Over the past six months, MetLife’s stock price fell to $77.79. Shareholders have lost 10.5% of their capital, which is disappointing considering the S&P 500 has climbed by 5.8%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in MetLife, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think MetLife Will Underperform?

Even with the cheaper entry price, we're cautious about MetLife. Here are three reasons why you should be careful with MET and a stock we'd rather own.

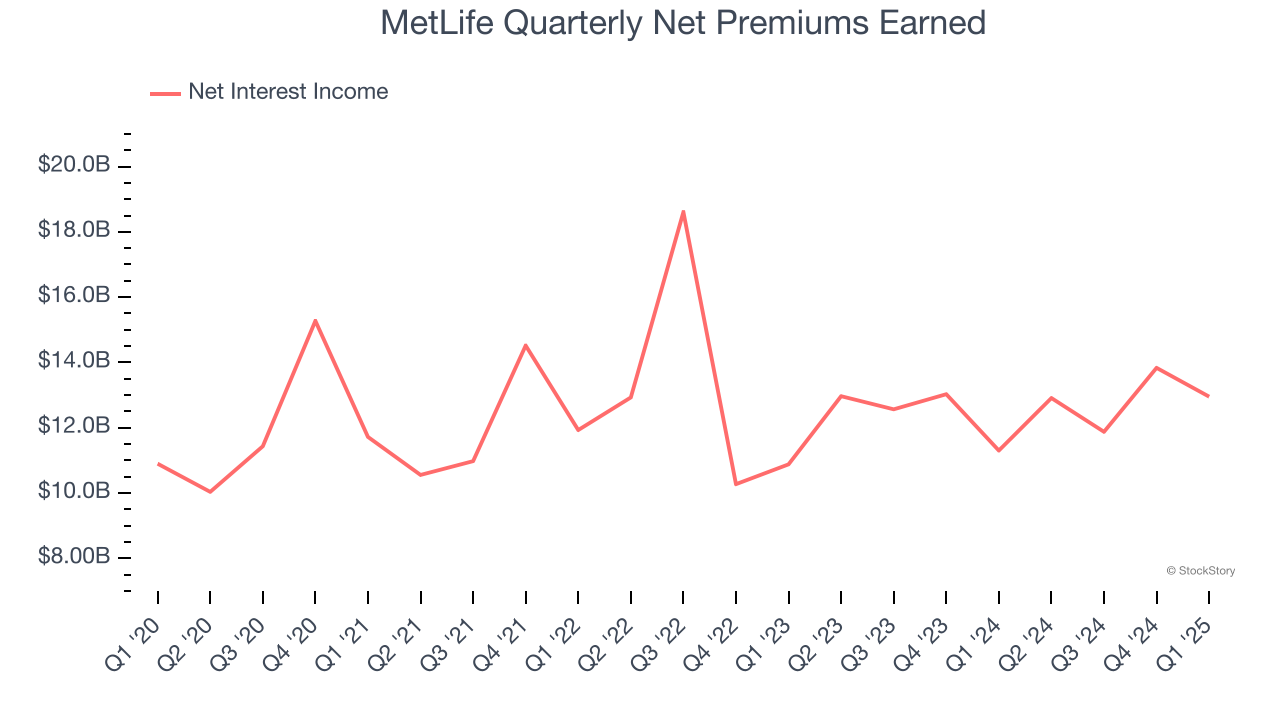

1. Declining Net Premiums Earned Reflects Weakness

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

MetLife’s net premiums earned has declined by 1.1% annually over the last two years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

