Over the last six months, Medpace’s shares have sunk to $293, producing a disappointing 11.5% loss - a stark contrast to the S&P 500’s 1.7% gain. This may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy MEDP? Find out in our full research report, it’s free.

Why Does MEDP Stock Spark Debate?

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ: MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

Two Positive Attributes:

1. Core Business Firing on All Cylinders

Investors interested in Drug Development Inputs & Services companies should track organic revenue in addition to reported revenue. This metric gives visibility into Medpace’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Medpace’s organic revenue averaged 17.8% year-on-year growth. This performance was fantastic and shows it can expand quickly without relying on expensive (and risky) acquisitions.

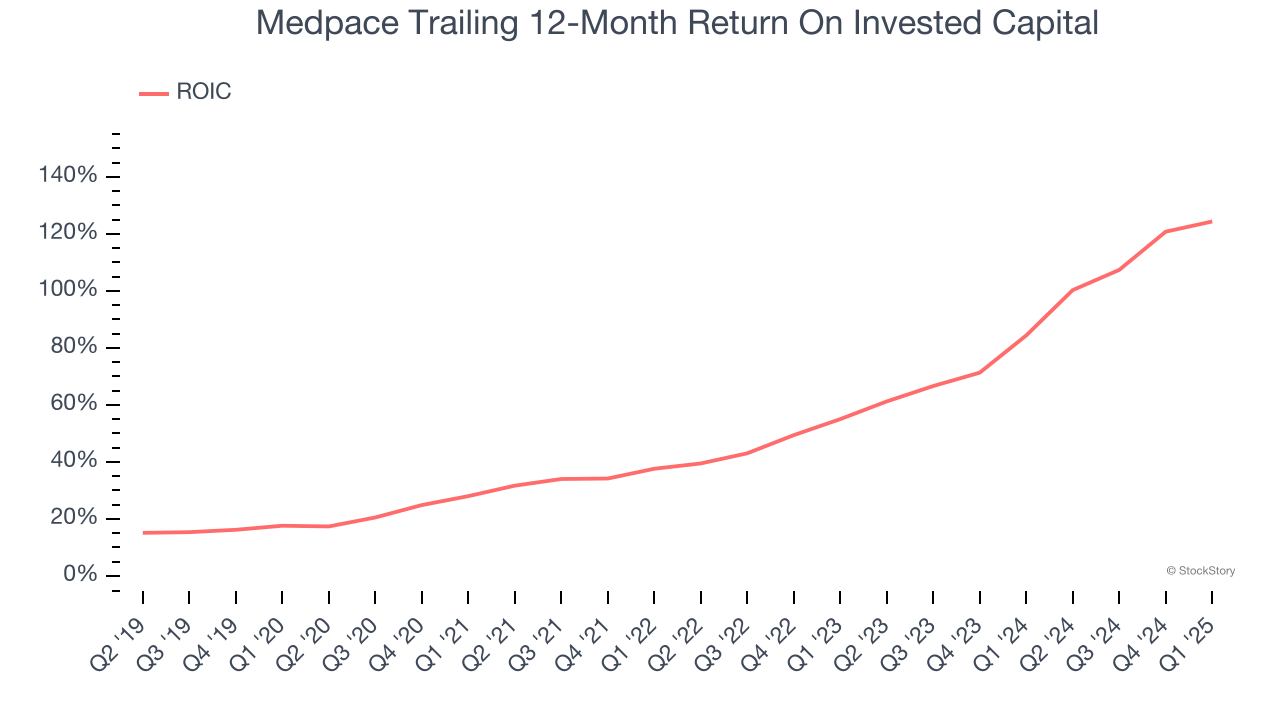

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Medpace’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Medpace’s revenue to stall, a deceleration versus its 19.3% annualized growth for the past five years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Final Judgment

Medpace’s merits more than compensate for its flaws. With the recent decline, the stock trades at 23.8× forward P/E (or $293 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Medpace

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.