While the broader market has struggled with the S&P 500 down 1.3% since September 2024, Pitney Bowes has surged ahead as its stock price has climbed by 39.6% to $9.27 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Pitney Bowes, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why we avoid PBI and a stock we'd rather own.

Why Do We Think Pitney Bowes Will Underperform?

With a century-long history dating back to 1920 and once synonymous with postage meters, Pitney Bowes (NYSE: PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes, helping them manage their shipping and mailing operations.

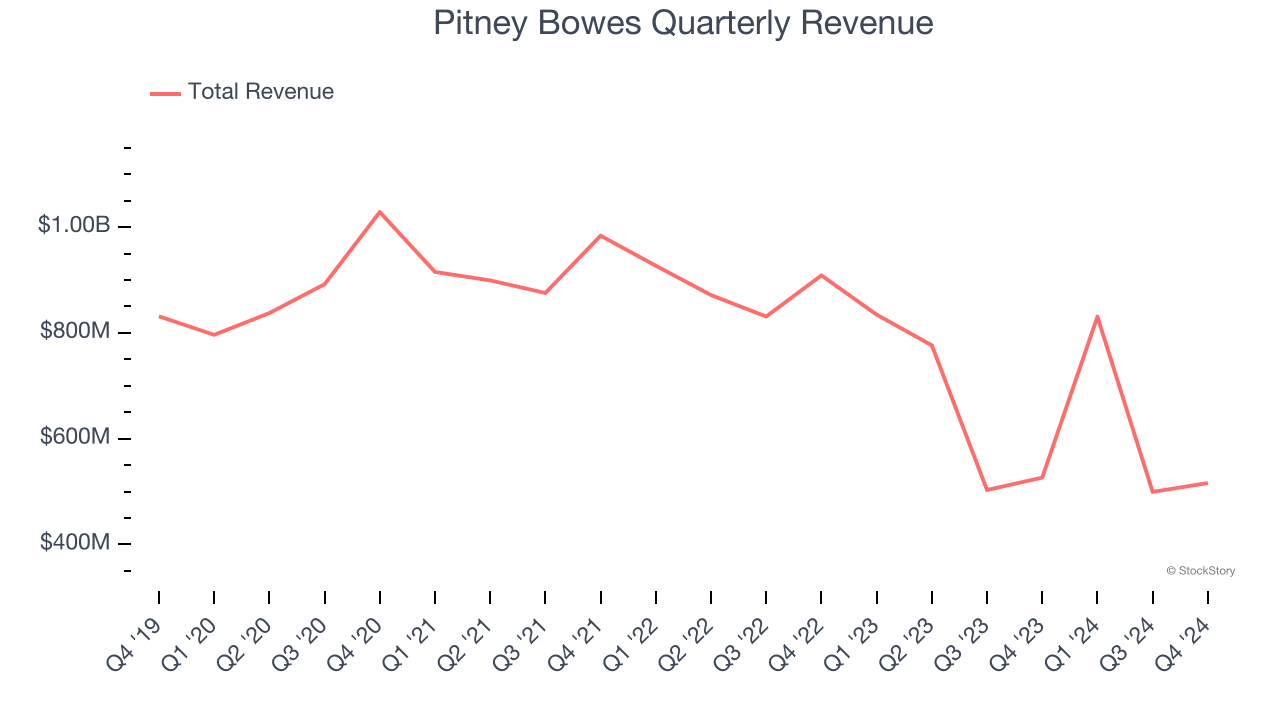

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Pitney Bowes’s demand was weak over the last five years as its sales fell at a 8.9% annual rate. This wasn’t a great result and signals it’s a low quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Pitney Bowes’s revenue to drop by 24.6%, close to its 23.6% annualized declines for the past two years. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Pitney Bowes, its EPS and revenue declined by 5% and 8.9% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Pitney Bowes’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Pitney Bowes falls short of our quality standards. With its shares outperforming the market lately, the stock trades at 8.1× forward price-to-earnings (or $9.27 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Pitney Bowes

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.