Over the past six months, Stellar Bancorp’s shares (currently trading at $26.45) have posted a disappointing 7.5% loss, well below the S&P 500’s 1.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Stellar Bancorp, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Stellar Bancorp Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why STEL doesn't excite us and a stock we'd rather own.

1. Projected Net Interest Income Growth Shows Limited Upside

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Stellar Bancorp’s net interest income to rise by 2.3%, a deceleration versus its 7.6% annualized growth for the past two years. This projection is below its 7.6% annualized growth rate for the past two years.

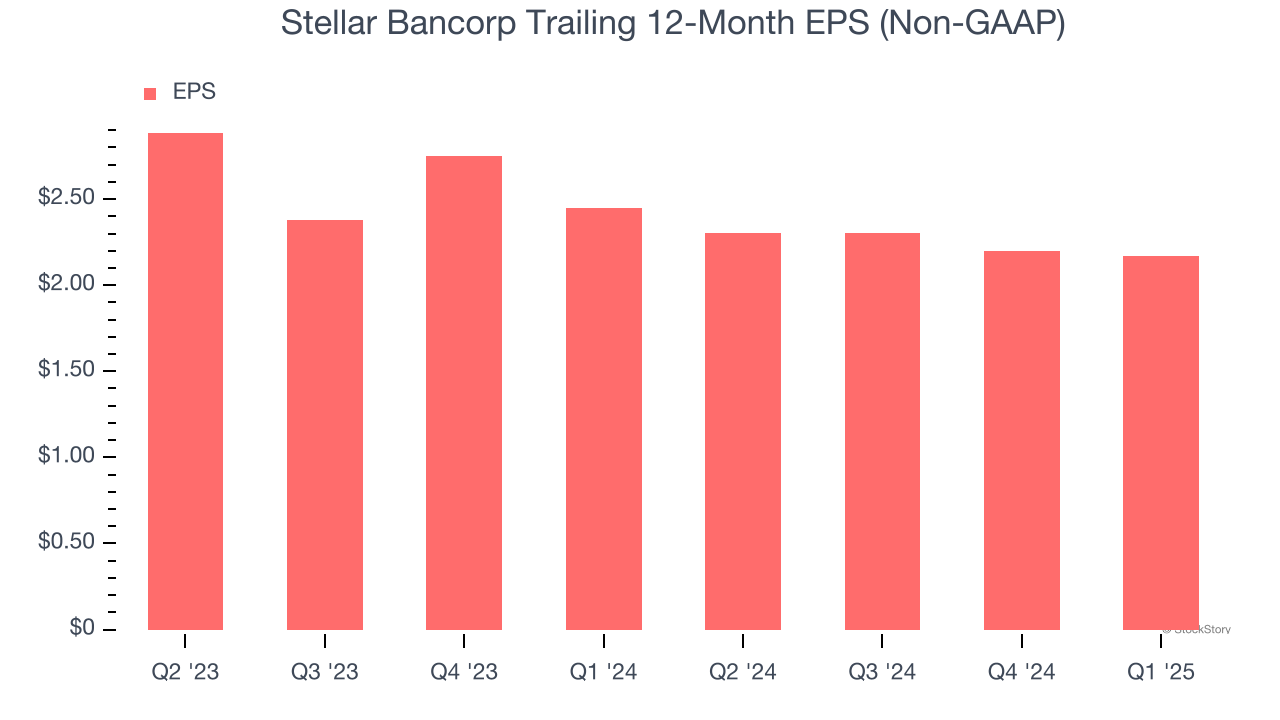

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Stellar Bancorp’s full-year EPS dropped 30.1%, or 14.1% annually, over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Stellar Bancorp’s low margin of safety could leave its stock price susceptible to large downswings.

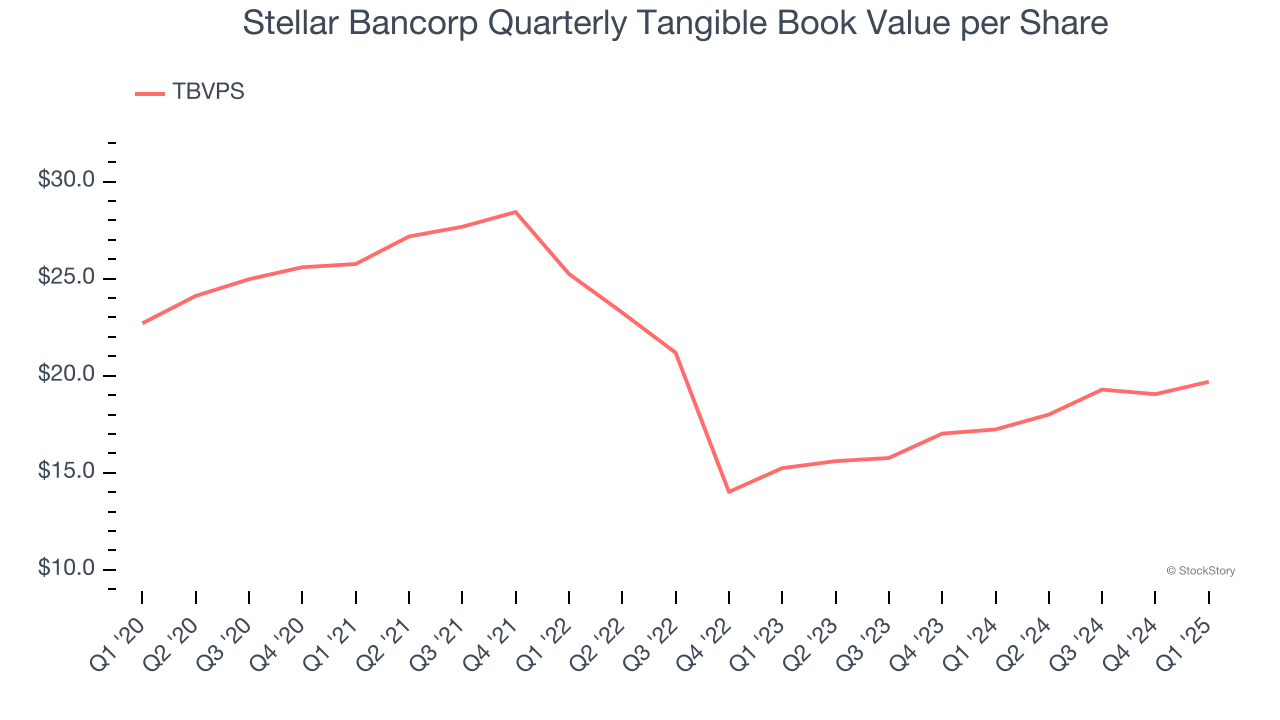

3. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, Stellar Bancorp’s TBVPS declined at a 2.8% annual clip over the last five years.

Final Judgment

Stellar Bancorp isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 0.8× forward P/B (or $26.45 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Stellar Bancorp

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.