Lincoln Financial Group has been treading water for the past six months, recording a small loss of 0.6% while holding steady at $38.16. The stock also fell short of the S&P 500’s 5.3% gain during that period.

Is there a buying opportunity in Lincoln Financial Group, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Lincoln Financial Group Will Underperform?

We're swiping left on Lincoln Financial Group for now. Here are three reasons why there are better opportunities than LNC and a stock we'd rather own.

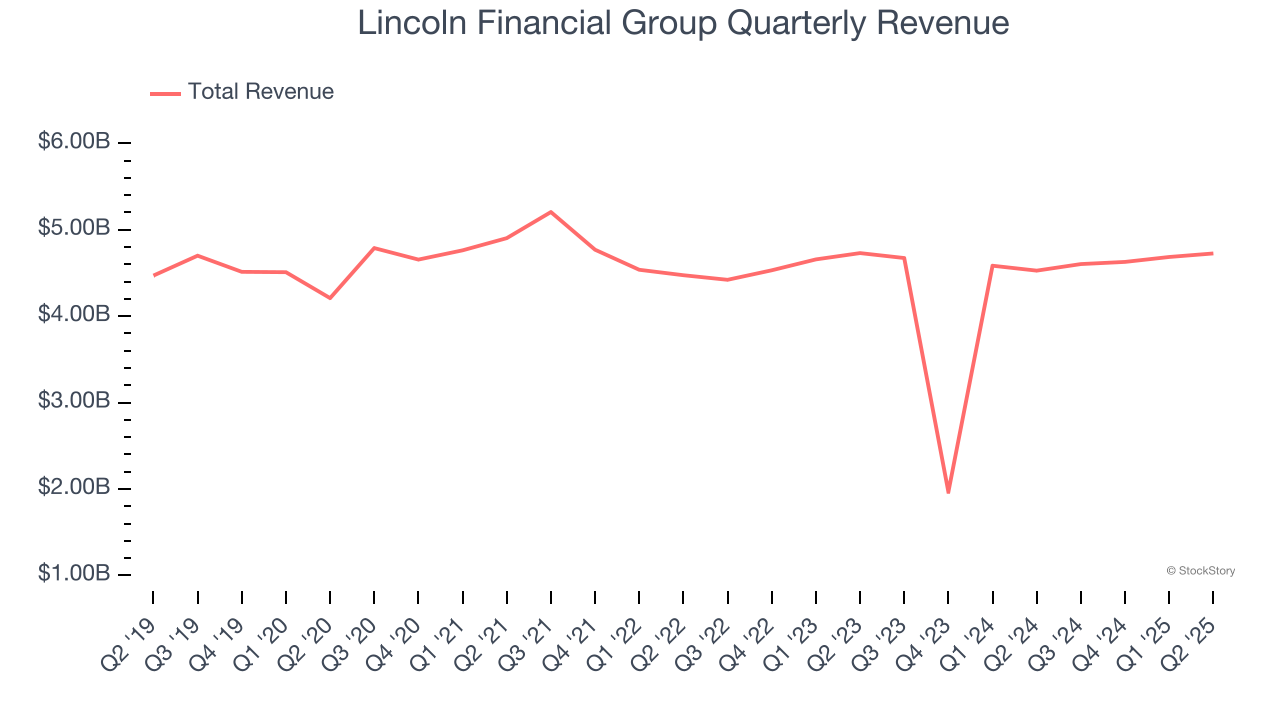

1. Long-Term Revenue Growth Flatter Than a Pancake

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

Unfortunately, Lincoln Financial Group struggled to consistently increase demand as its $18.64 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