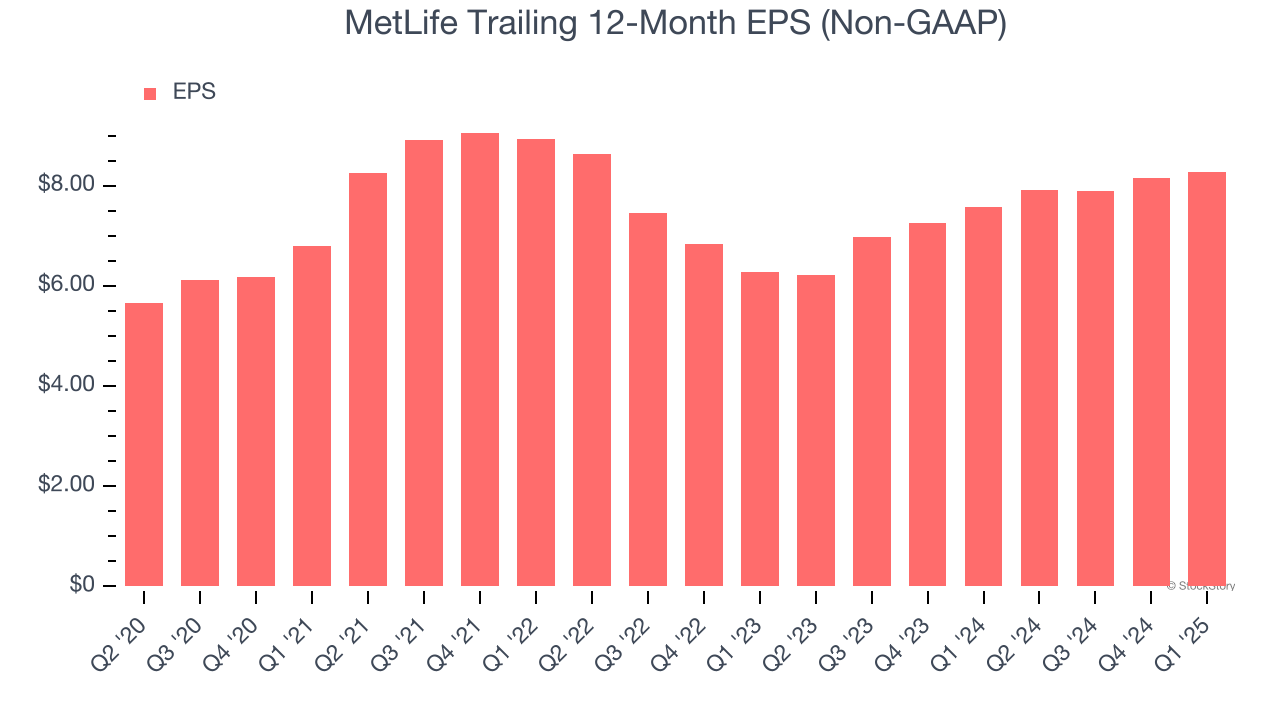

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

MetLife’s EPS grew at a weak 4.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

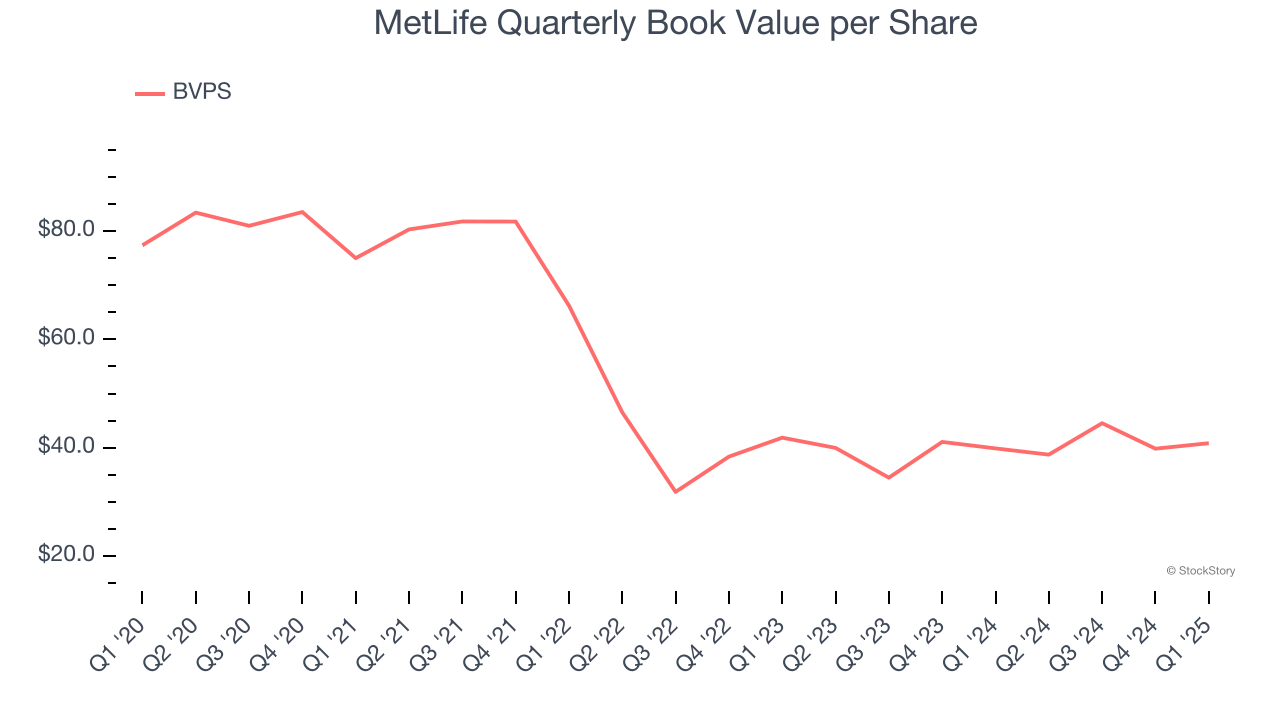

3. Declining BVPS Reflects Erosion of Asset Value

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Disappointingly for investors, MetLife’s BVPS declined at a 1.2% annual clip over the last two years.

Final Judgment

We see the value of companies helping consumers, but in the case of MetLife, we’re out. After the recent drawdown, the stock trades at 2× forward P/B (or $77.79 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than MetLife

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.