IT incident response platform PagerDuty (NYSE: PD) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.8% year on year to $119.8 million. The company expects next quarter’s revenue to be around $123.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.24 per share was 28.3% above analysts’ consensus estimates.

Is now the time to buy PagerDuty? Find out by accessing our full research report, it’s free.

PagerDuty (PD) Q1 CY2025 Highlights:

- Revenue: $119.8 million vs analyst estimates of $119.2 million (7.8% year-on-year growth, in line)

- Adjusted EPS: $0.24 vs analyst estimates of $0.19 (28.3% beat)

- Adjusted Operating Income: $24.36 million vs analyst estimates of $17.95 million (20.3% margin, 35.7% beat)

- The company dropped its revenue guidance for the full year to $496 million at the midpoint from $503.5 million, a 1.5% decrease

- Management raised its full-year Adjusted EPS guidance to $0.98 at the midpoint, a 5.4% increase

- Operating Margin: -8.6%, up from -19.5% in the same quarter last year

- Free Cash Flow Margin: 24.2%, similar to the previous quarter

- Customers: 15,247, up from 15,114 in the previous quarter

- Billings: $113.4 million at quarter end, up 6.4% year on year

- Market Capitalization: $1.47 billion

Company Overview

Started by three former Amazon engineers, PagerDuty (NYSE: PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

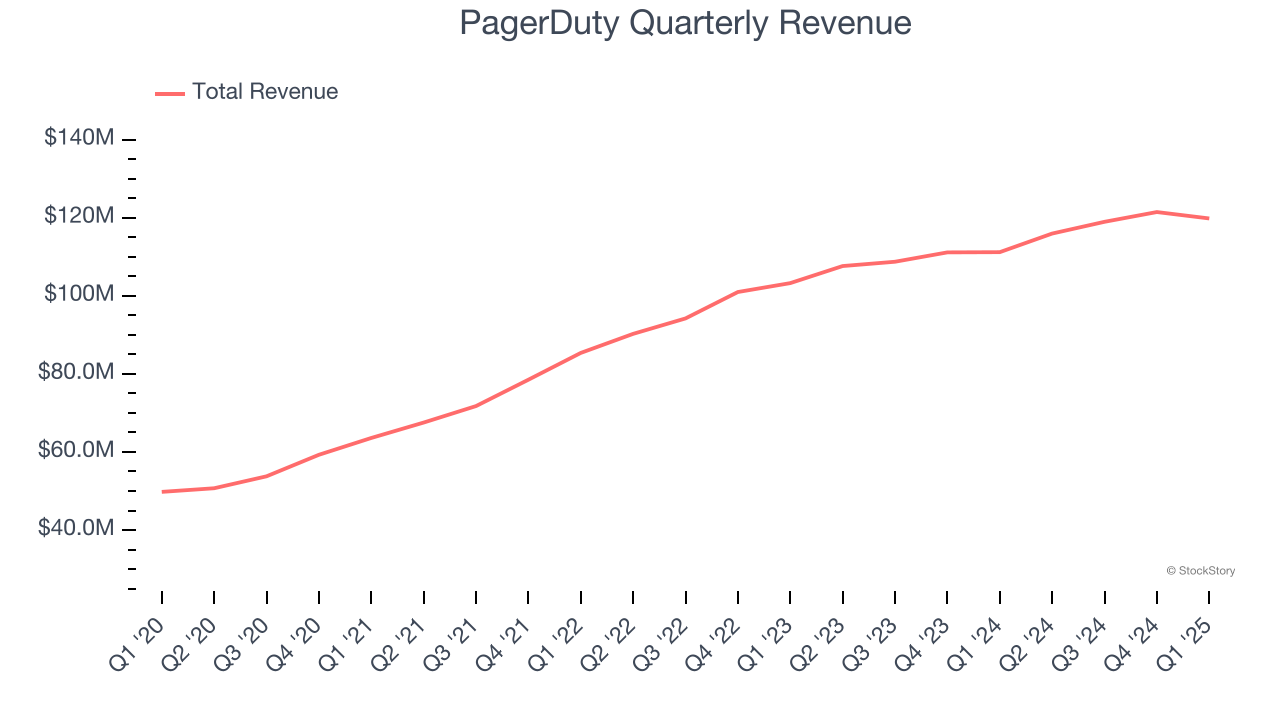

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, PagerDuty grew its sales at a 16.2% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, PagerDuty grew its revenue by 7.8% year on year, and its $119.8 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

