Infrastructure investment and operations firm FTAI Infrastructure (NASDAQ: FIP) missed Wall Street’s revenue expectations in Q1 CY2025, but sales rose 16.5% year on year to $96.16 million. Its GAAP profit of $0.89 per share was significantly above analysts’ consensus estimates.

Is now the time to buy FTAI Infrastructure? Find out by accessing our full research report, it’s free.

FTAI Infrastructure (FIP) Q1 CY2025 Highlights:

- Revenue: $96.16 million vs analyst estimates of $107.8 million (16.5% year-on-year growth, 10.8% miss)

- EPS (GAAP): $0.89 vs analyst estimates of -$0.34 (significant beat)

- Adjusted EBITDA: $155.2 million vs analyst estimates of $39.93 million (161% margin, significant beat)

- Operating Margin: 125%, up from -12.6% in the same quarter last year

- Free Cash Flow was -$152.2 million compared to -$17.14 million in the same quarter last year

- Market Capitalization: $522.2 million

Company Overview

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ: FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

Sales Growth

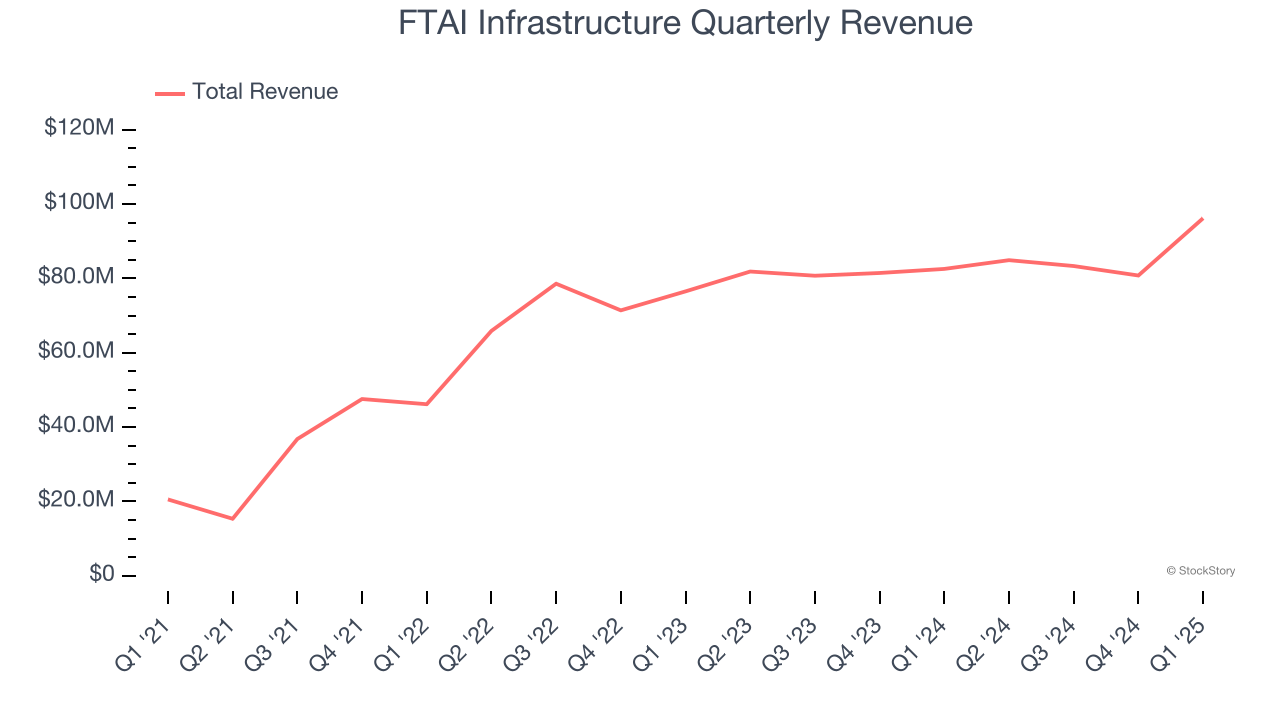

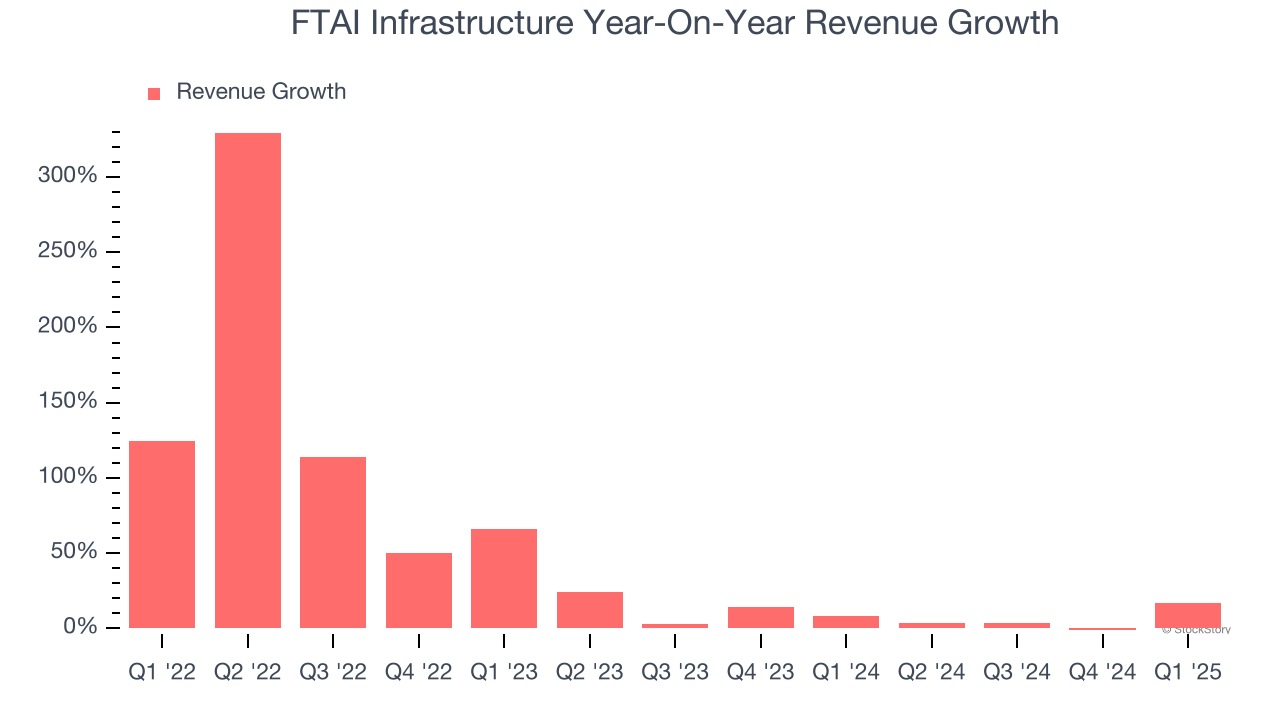

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, FTAI Infrastructure’s 33.3% annualized revenue growth over the last three years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. FTAI Infrastructure’s annualized revenue growth of 8.7% over the last two years is below its three-year trend, but we still think the results were respectable.

This quarter, FTAI Infrastructure’s revenue grew by 16.5% year on year to $96.16 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 78.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

