Shareholders of Pursuit would probably like to forget the past six months even happened. The stock dropped 22.6% and now trades at $31.72. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Pursuit, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Pursuit Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Pursuit. Here are three reasons why you should be careful with PRSU and a stock we'd rather own.

1. Revenue Spiraling Downwards

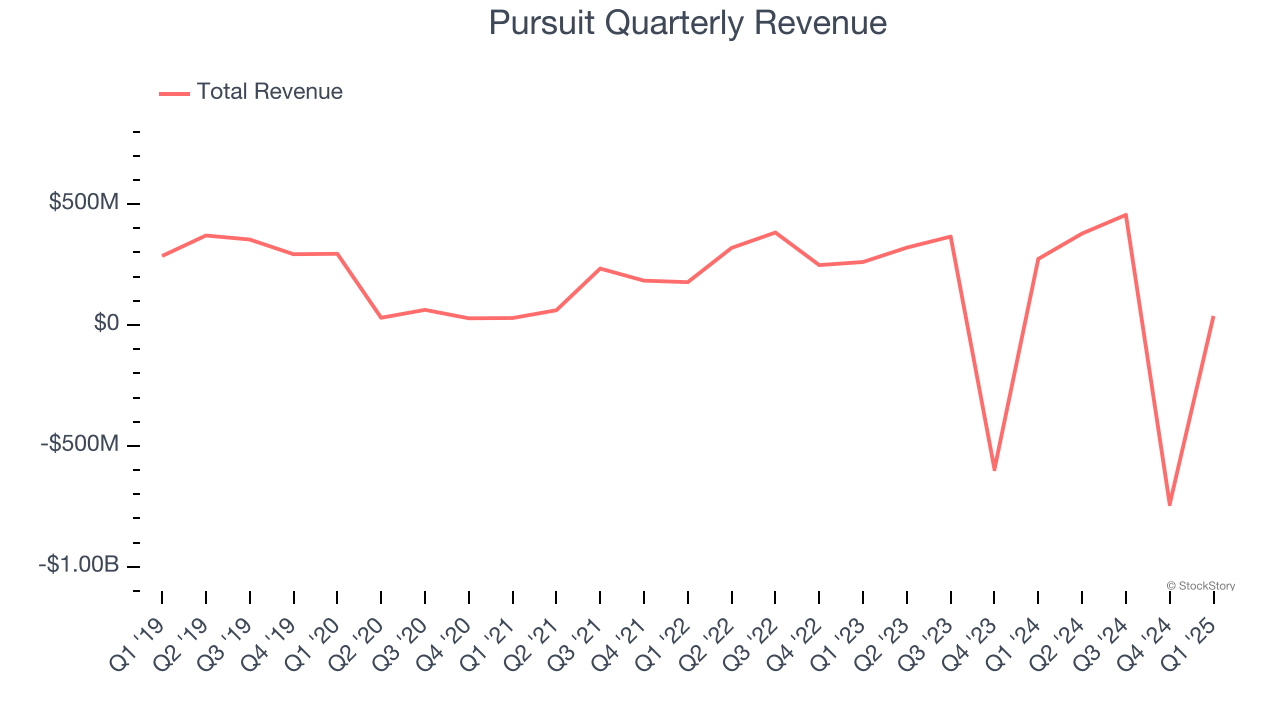

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Pursuit’s demand was weak and its revenue declined by 37% per year. This wasn’t a great result and signals it’s a lower quality business.

2. EPS Trending Down

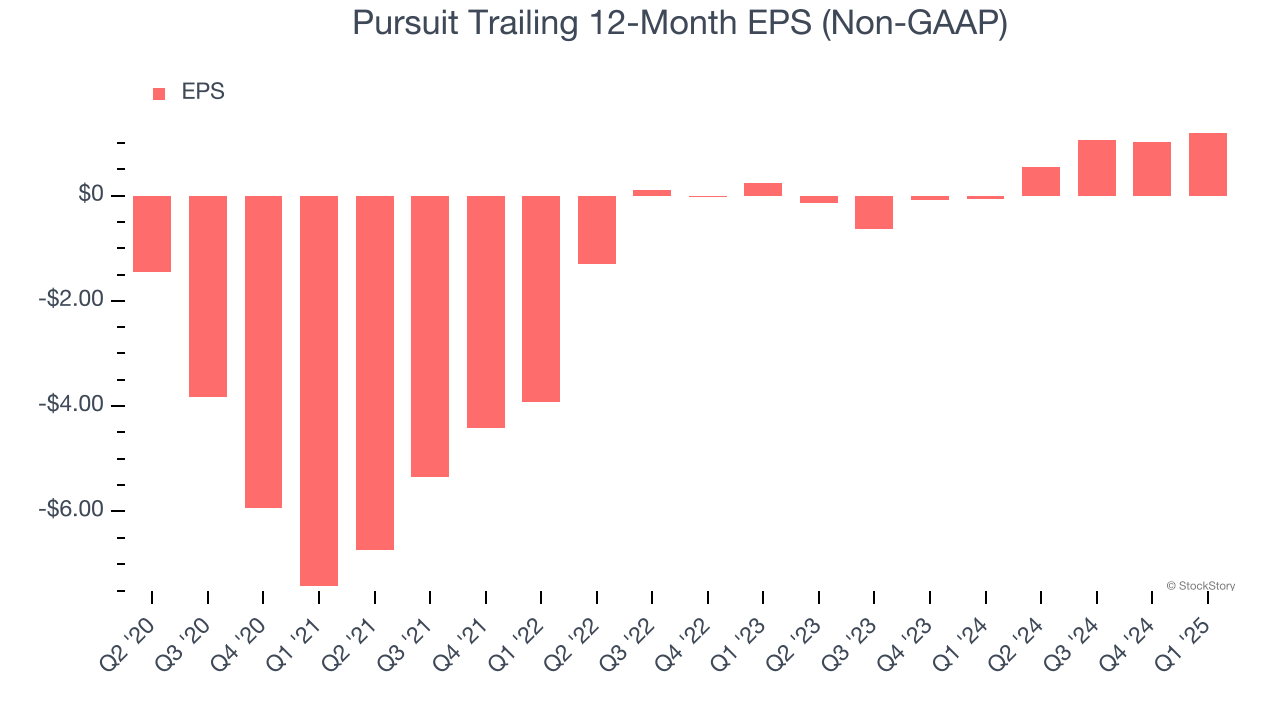

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Pursuit, its EPS and revenue declined by 27.3% and 37% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Pursuit’s low margin of safety could leave its stock price susceptible to large downswings.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Pursuit’s five-year average ROIC was negative 10.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Pursuit isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 8.8× forward EV-to-EBITDA (or $31.72 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Pursuit

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.