Revolve’s stock price has taken a beating over the past six months, shedding 29.6% of its value and falling to $21.98 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Revolve, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Revolve Will Underperform?

Even though the stock has become cheaper, we're cautious about Revolve. Here are three reasons why there are better opportunities than RVLV and a stock we'd rather own.

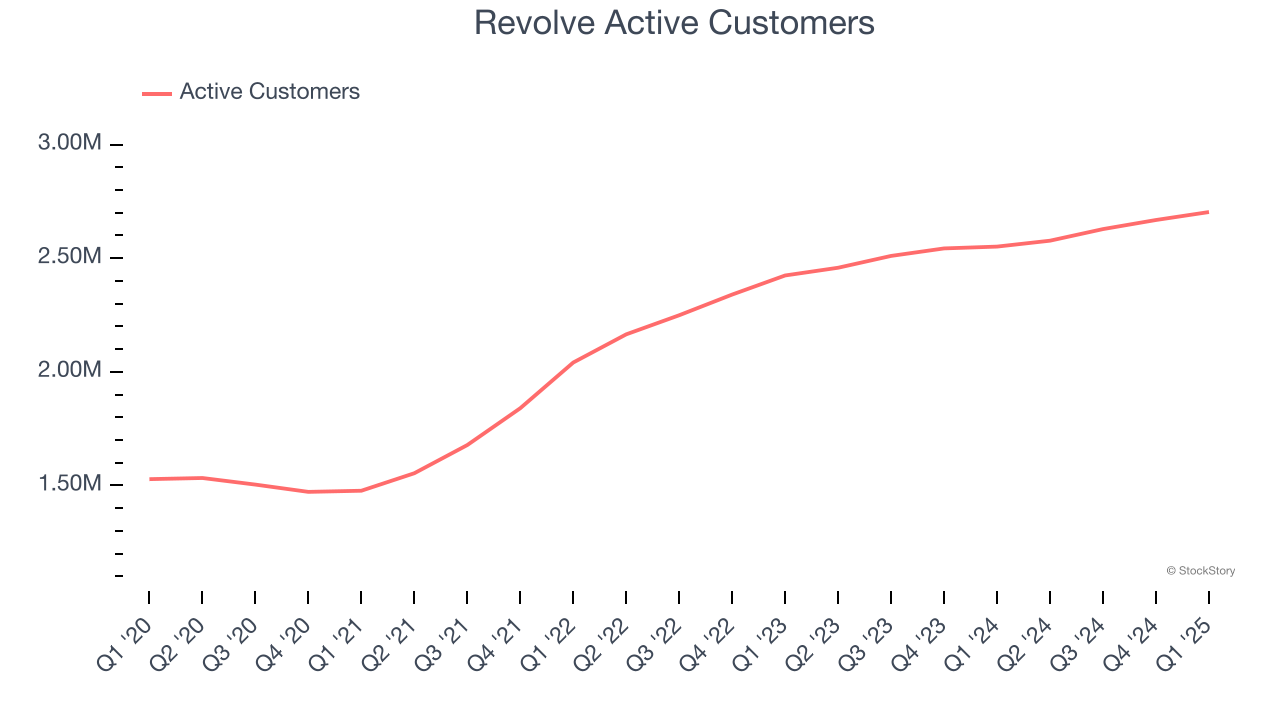

1. Change in Active Customers Points to Soft Demand

As an online retailer, Revolve generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Revolve’s active customers , a key performance metric for the company, increased by 7.4% annually to 2.7 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Revolve wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

