American firearms manufacturer Smith & Wesson (NASDAQ: SWBI) reported Q2 CY2025 results topping the market’s revenue expectations, but sales fell by 3.7% year on year to $85.08 million. Its non-GAAP loss of $0.08 per share was 33.3% above analysts’ consensus estimates.

Is now the time to buy Smith & Wesson? Find out by accessing our full research report, it’s free.

Smith & Wesson (SWBI) Q2 CY2025 Highlights:

- Revenue: $85.08 million vs analyst estimates of $79.23 million (3.7% year-on-year decline, 7.4% beat)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.12 (33.3% beat)

- Adjusted EBITDA: $8.05 million vs analyst estimates of $3.59 million (9.5% margin, significant beat)

- Operating Margin: -3.5%, down from 1.2% in the same quarter last year

- Free Cash Flow was -$12.4 million compared to -$35.52 million in the same quarter last year

- Market Capitalization: $355.4 million

Company Overview

With a history dating back to 1852, Smith & Wesson (NASDAQ: SWBI) is a firearms manufacturer known for its handguns and rifles.

Revenue Growth

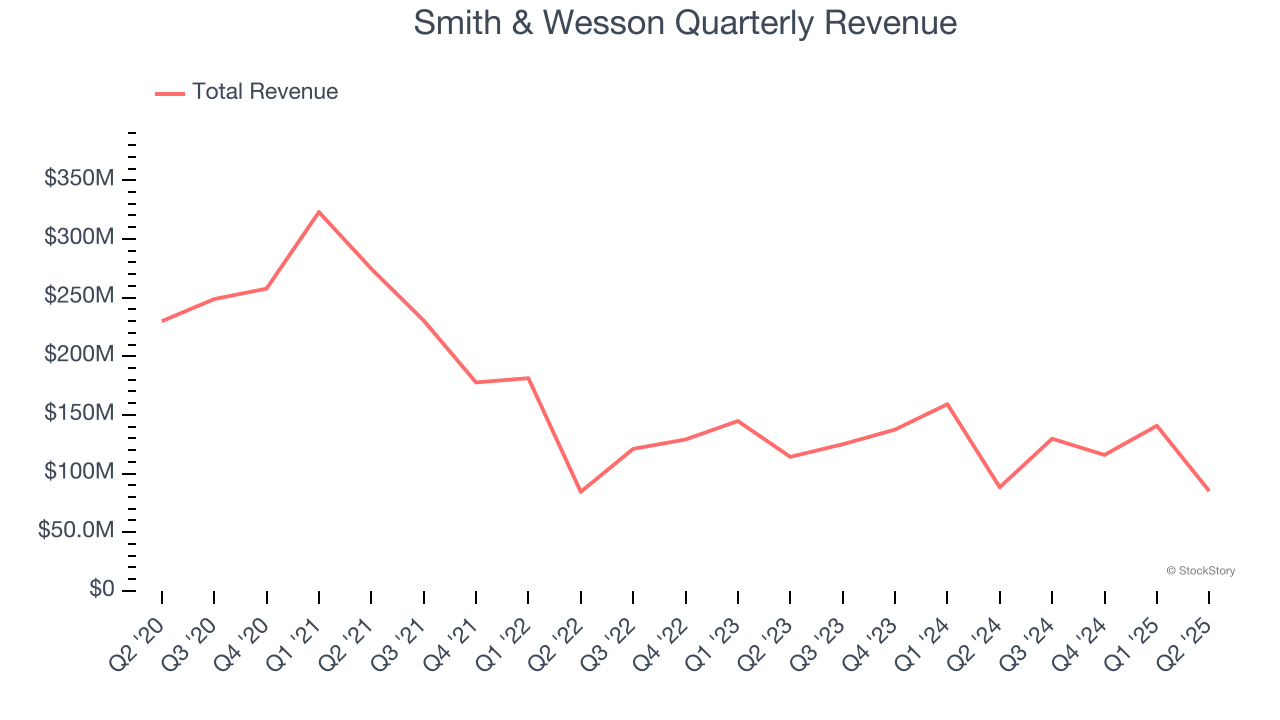

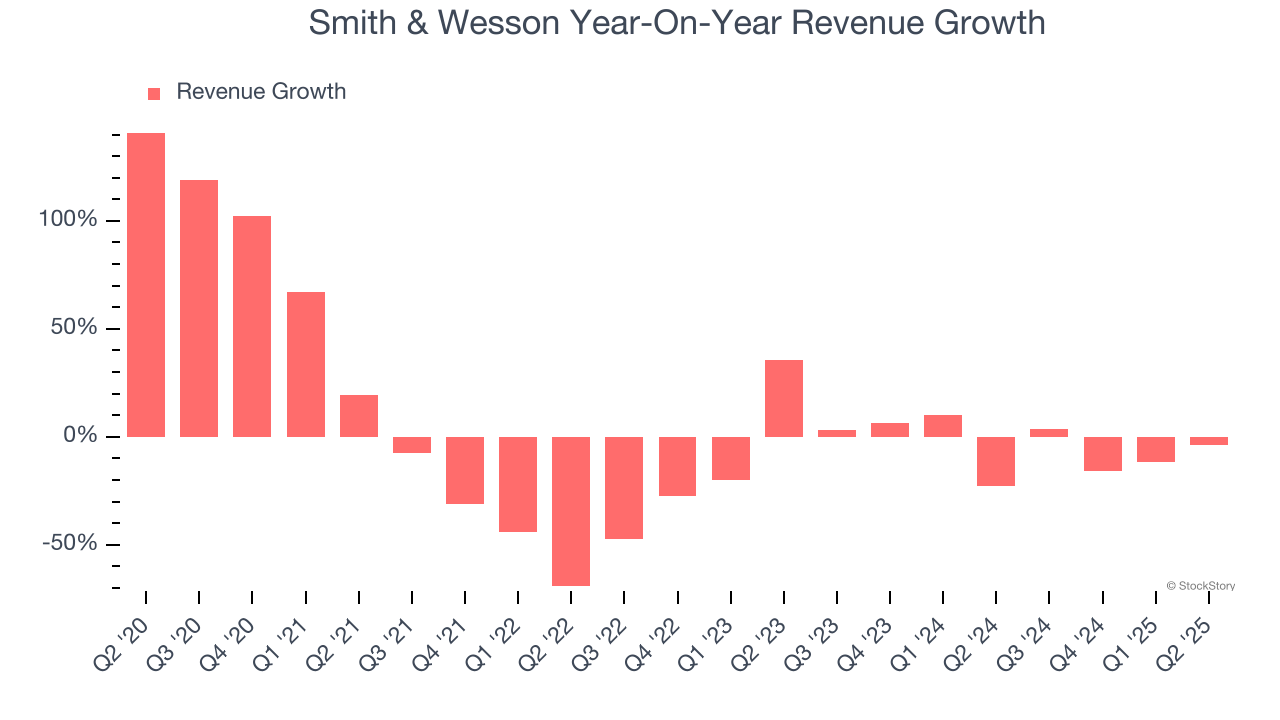

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Smith & Wesson struggled to consistently generate demand over the last five years as its sales dropped at a 6.6% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Smith & Wesson’s annualized revenue declines of 3.8% over the last two years suggest its demand continued shrinking.

This quarter, Smith & Wesson’s revenue fell by 3.7% year on year to $85.08 million but beat Wall Street’s estimates by 7.4%.

Looking ahead, sell-side analysts expect revenue to decline by 2% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