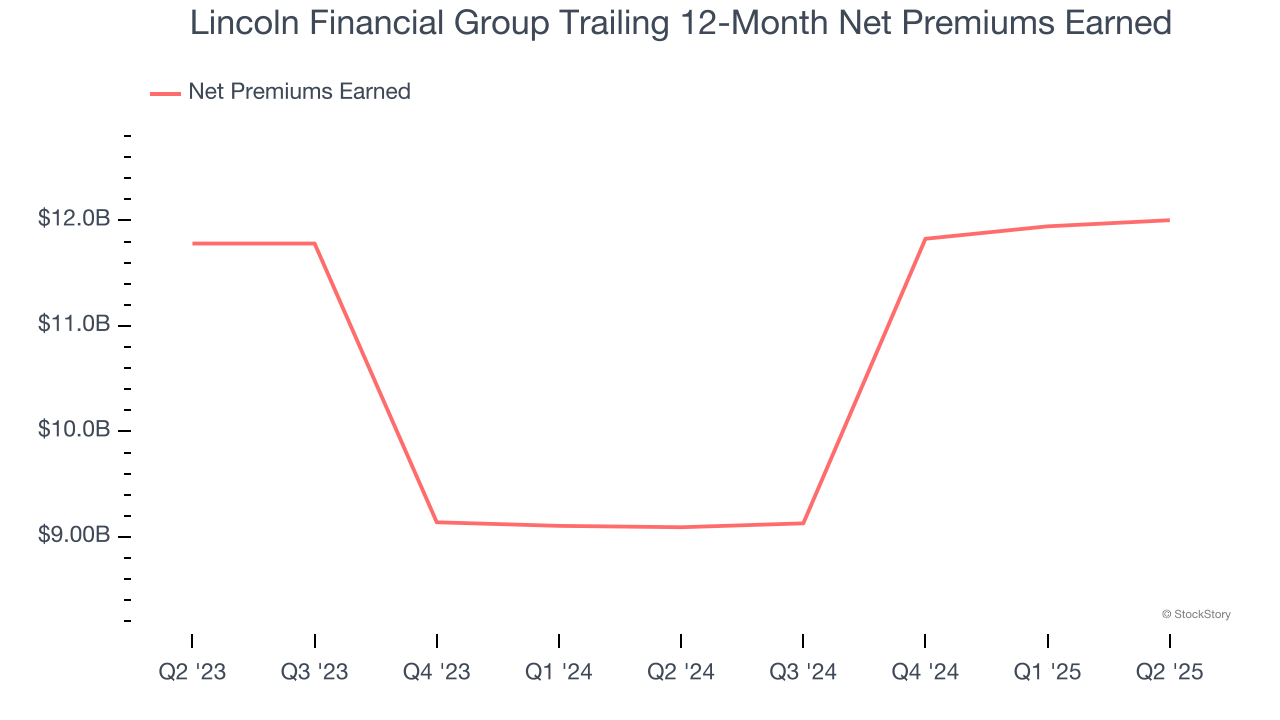

2. Net Premiums Earned Hits a Plateau

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Lincoln Financial Group’s net premiums earned was flat over the last two years, much worse than the broader insurance industry and in line with its total revenue.

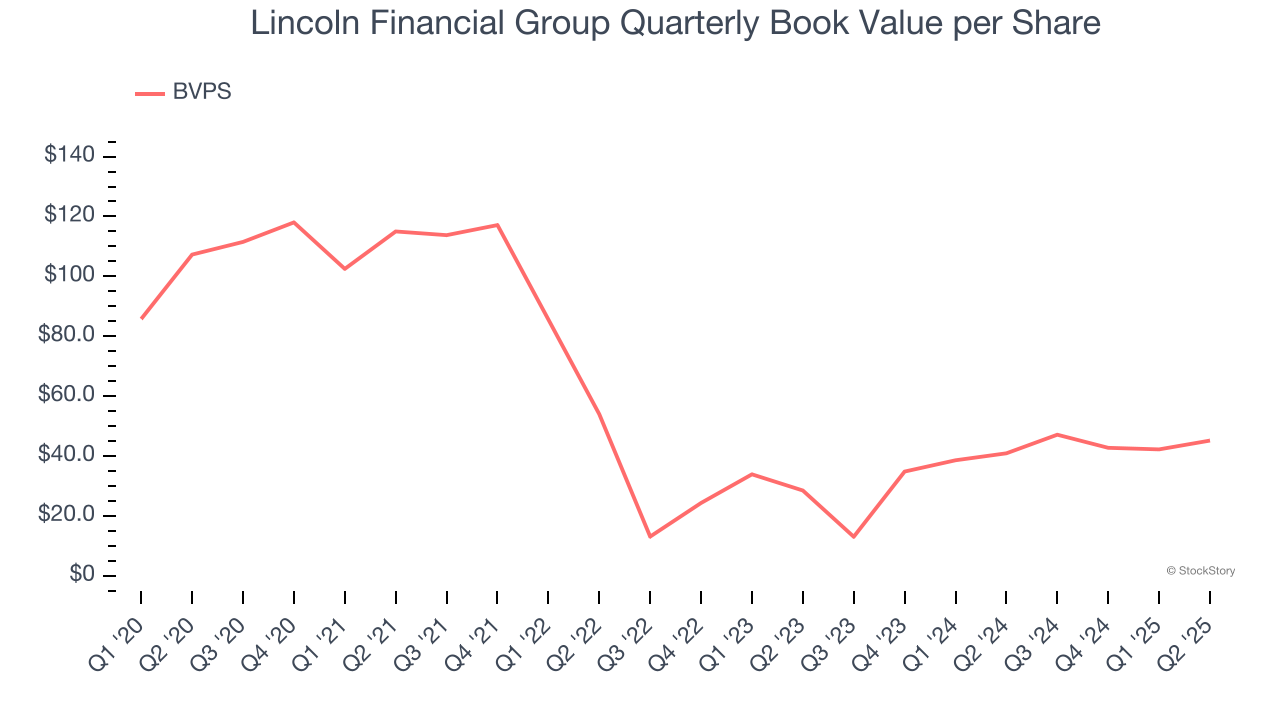

3. Growing BVPS Reflects Strong Asset Base

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Although Lincoln Financial Group’s BVPS declined at a 15.9% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at an incredible 25.9% annual clip (from $28.49 to $45.17 per share).

Final Judgment

Lincoln Financial Group falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 0.9× forward P/B (or $38.16 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.