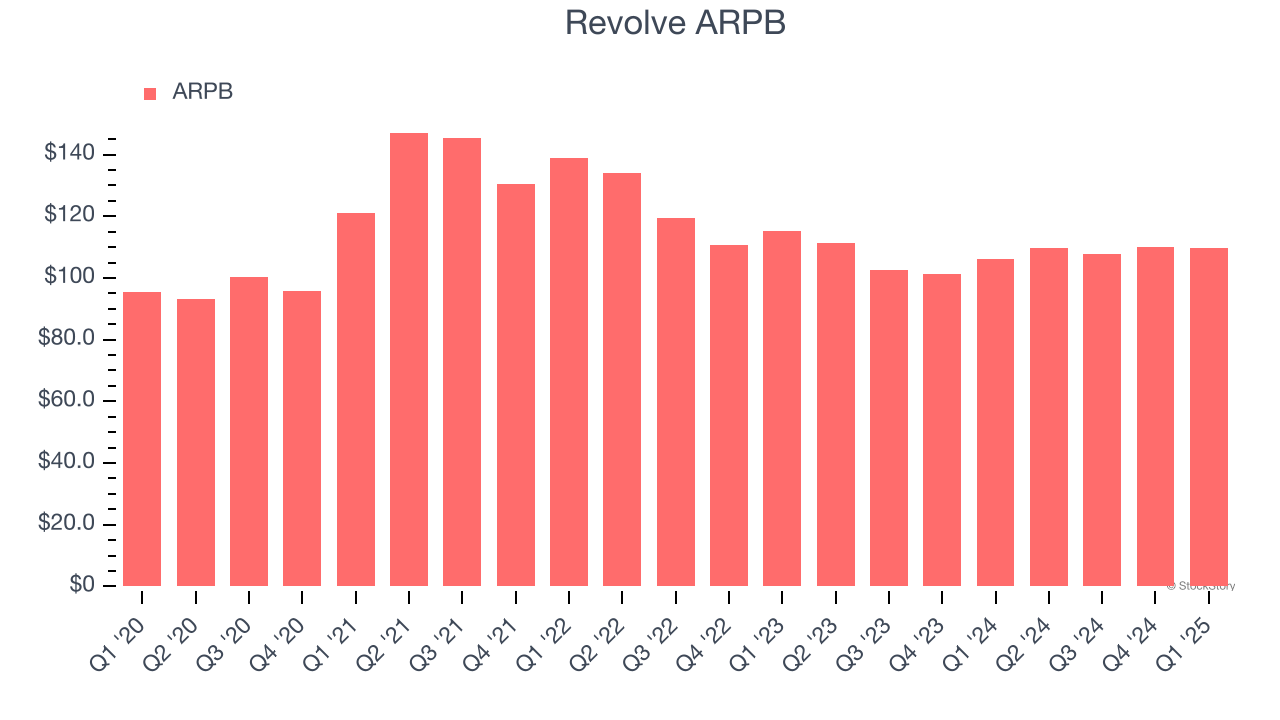

2. Customer Spending Decreases, Engagement Falling?

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Revolve’s ARPB fell over the last two years, averaging 4% annual declines. This isn’t great when combined with its weaker active customers performance. If Revolve tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyer growth would be sustainable.

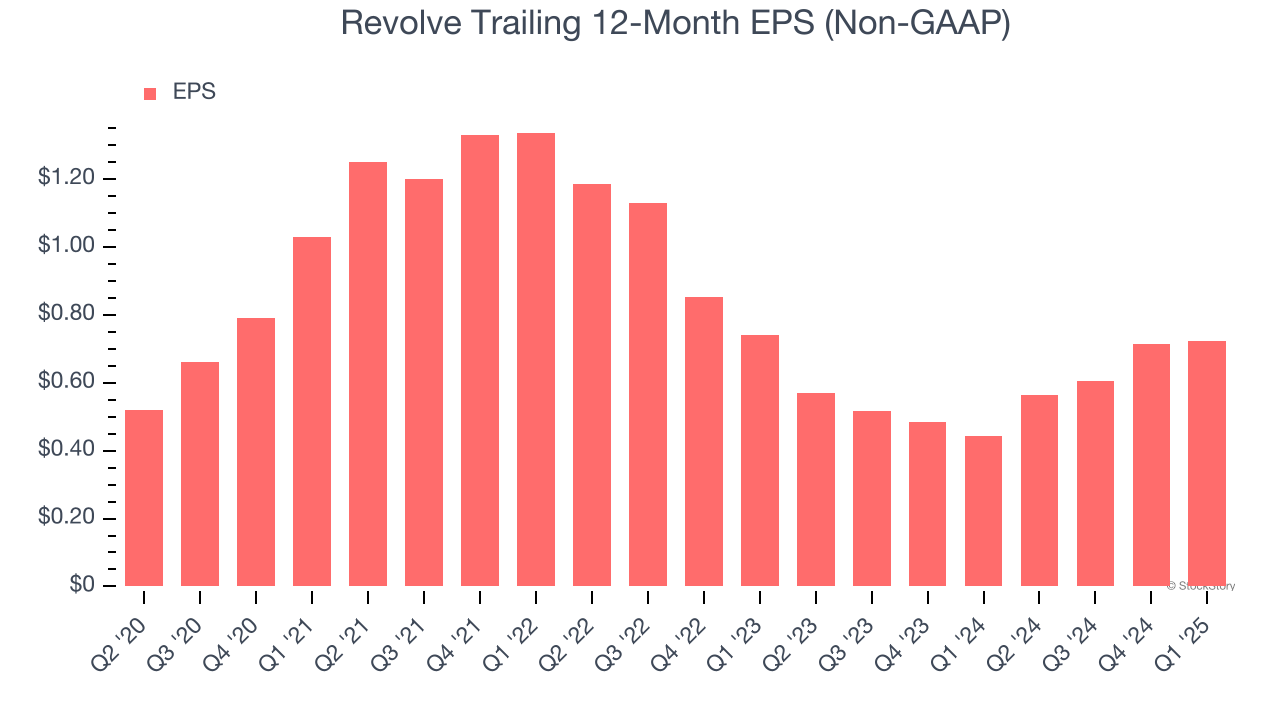

3. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Revolve, its EPS declined by 18.5% annually over the last three years while its revenue grew by 5.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Revolve falls short of our quality standards. Following the recent decline, the stock trades at 20.4× forward EV/EBITDA (or $21.98 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Revolve

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.