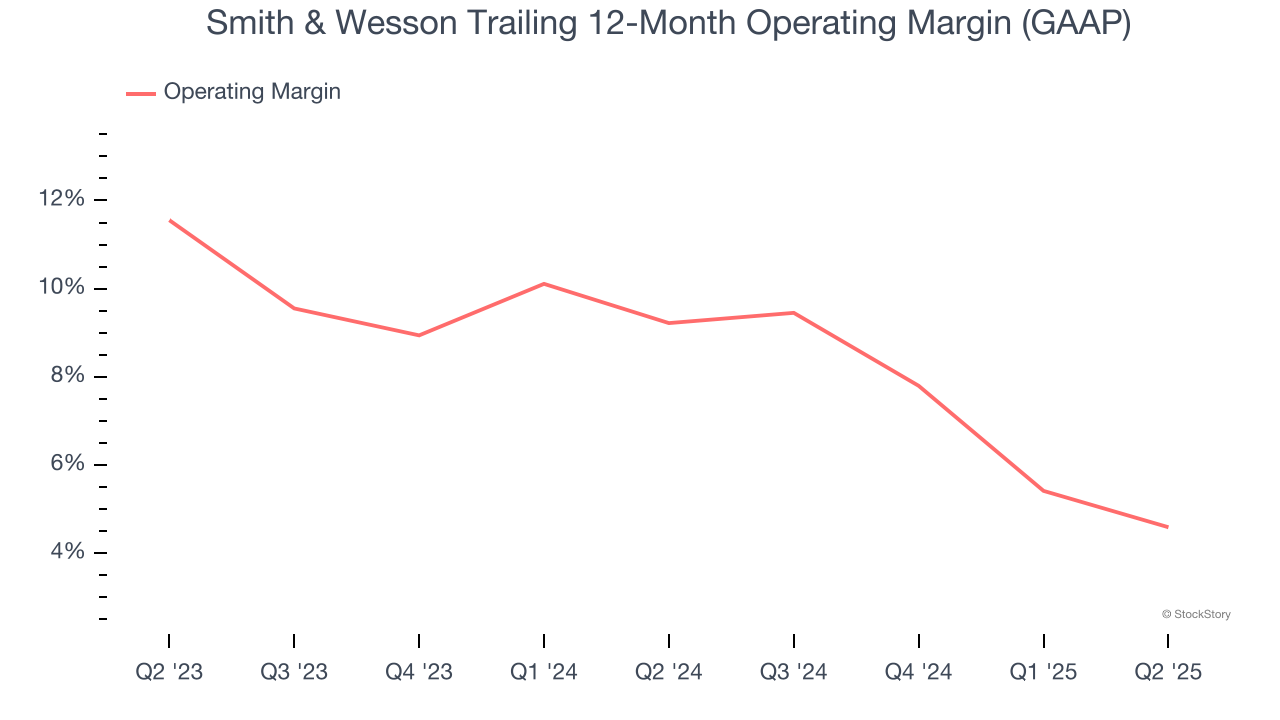

Smith & Wesson’s operating margin has been trending down over the last 12 months and averaged 7% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Smith & Wesson generated an operating margin profit margin of negative 3.5%, down 4.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

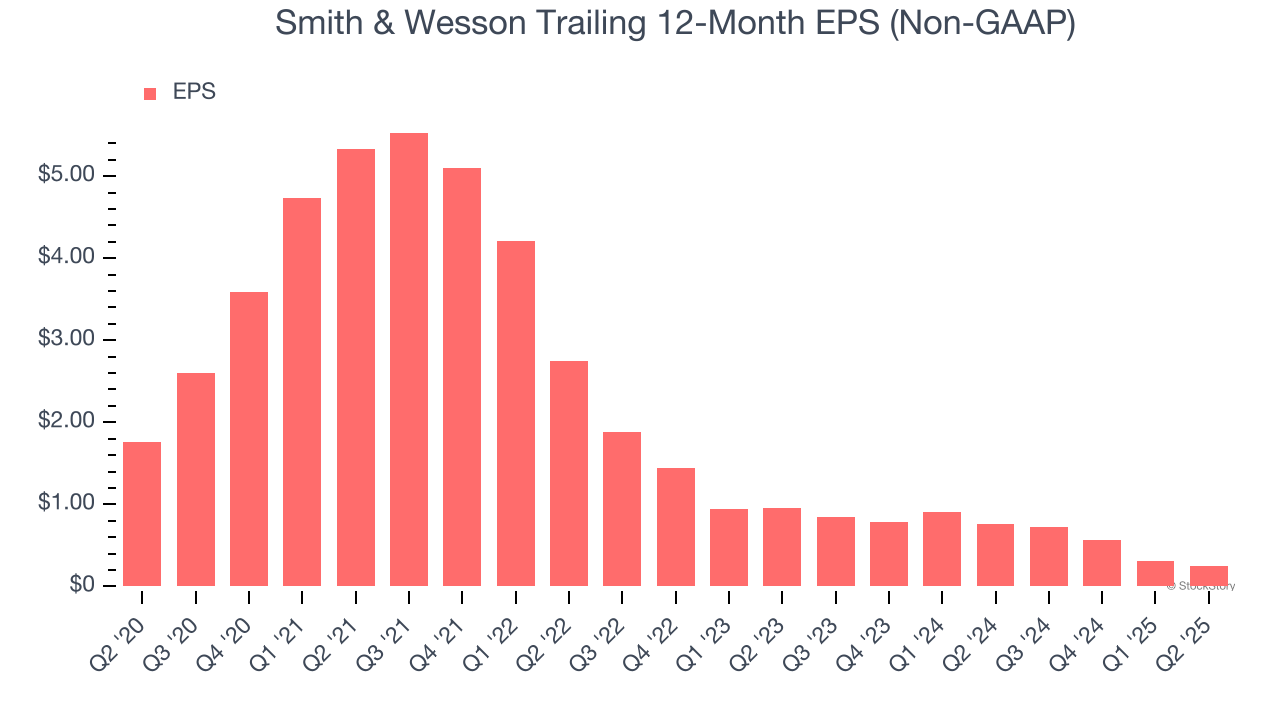

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Smith & Wesson, its EPS declined by 32.3% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q2, Smith & Wesson reported adjusted EPS of negative $0.08, down from negative $0.02 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Smith & Wesson’s Q2 Results

It was good to see Smith & Wesson beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 2.3% to $8.40 immediately following the results.

Smith & Wesson put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.