Fabless chip and software maker Broadcom (NASDAQ: AVGO) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 22% year on year to $15.95 billion. The company expects next quarter’s revenue to be around $17.4 billion, coming in 2.1% above analysts’ estimates. Its non-GAAP profit of $1.69 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Broadcom? Find out by accessing our full research report, it’s free.

Broadcom (AVGO) Q2 CY2025 Highlights:

- Revenue: $15.95 billion vs analyst estimates of $15.9 billion (22% year-on-year growth, in line)

- Adjusted EPS: $1.69 vs analyst estimates of $1.66 (1.6% beat)

- Adjusted EBITDA: $10.7 billion vs analyst estimates of $10.46 billion (67.1% margin, 2.3% beat)

- Revenue Guidance for Q3 CY2025 is $17.4 billion at the midpoint, above analyst estimates of $17.05 billion

- Operating Margin: 36.9%, up from 29% in the same quarter last year

- Free Cash Flow Margin: 44%, up from 36.7% in the same quarter last year

- Inventory Days Outstanding: 38, down from 56 in the previous quarter

- Market Capitalization: $1.42 trillion

Company Overview

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ: AVGO) is a semiconductor conglomerate spanning wireless communications, networking, and data storage as well as infrastructure software focused on mainframes and cybersecurity.

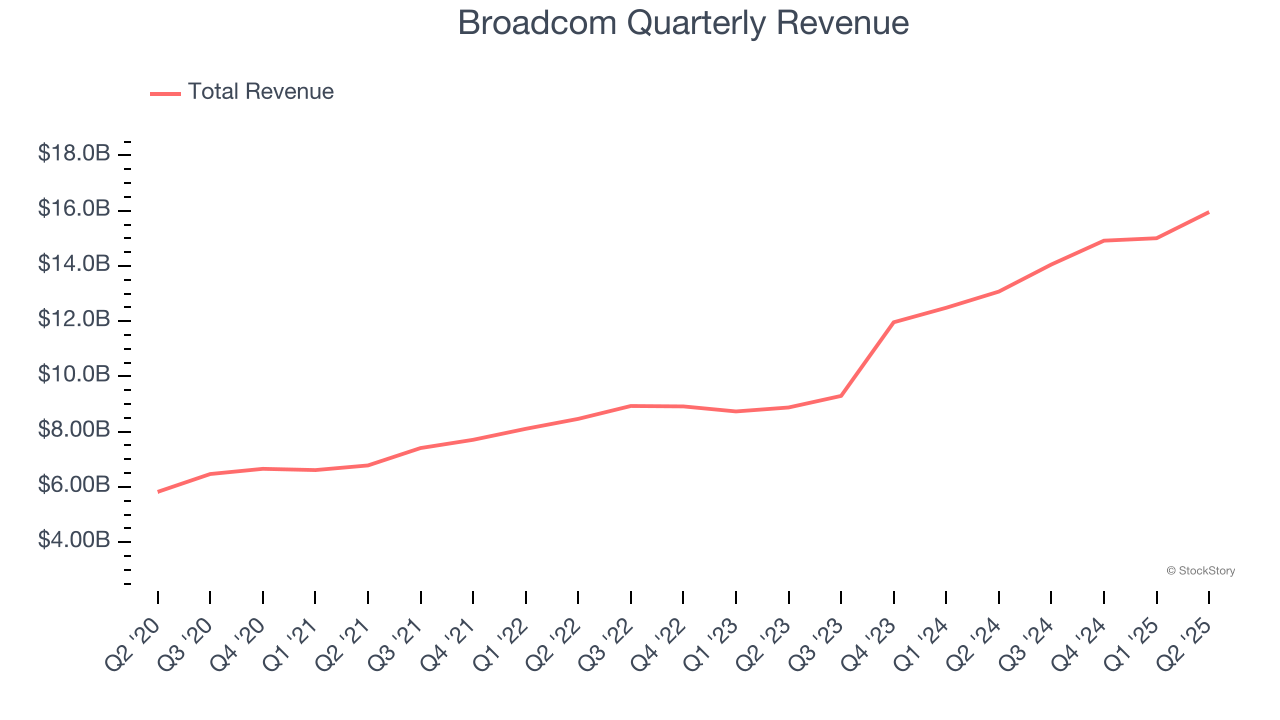

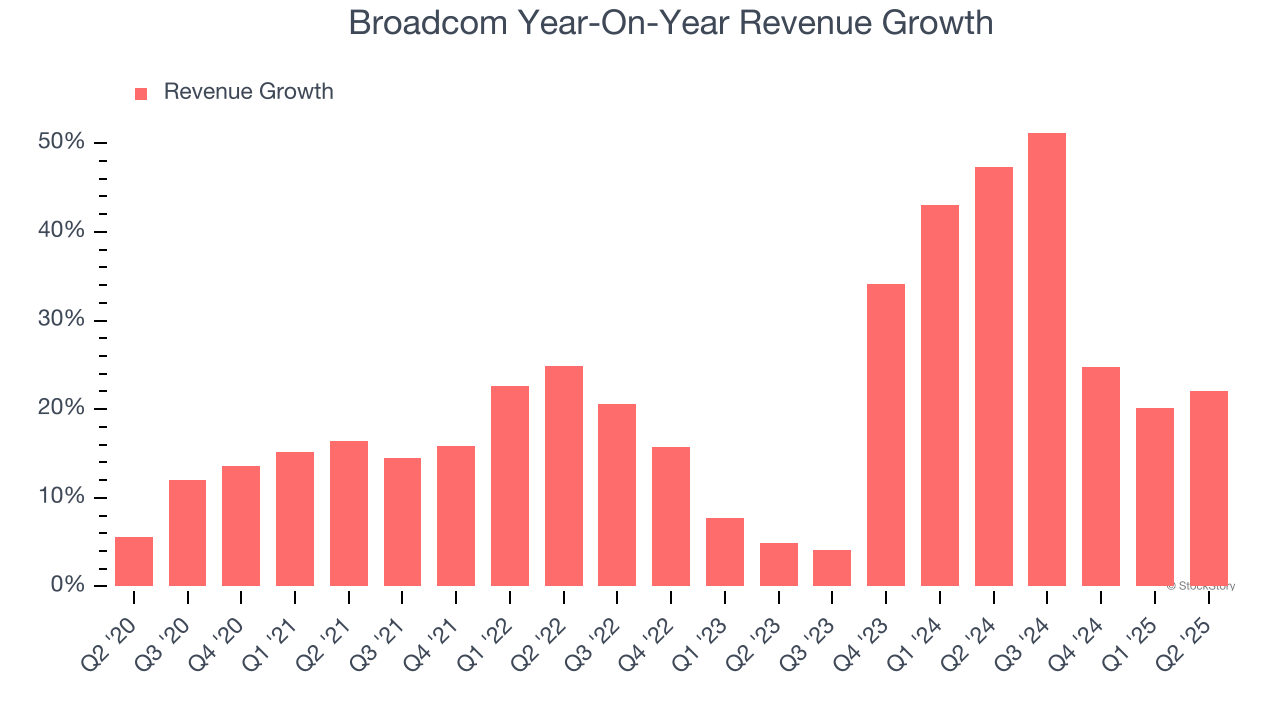

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Broadcom’s sales grew at an incredible 20.9% compounded annual growth rate over the last five years. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Broadcom’s annualized revenue growth of 30% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Broadcom’s year-on-year revenue growth of 22% was excellent, and its $15.95 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 23.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and implies the market is forecasting success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

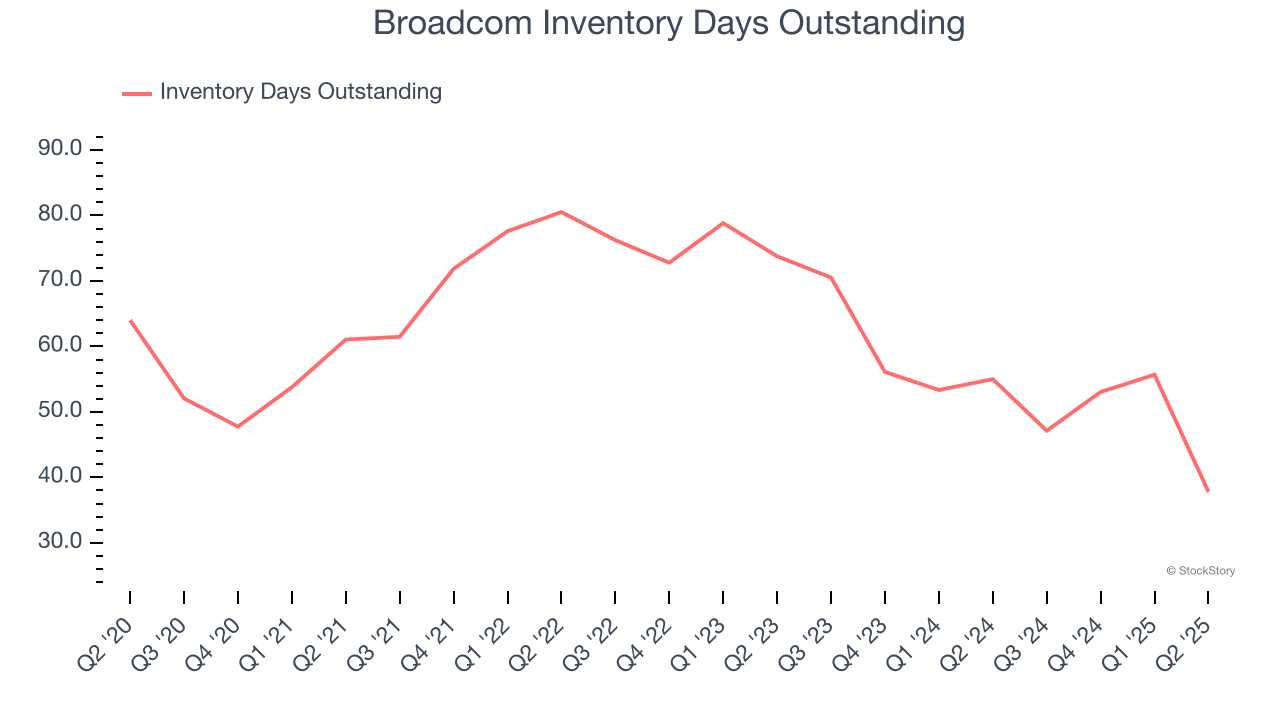

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Broadcom’s DIO came in at 38, which is 24 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Broadcom’s Q2 Results

We were impressed by Broadcom’s strong improvement in inventory levels. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $306.15 immediately following the results.

Sure, Broadcom had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.