Shareholders of Peloton would probably like to forget the past six months even happened. The stock dropped 21.3% and now trades at $6.55. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Peloton, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Peloton Will Underperform?

Despite the more favorable entry price, we're swiping left on Peloton for now. Here are three reasons why you should be careful with PTON and a stock we'd rather own.

1. Decline in Connected Fitness Subscribers Points to Weak Demand

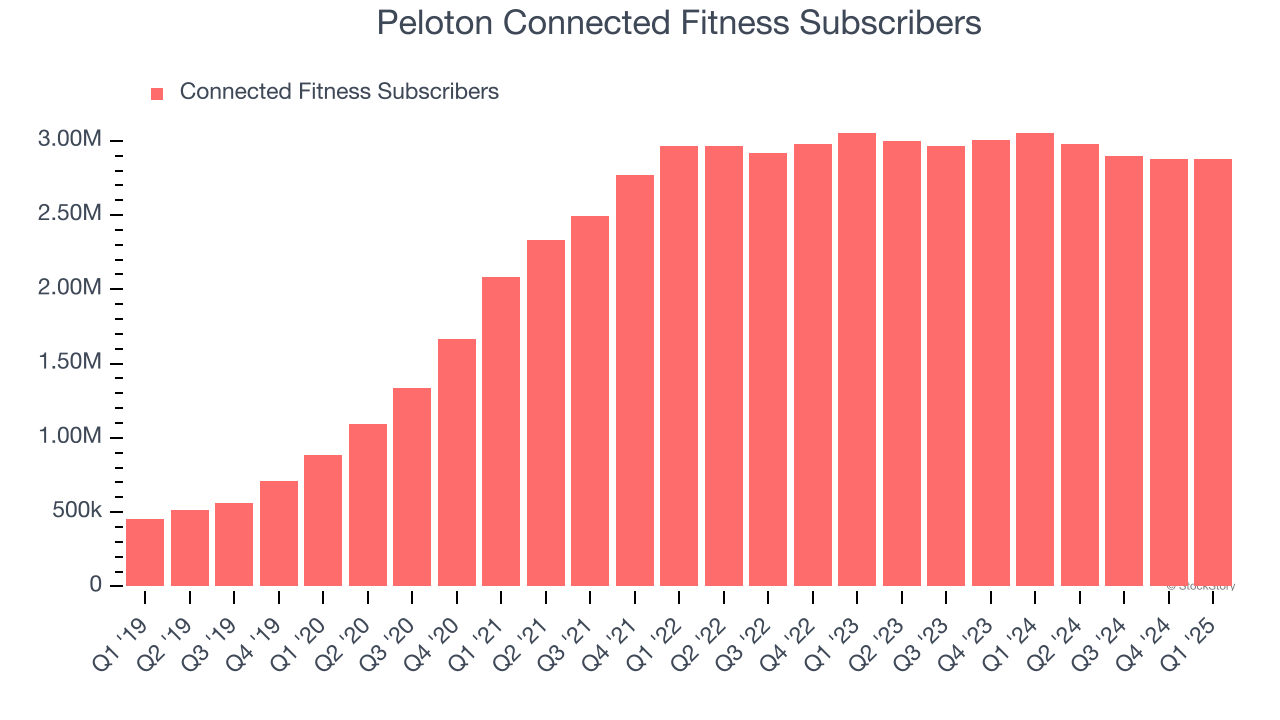

Revenue growth can be broken down into changes in price and volume (for companies like Peloton, our preferred volume metric is connected fitness subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Peloton’s connected fitness subscribers came in at 2.88 million in the latest quarter, and over the last two years, averaged 1.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Peloton might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Peloton’s revenue to drop by 4.1%, close to its 11.9% annualized growth for the past five years. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

3. Operating Losses Sound the Alarms

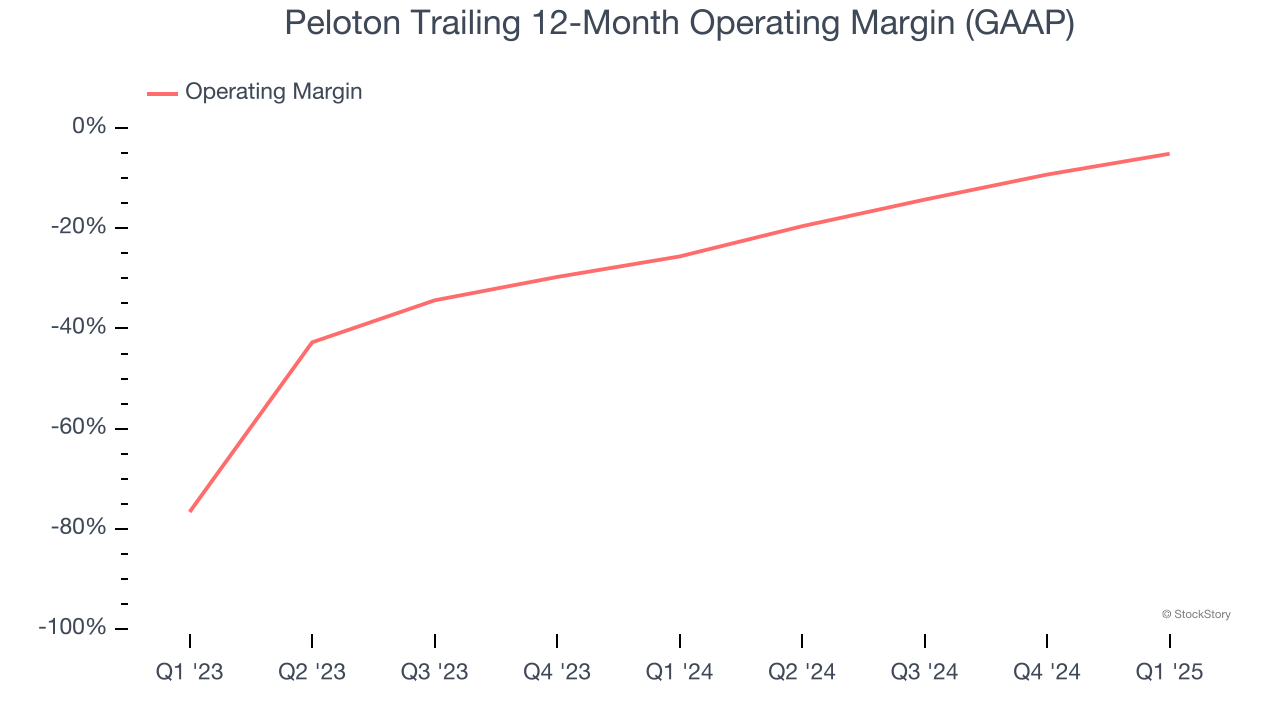

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Peloton’s operating margin has risen over the last 12 months, but it still averaged negative 15.7% over the last two years. This is due to its large expense base and inefficient cost structure.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Peloton, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 7.7× forward EV-to-EBITDA (or $6.55 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Peloton

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.