Over the past six months, Peoples Bancorp’s shares (currently trading at $28.88) have posted a disappointing 9.5% loss, well below the S&P 500’s 1.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Peoples Bancorp, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Peoples Bancorp Not Exciting?

Even with the cheaper entry price, we're swiping left on Peoples Bancorp for now. Here are three reasons why you should be careful with PEBO and a stock we'd rather own.

1. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Peoples Bancorp’s net interest income to stall, a deceleration versus its 13% annualized growth for the past two years. This projection is below its 13% annualized growth rate for the past two years.

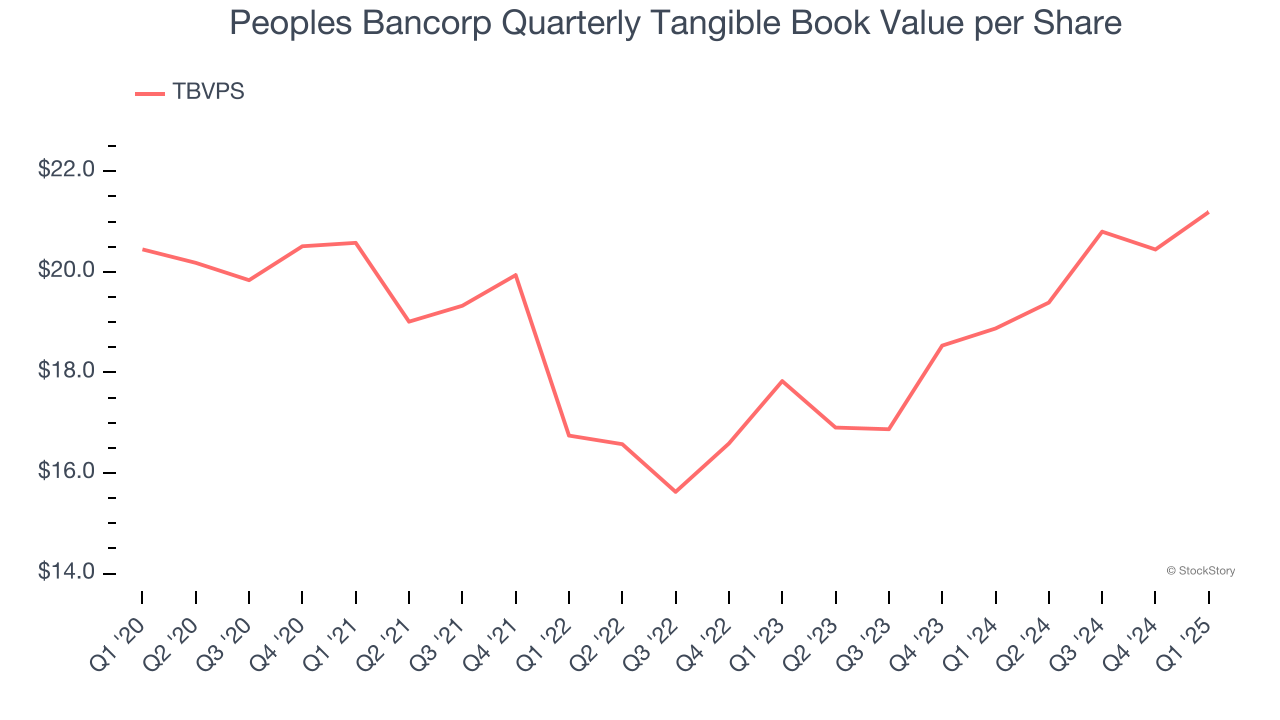

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Disappointingly for investors, Peoples Bancorp’s TBVPS grew at a mediocre 9% annual clip over the last two years.

3. High Interest Expenses Increase Risk

Leverage is core to the bank's business model (loans funded by deposits) and to ensure their stability, regulators require certain levels of capital and liquidity, focusing on a bank’s Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a bank holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all banks must maintain a Tier 1 capital ratio greater than 4.5% On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, banks generally must maintain a 7-10% ratio at minimum.

Over the last two years, Peoples Bancorp has averaged a Tier 1 capital ratio of 12.4%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

Final Judgment

Peoples Bancorp isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 0.9× forward P/B (or $28.88 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Peoples Bancorp

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.