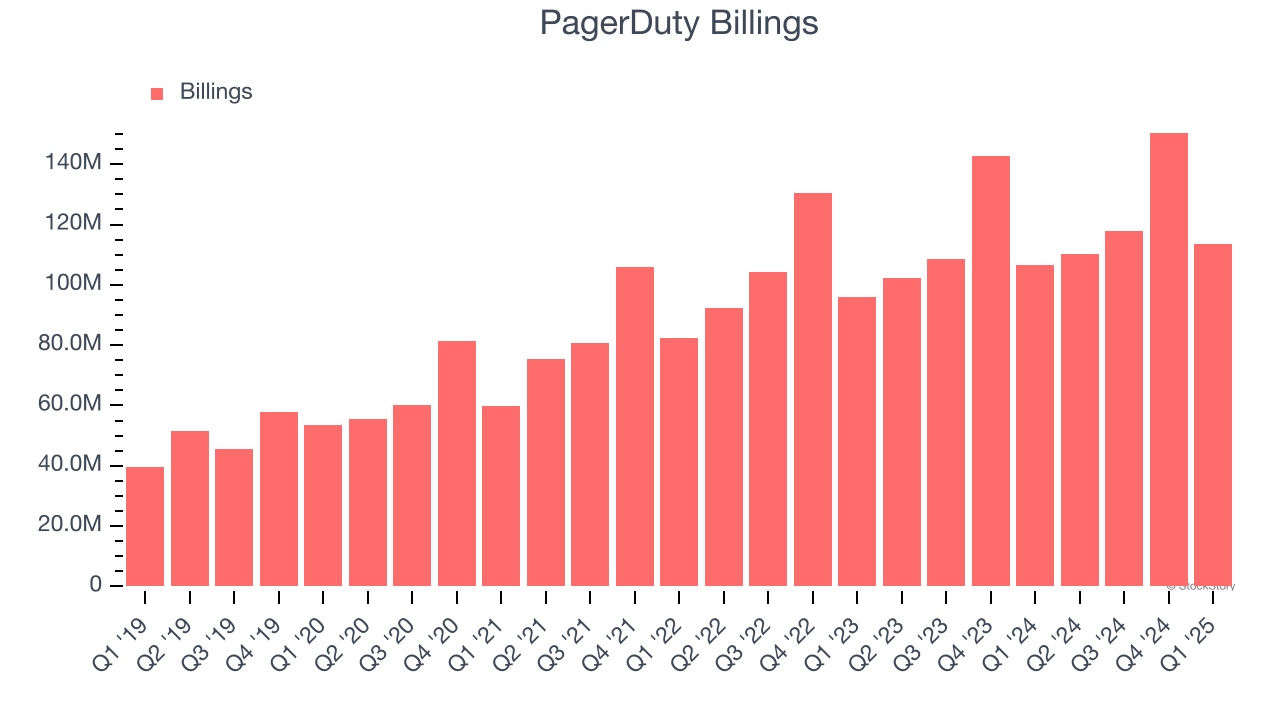

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

PagerDuty’s billings came in at $113.4 million in Q1, and over the last four quarters, its growth was underwhelming as it averaged 7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

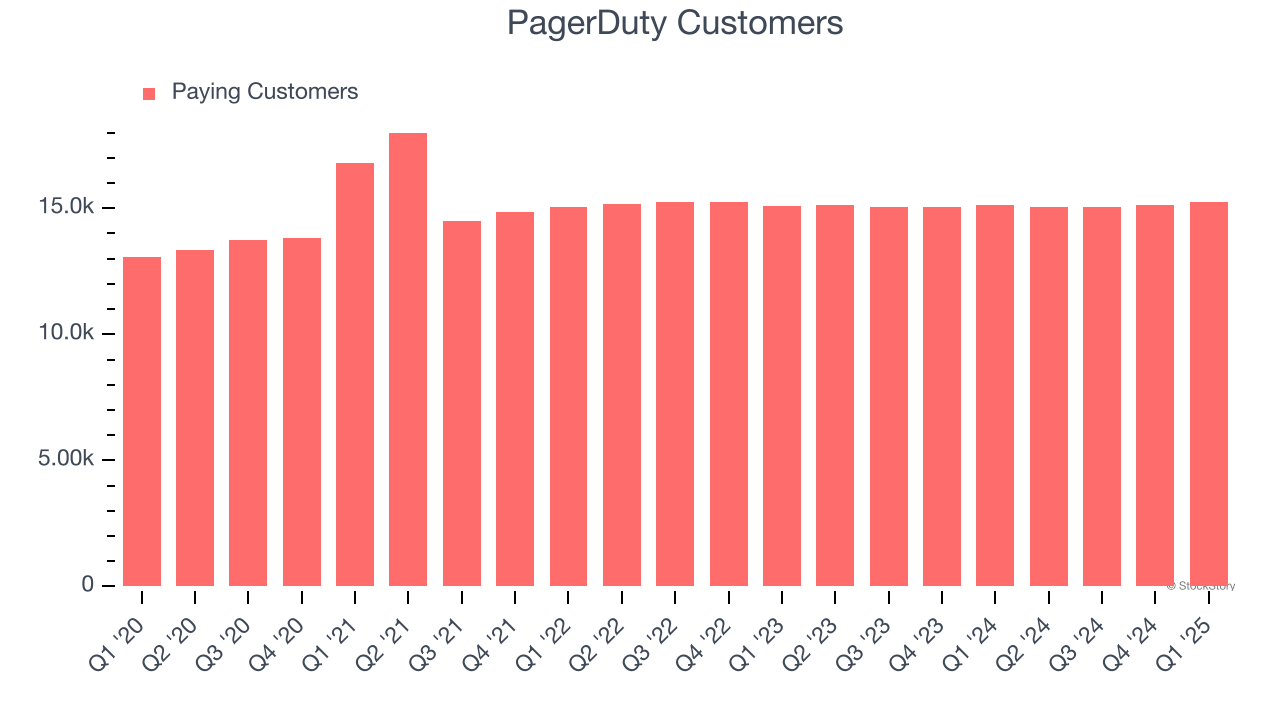

Customer Base

PagerDuty reported 15,247 customers at the end of the quarter, a sequential increase of 133. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that PagerDuty has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

Key Takeaways from PagerDuty’s Q1 Results

We were impressed by PagerDuty’s strong growth in customers this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its full-year revenue guidance was lowered and came in below expectations. The company's EPS guidance for next quarter also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.6% to $15.69 immediately after reporting.

PagerDuty didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.