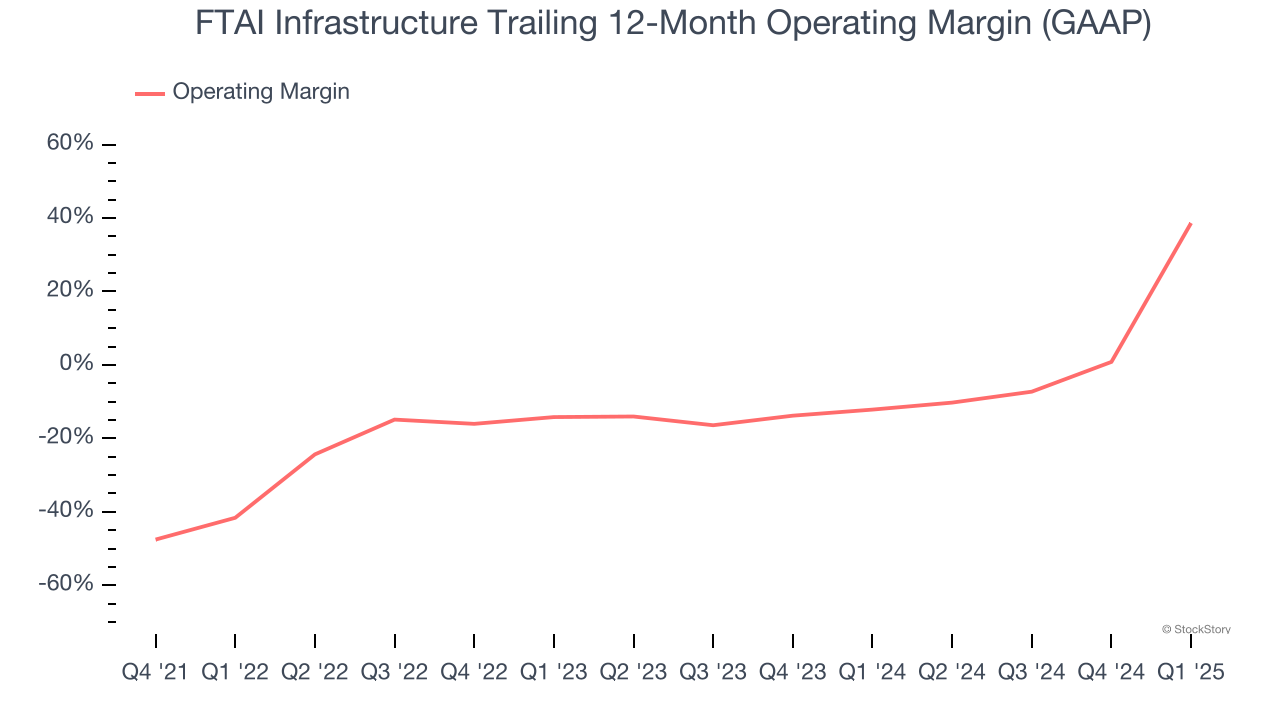

Operating Margin

Although FTAI Infrastructure was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.8% over the last four years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, FTAI Infrastructure’s operating margin rose by 80.2 percentage points over the last four years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, FTAI Infrastructure generated an operating profit margin of 125%, up 137.6 percentage points year on year. The increase was solid and shows its expenses recently grew slower than its revenue, leading to higher efficiency.

Earnings Per Share

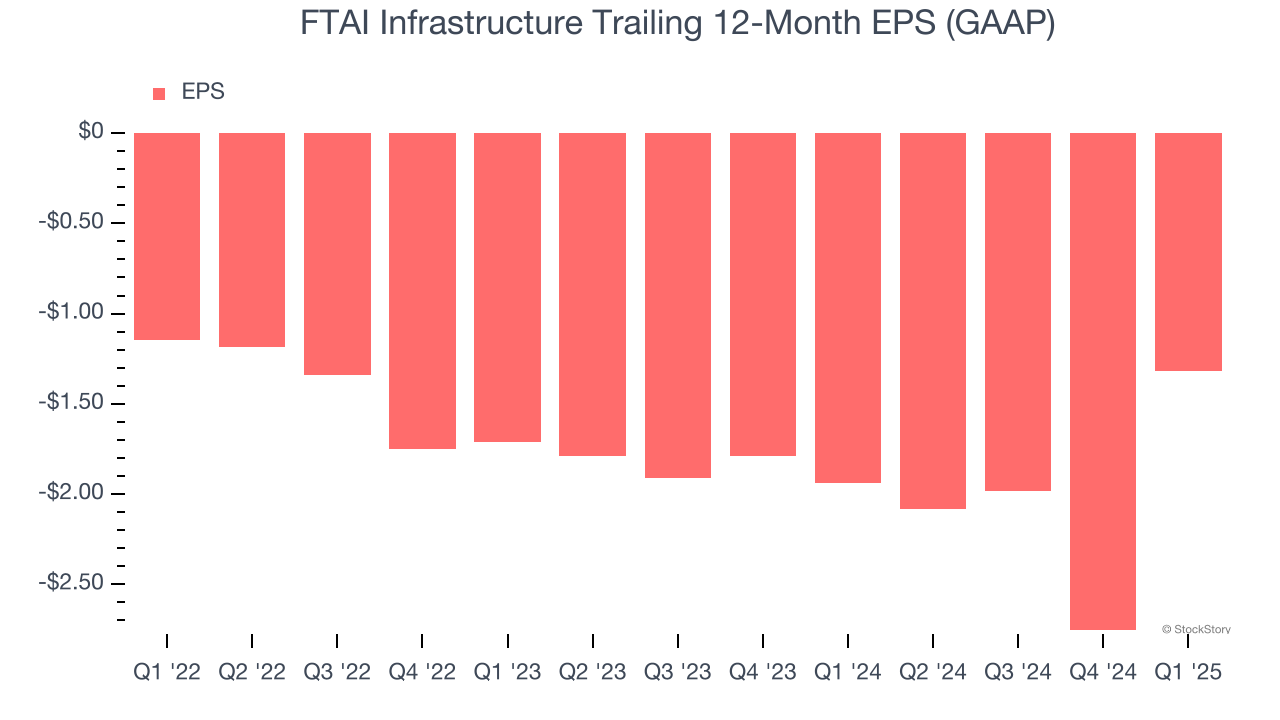

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although FTAI Infrastructure’s full-year earnings are still negative, it reduced its losses and improved its EPS by 12.1% annually over the last two years.

In Q1, FTAI Infrastructure reported EPS at $0.89, up from negative $0.54 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FTAI Infrastructure to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.32 will advance to negative $0.84.

Key Takeaways from FTAI Infrastructure’s Q1 Results

We were impressed by how significantly FTAI Infrastructure blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed significantly. Still, we think this was a decent quarter. The stock remained flat at $4.66 immediately after reporting.

So should you invest in FTAI Infrastructure right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.