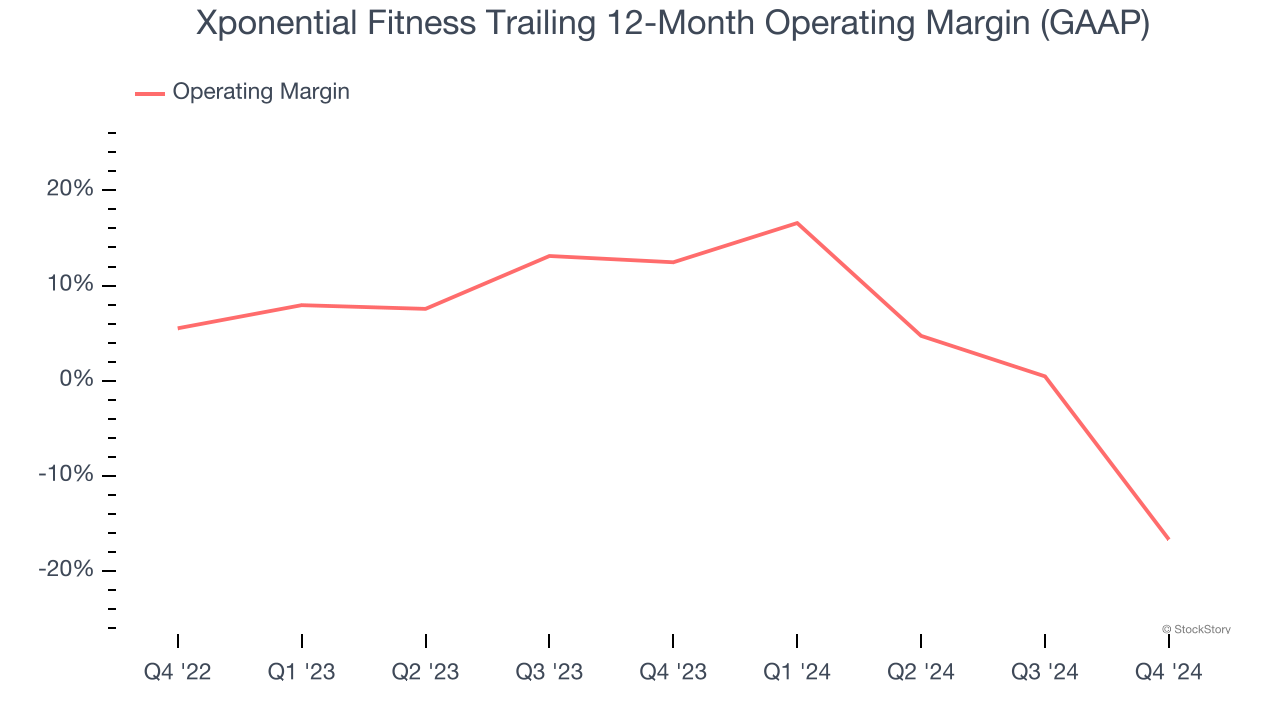

Xponential Fitness’s operating margin has been trending down over the last 12 months and averaged negative 2.1% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

Xponential Fitness’s operating margin was negative 62.4% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

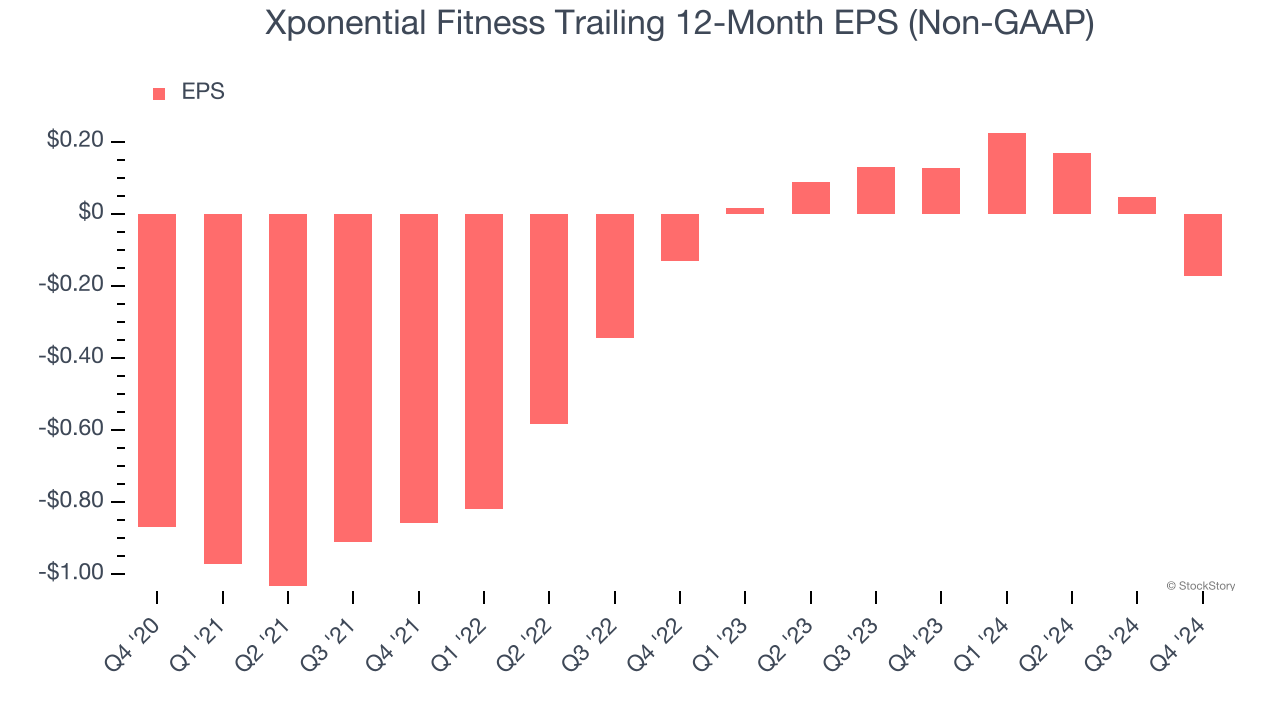

Although Xponential Fitness’s full-year earnings are still negative, it reduced its losses and improved its EPS by 33.3% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Xponential Fitness reported EPS at negative $0.19, down from $0.03 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Xponential Fitness’s full-year EPS of negative $0.17 will flip to positive $1.72.

Key Takeaways from Xponential Fitness’s Q4 Results

It was encouraging to see Xponential Fitness beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue and EBITDA guidance missed significantly, making this a weaker quarter. The stock traded down 19.8% to $9.77 immediately after reporting.

Xponential Fitness may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.